As filed with the Securities and Exchange Commission on April 26, 2002

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

RED ROBIN GOURMET BURGERS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

5812 |

|

84-1573084 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Primary standard industrial

classification code number) |

|

(I.R.S. employer

identification number) |

5575 DTC Parkway, Suite 110

Greenwood Village, Colorado 80111

(303) 846-6000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael J. Snyder

Chief Executive Officer

5575 DTC Parkway, Suite 110

Greenwood Village, Colorado 80111

(303) 846-6000

(Name, address, including zip

code, and telephone number, including area code,

of agent for service)

Copies To:

| Thomas J. Leary Brandi R. Steege O’Melveny & Myers LLP 610 Newport Center Drive, Suite 1700 Newport Beach, California 92660 (949) 760-9600 |

|

Valerie Ford Jacob Stuart H. Gelfond Fried, Frank, Harris, Shriver & Jacobson One New York Plaza New York, New York 10004 (212) 859-8000 |

Approximate date of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the

“Securities Act”) check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ¨

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

|

Proposed Maximum Aggregate Offering Price(1) |

|

Amount of Registration Fee |

|

|

|

|

|

| Common Stock, $0.001 par value per share |

|

$60,000,000 |

|

$5,520 |

(1) |

|

Estimated solely for the purpose of determining the registration fee pursuant to Rule 457(o) promulgated under the Securities Act of 1933, as amended.

|

The registrant hereby amends this

registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Red Robin may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and Red Robin is not soliciting an offer to buy these securities in any state where the offer or sale is not

permitted.

PROSPECTUS

SUBJECT TO COMPLETION

DATED , 2002

Shares

Common Stock

Red Robin Gourmet Burgers, Inc. and the selling stockholders are offering shares of common stock in a firmly underwritten

offering. This is Red Robin’s initial public offering, and no public market currently exists for our shares. Red Robin anticipates that the initial public offering price for its shares will be between

$ and $ per share. Red Robin will not receive any of the proceeds from shares sold by the selling

stockholders.

We will apply to list our common

stock on The Nasdaq Stock Market’s National Market under the symbol “RRGB.”

Investing in our common stock involves risks that are described under “Risk Factors” beginning on page 7 of this prospectus.

| |

|

Per Share

|

|

Total

|

| Offering Price |

|

$ |

|

|

$ |

|

| Discounts and Commissions to Underwriters |

|

$ |

|

|

$ |

|

| Offering Proceeds to Red Robin |

|

$ |

|

|

$ |

|

| Offering Proceeds to the Selling Stockholders |

|

$ |

|

|

$ |

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or has determined if this prospectus is truthful or complete. Any representation to the contrary is a

criminal offense.

We and the selling stockholders have granted the underwriters the right to purchase up to an additional

shares of common stock to cover any over-allotments. The underwriters can exercise this right at any time from time to time

within 30 days after the offering. Delivery of the shares of common stock will be made on or about , 2002.

| Banc of America Securities LLC |

|

U.S. Bancorp Piper Jaffray |

Wachovia Securities

The date of this prospectus is

, 2002

| |

|

Page

|

| |

|

i |

| |

|

1 |

| |

|

7 |

| |

|

16 |

| |

|

17 |

| |

|

18 |

| |

|

19 |

| |

|

20 |

| |

|

21 |

| |

|

23 |

| |

|

34 |

| |

|

47 |

| |

|

60 |

| |

|

64 |

| |

|

66 |

| |

|

68 |

| |

|

69 |

| |

|

73 |

| |

|

76 |

| |

|

76 |

| |

|

76 |

| |

|

F-1 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information that is different. We are offering to sell and seeking offers to buy shares of our common stock only in

jurisdictions where offers or sales are permitted. The information in this document may only be accurate on the date of this document. Our business, financial condition or results of operations may have changed since that date.

Red Robin®, America’s Gourmet Burgers & Spirits® and Mad Mixology® are federally registered trademarks and service marks owned by Red

Robin. Red Robin® is also registered in Canada. This prospectus also contains trademarks of companies other than Red

Robin.

Throughout this prospectus, our fiscal years ended December 28,

1997, December 27, 1998, December 26, 1999, December 31, 2000 and December 30, 2001 are referred to as years 1997, 1998, 1999, 2000 and 2001, respectively. Our fiscal year consists of 52 or 53 weeks and ends on the last Sunday in December in each

fiscal year. Fiscal year 2000 included 53 weeks. All other fiscal years shown included 52 weeks.

Unless we indicate otherwise,

all of the information in this prospectus assumes:

| |

• |

|

the underwriters will not exercise their over-allotment option to purchase up to additional shares of our common stock from us and the selling

stockholders at the price set forth on the cover of this prospectus; |

| |

• |

|

an offering price of $ per share; |

| |

• |

|

no exercise of options to purchase an aggregate of 4,240,950 shares of common stock which are outstanding as of March 24, 2002 under our stock option plans; and

|

| |

• |

|

that we have not completed a -for- reverse stock split that we intend to complete prior to the consummation of this

offering. |

i

This summary highlights information contained elsewhere in this prospectus.

This summary is not complete and does not contain all of the information you should consider before investing in our common stock. You should read the entire prospectus carefully, including the “Risk Factors” section and our consolidated

financial statements and the related notes. References in this prospectus to “Red Robin,” “company,” “we,” “us” and “our” refer to the business of Red Robin Gourmet Burgers, Inc. and its

subsidiaries.

OUR BUSINESS

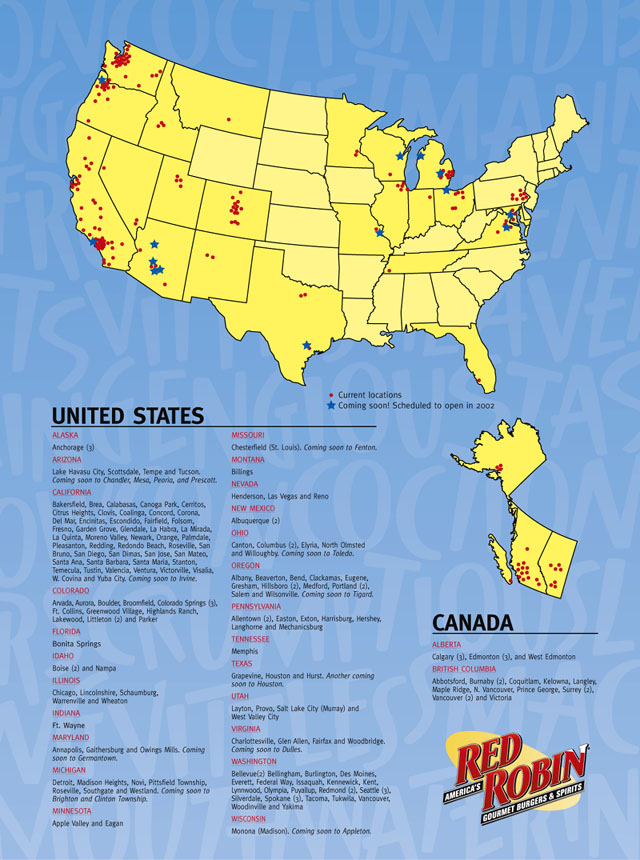

Red Robin is a leading casual dining restaurant chain focused on serving an imaginative selection of high quality gourmet burgers in a family-friendly atmosphere. We own and operate 87 restaurants in 12 states, and

have 97 additional restaurants operating under franchise or license agreements in 19 states and Canada.

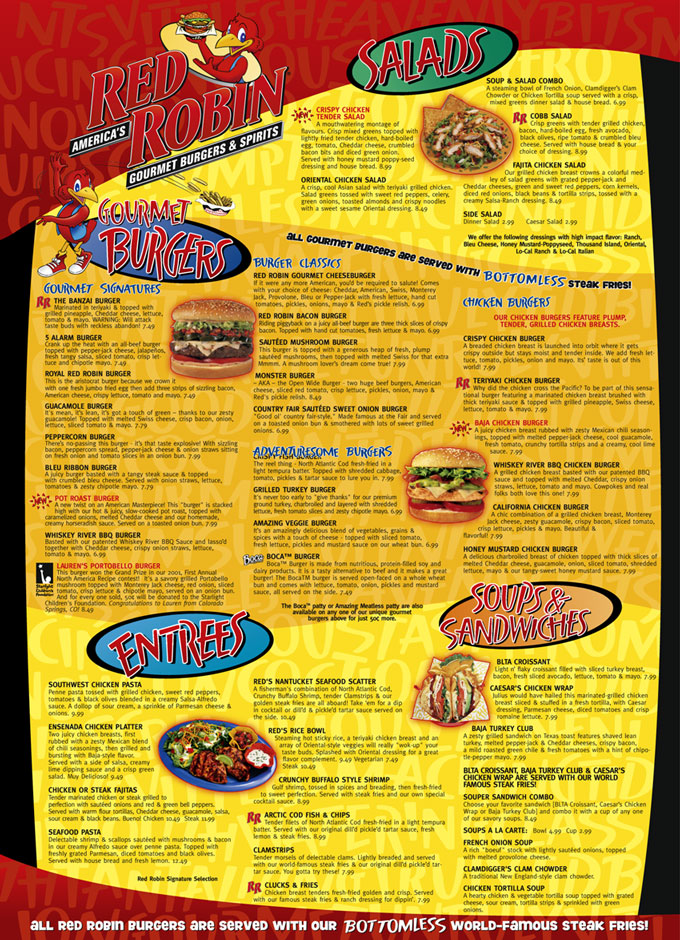

Our menu is centered

around our signature product, the gourmet burger, which we make from beef, chicken, veggie, fish, turkey and pot roast and serve in a variety of recipes. We offer a wide selection of toppings for our gourmet burgers, including fresh guacamole,

roasted green chilies, honey mustard dressing, grilled pineapple, crispy onion straws, sautéed mushrooms and a choice of six different cheeses. In addition to our gourmet burgers, which accounted for approximately 44.0% of our total food

sales in 2001, we also serve an array of other food items that are designed to appeal to a broad group of guests, including salads, soups, appetizers, other entrees such as rice bowls and pasta, desserts and our signature Mad Mixology® alcoholic and non-alcoholic specialty beverages.

Our restaurants are designed to create a fun and memorable dining experience in a family-friendly atmosphere and provide our guests with an exceptional dining value. Our concept attracts

a broad guest base by appealing to the entire family, particularly women, teens, tweens and children.

OUR CONCEPT AND BUSINESS STRATEGY

Our objective is to be the leading gourmet burger and casual dining restaurant destination. To achieve our objective, we

have developed the following strategies.

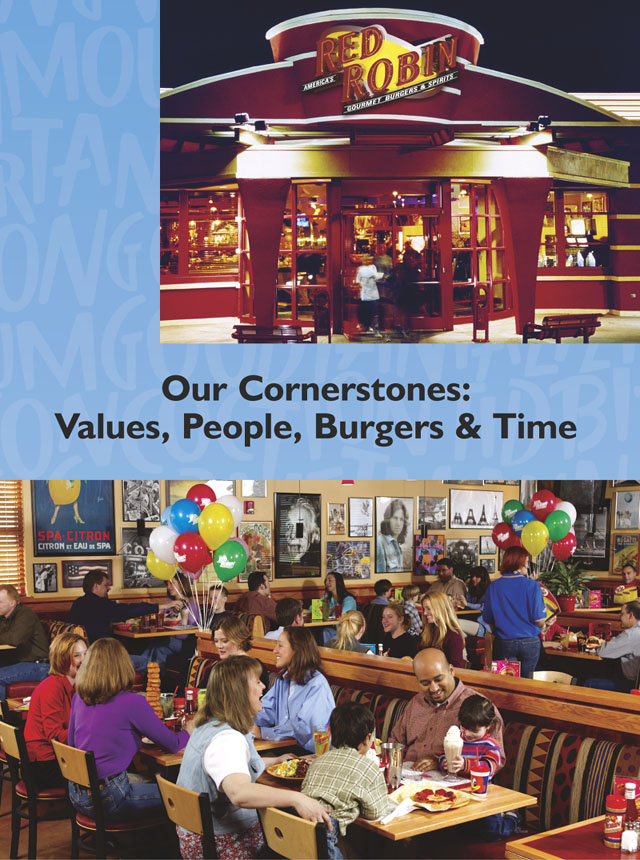

| |

• |

|

Focus on key guiding principals, or “cornerstones,” that drive our success. In managing our operations, we focus on four cornerstones

that we believe are essential to our business. Our four cornerstones are: 1) Values—to enhance the dining experience of our guests, we strive to maintain our core values—honor, integrity, seeking knowledge and having fun; 2)

People—we recognize that our team members are our strongest asset and seek to provide them with comprehensive training programs to ensure superior guest service; 3) Burgers—we strive to be the number one casual dining

destination for gourmet burgers in the markets in which we operate; and 4) Time—we believe in giving our guests the “gift of time” and we strive to provide guests with a 37-minute dining experience at lunch and 42 minutes at

dinner. |

| |

• |

|

Offer high quality, imaginative menu items. Our restaurants feature menu items that use imaginative toppings and showcase recipes that capture

tastes and flavors that our guests do not typically associate with burgers, salads and sandwiches. We believe the success of our concept is due to our ability to interpret the latest food trends and incorporate them into our gourmet burgers and

other menu items. |

1

| |

• |

|

Create a fun, festive and memorable dining experience. We promote an exciting, high-energy and family-friendly atmosphere by decorating our

restaurant interiors with an eclectic selection of celebrity posters, three-dimensional artwork, carousel horses and statues of our mascot “Red”. |

| |

• |

|

Provide an exceptional dining value with broad consumer appeal. We offer generous portions of high quality, imaginative food and beverages for a

per person average check of approximately $10.00, which includes alcoholic beverages. We believe this price-to-value relationship differentiates us from our competitors, many of whom have significantly higher average guest checks, and allows us to

appeal to a broad base of consumers with a wide range of income levels. |

| |

• |

|

Deliver strong unit economics. We believe our company-owned restaurants provide strong unit-level economics. In 2001, our comparable

company-owned restaurants generated average sales of approximately $3.0 million and restaurant level operating profit of approximately $618,000, or 20.5% of comparable company-owned restaurant sales. The average cash investment cost for our

free-standing restaurants opened in 2001 was approximately $1.7 million, excluding pre-opening costs, which averaged approximately $146,000 per restaurant. |

| |

• |

|

Pursue disciplined restaurant and franchise growth. Our management team adheres to a disciplined expansion strategy, including both company-owned

and franchised development. In 2001, we opened six company-owned restaurants and our franchisees opened 16 restaurants and expanded into two new states. In 2002, we expect to open ten new company-owned restaurants and relocate one restaurant, and we

expect our franchisees to open seven new restaurants. |

| |

• |

|

Build awareness of the Red Robin® America’s Gourmet Burgers & Spirits®

brand. We believe that the Red Robin name has achieved substantial brand equity among our guests and has become well known within our markets for our signature menu items. We intend to strengthen this brand loyalty by

continuing to offer new menu items and deliver a consistently memorable guest experience. |

| |

• |

|

Continue to capitalize on favorable lifestyle and demographic trends. We believe that we have benefited from several key lifestyle and

demographic trends that have helped drive our business. These trends include: |

— Increase in

consumption of food away from home. The National Restaurant Association estimates that the restaurant industry captured 45.3% of all consumer dollars spent on food in 2000 and projects the restaurant industry’s share

to increase to 53.0% by 2010. Given our attractive average guest check, family-friendly atmosphere and fun, festive and memorable dining experience, we believe we are well-positioned to continue to benefit from this expected increase in food

consumed away from home.

— The large and growing teen population. According to the

United States Census Bureau, the teen segment of the population, persons 12 to 19 years old, is expected to grow 36.6% faster than the overall population from 31.6 million in 2000 to 33.6 million by 2005. Given that our concept attracts a

significant number of teens and tweens, we believe we will continue to benefit from the strong growth in this segment of the population.

We believe these and other lifestyle and demographic trends will continue to be favorable to us and offer us strong opportunities for future restaurant expansion.

2

OUR GROWTH STRATEGIES

We believe that there are significant opportunities to grow our concept and brand on a nationwide basis through both new company-owned and franchised restaurants. We believe that our

concept and brand can support as many as 850 additional company-owned or franchised restaurants throughout the United States.

Company-owned restaurants. Our primary source of expansion and growth in the near term will be the addition of new company-owned restaurants. We are pursuing a disciplined growth strategy and intend to develop

many of our new restaurants in our existing markets, and selectively enter into new markets. Our growth strategy incorporates a cluster strategy for market penetration, which we believe will enable us to gain operating efficiencies, increase brand

awareness and enhance convenience and ease of access for our guests, all of which we believe will lead to significant repeat business. Our site selection criteria for new restaurants is flexible and allows us to adapt to a variety of locations near

high activity areas such as retail centers, big box shopping centers and entertainment centers.

Franchised

restaurants. The other key aspect of our growth strategy is the continued development of our franchise restaurants. We expect the majority of our new franchise restaurant growth to occur through the development of new

restaurants by new franchisees, primarily in the Northeast, Midwest and the South. We intend to continue to strengthen our franchise system by attracting experienced and well-capitalized area developers who are quality-conscious restaurant operators

and who possess the expertise and resources to execute the development of new restaurants on a large scale.

OUR HISTORY

Red Robin opened its first restaurant in 1969, in Seattle, Washington near the University of Washington campus. In 1996, Mike Snyder, then

our leading franchisee, became our president and implemented a number of strategic initiatives, including strengthening our gourmet burger concept, recruiting a new management team, upgrading management information systems, streamlining operations

and improving guest service. As a result of these and other initiatives, we increased the average annual restaurant sales of our comparable company-owned restaurants from $2.1 million in 1995 to $3.0 million in 2001 and expanded restaurant-level

operating profit margins from 13.0% in 1995 to 19.2% in 2001. In 2000, we completed a recapitalization of our company, and acquired Mike Snyder’s 14-unit franchise company, The Snyder Group Company. In addition, Quad-C, a private equity firm

whose principals have substantial restaurant experience, made an equity investment of $25.0 million in our company through its affiliates.

Our principal executive offices are located at 5575 DTC Parkway, Suite 110, Greenwood Village, Colorado 80111. Our telephone number is (303) 846-6000.

Our website is www.redrobin.com. The information on our website is not part of this prospectus.

3

THE OFFERING

| Common stock offered by: |

|

|

| |

| Red Robin Gourmet Burgers, Inc. |

|

shares |

| Selling stockholders |

|

shares |

| |

| Common stock to be outstanding after this offering |

|

shares |

| |

| Use of proceeds |

|

We intend to use the proceeds of this offering: |

| |

| |

|

• to repay approximately $ million

of indebtedness under our term loan, including related fees; |

| |

| |

|

• to repay approximately $ million

of indebtedness under our revolving credit facility; and |

| |

| |

|

• to repay approximately $ million

of indebtedness under one real estate and three equipment loans, including related fees. |

| |

| |

|

The remaining net proceeds will be used for general corporate purposes, including opening new restaurants and acquiring existing restaurants from franchisees. We will not

receive any of the proceeds from the sale of shares by the selling stockholders. See “Use of Proceeds.” |

| |

| Proposed Nasdaq National Market symbol |

|

RRGB |

| |

| Risk factors |

|

See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in

shares of our common stock. |

The number of shares of common stock to be outstanding after this offering is

based on our shares outstanding as of , 2002. This information excludes:

| |

• |

|

shares of common stock reserved for issuance under our stock option plans, of which

shares are subject to options outstanding at a weighted average exercise price of $ per share; |

| |

• |

|

shares of common stock reserved for issuance under our employee stock purchase plan; and |

| |

• |

|

the effect of a -for- reverse stock split that we intend to complete prior to the consummation of this offering.

|

4

SUMMARY CONSOLIDATED FINANCIAL AND OPERATING DATA

| |

|

Fiscal Year Ended

|

|

| |

|

1999

|

|

|

2000(1)

|

|

|

2001

|

|

| |

|

(in thousands, except per share data, restaurant-related data and footnotes) |

|

| Statement of Income Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| Restaurant |

|

$ |

121,430 |

|

|

$ |

180,413 |

|

|

$ |

214,963 |

|

| Franchise royalties and fees |

|

|

8,249 |

|

|

|

8,247 |

|

|

|

9,002 |

|

| Rent revenue |

|

|

333 |

|

|

|

510 |

|

|

|

520 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

130,012 |

|

|

|

189,170 |

|

|

|

224,485 |

|

| Income from operations |

|

|

7,145 |

|

|

|

8,805 |

|

|

|

18,740 |

|

| Interest expense |

|

|

4,156 |

|

|

|

6,482 |

|

|

|

7,850 |

|

| Interest income |

|

|

(186 |

) |

|

|

(742 |

) |

|

|

(746 |

) |

| Other expense |

|

|

391 |

|

|

|

191 |

|

|

|

190 |

|

| (Provision) benefit for income taxes(2) |

|

|

1,596 |

|

|

|

12,557 |

|

|

|

(3,722 |

) |

| Net income(2) |

|

|

4,380 |

|

|

|

15,431 |

|

|

|

7,724 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share(2) |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.51 |

|

|

$ |

0.71 |

|

|

$ |

0.26 |

|

| Diluted |

|

$ |

0.51 |

|

|

$ |

0.71 |

|

|

$ |

0.26 |

|

| Shares used in computing net income per common share |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

8,617 |

|

|

|

21,587 |

|

|

|

29,248 |

|

| Diluted |

|

|

8,617 |

|

|

|

21,587 |

|

|

|

29,684 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selected Operating Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| System-wide restaurants open at end of year |

|

|

144 |

|

|

|

164 |

|

|

|

182 |

|

| Company-owned restaurants open at end of year |

|

|

46 |

|

|

|

73 |

|

|

|

77 |

|

| Average annual comparable company-owned restaurant sales(3) |

|

$ |

2,664 |

|

|

$ |

2,890 |

|

|

$ |

3,020 |

|

| Comparable company-owned restaurant sales increase(3) |

|

|

5.8 |

% |

|

|

6.9 |

% |

|

|

2.0 |

% |

| Restaurant-level operating profit(4) |

|

$ |

20,340 |

|

|

$ |

32,423 |

|

|

$ |

41,215 |

|

| EBITDA(5) |

|

|

12,539 |

|

|

|

16,870 |

|

|

|

29,231 |

|

| EBITDA margin(5) |

|

|

9.6 |

% |

|

|

8.9 |

% |

|

|

13.0 |

% |

| |

|

December 30, 2001

|

| |

|

Actual

|

|

As Adjusted(6)

|

| |

|

|

|

(unaudited) |

| Balance Sheet Data: |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

18,992 |

|

$ |

|

| Total assets |

|

|

155,041 |

|

|

|

| Long-term debt, including current portion |

|

|

80,087 |

|

|

|

| Total stockholders’ equity |

|

|

47,578 |

|

|

|

(1) |

|

In May 2000, we purchased all of the outstanding capital stock of one of our franchisees, The Snyder Group Company, for approximately $23.7 million plus liabilities assumed of

$20.0 million, thereby acquiring 14 restaurants and significantly changing our capital structure. See the financial statements of The Snyder Group Company and the related notes included elsewhere in this prospectus. |

5

| |

|

|

In addition, in May 2000, we sold 12,500,000 shares of our common stock to affiliates of Quad-C, a private equity firm, for $25.0 million. The proceeds were used to pay off

debentures and promissory notes, as well as pay down bank debt and fund new restaurant construction. |

| |

(2) |

|

Net income in 1999 included a benefit for income taxes of $1.6 million and net income in 2000 included a benefit for income taxes of $12.6 million, in each case as a result of

the reversal of previously recorded deferred tax asset valuation allowance. Due to our improved profitability, the deferred tax asset valuation allowance was reversed because it became more likely than not that the deferred tax asset would be

realized in the future. |

| |

(3) |

|

Company-owned restaurants become comparable in the first period following the first full fiscal year of operations. For example, the restaurants we acquired in May 2000 from

The Snyder Group Company will be included in comparable company-owned restaurants in 2002. |

| |

(4) |

|

We define restaurant-level operating profit to be restaurant sales minus restaurant operating costs, excluding restaurant closures and impairment costs.

|

| |

(5) |

|

EBITDA represents earnings before interest, taxes, depreciation and amortization. EBITDA is another measure commonly used to evaluate operating performance. EBITDA is not a

measurement determined in accordance with generally accepted accounting principles and should not be considered in isolation or as an alternative to net income, cash flows generated by operations, investing or financing activities or other financial

statement data presented as indicators of financial performance or liquidity. EBITDA as presented may not be comparable to other similarly titled measures of other companies. EBITDA margin is calculated as EBITDA divided by total revenues. The

following table sets forth our calculation of EBITDA: |

| |

|

1999

|

|

2000

|

|

2001

|

| |

|

(in thousands) |

| Income (loss) from operations |

|

$ |

7,145 |

|

$ |

8,805 |

|

$ |

18,740 |

| Depreciation and amortization |

|

|

5,394 |

|

|

8,065 |

|

|

10,491 |

| |

|

|

|

|

|

|

|

|

|

| EBITDA |

|

$ |

12,539 |

|

$ |

16,870 |

|

$ |

29,231 |

| |

|

|

|

|

|

|

|

|

|

| |

(6) |

|

Adjusted to reflect the sale of shares of our common stock offered by us in this

offering at an offering price of $ per share, less the underwriting discount and estimated offering expenses payable by us, and the use of the proceeds from this offering to repay approximately

$ million of indebtedness under our term loan, including related fees, approximately

$ million of indebtedness under our revolving credit facility and approximately $

million of indebtedness under one real estate and three equipment loans, including related fees. |

6

An investment in our common stock involves a high degree of risk. You should

carefully read and consider the risks described below before deciding to invest in our common stock. If any of the following risks actually occurs, our business, financial condition, results of operation or cash flows could be materially harmed. In

any such case, the trading price of our common stock could decline, and you could lose all or part of your investment. When determining whether to buy our common stock, you should also refer to the other information in this prospectus, including our

consolidated financial statements and the related notes.

Risks related

to our business

Our growth strategy depends on opening new restaurants. Our ability to expand our

restaurant base is influenced by factors beyond our control, which may slow restaurant development and expansion and impair our growth strategy.

We are pursuing an accelerated but disciplined growth strategy which, to be successful, will depend in large part on our ability and the ability of our franchisees to open new restaurants and to operate these

restaurants on a profitable basis. We anticipate that our new restaurants will generally take several months to reach planned operating levels due to inefficiencies typically associated with new restaurants, including lack of market awareness, the

need to hire and train sufficient team members and other factors. We cannot guarantee that we or our franchisees will be able to achieve our expansion goals or that new restaurants will be operated profitably. Further, we cannot assure you that any

restaurant we open will obtain operating results similar to those of our existing restaurants. The success of our planned expansion will depend upon numerous factors, many of which are beyond our control, including the following:

| |

• |

|

the hiring, training and retention of qualified operating personnel, especially managers; |

| |

• |

|

reliance on the knowledge of our executives and franchisees to identify available and suitable restaurant sites; |

| |

• |

|

competition for restaurant sites; |

| |

• |

|

negotiation of favorable lease terms; |

| |

• |

|

timely development of new restaurants, including the availability of construction materials and labor; |

| |

• |

|

management of construction and development costs of new restaurants; |

| |

• |

|

securing required governmental approvals and permits in a timely manner, or at all; |

| |

• |

|

competition in our markets; and |

| |

• |

|

general economic conditions. |

Our success depends on our ability to

locate and secure a sufficient number of suitable new restaurant sites.

One of our biggest challenges in meeting our growth

objectives will be to locate and secure an adequate supply of suitable new restaurant sites. There can be no assurance that we will be able to find sufficient suitable locations, or suitable leases, for our planned expansion in any future period. We

have experienced delays in opening some of our restaurants and may experience delays in the future. Delays or failures in opening new restaurants could materially adversely affect our planned growth.

7

Our restaurant expansion strategy focuses primarily on further penetrating existing markets. This strategy could cause sales in

some of our existing restaurants to decline.

Our areas of highest concentration are California, Colorado, Washington and

Oregon. In accordance with our expansion strategy, we intend to open new restaurants primarily in our existing markets. Because we typically draw guests from a relatively small radius around each of our restaurants, the sales performance and guest

counts for restaurants near the area in which a new restaurant opens may decline due to the opening of new restaurants.

Our expansion into new markets may

present increased risks due to our unfamiliarity with the area.

Some of our new restaurants will be located in areas where

we have little or no meaningful experience. Those markets may have different competitive conditions, consumer tastes and discretionary spending patterns than our existing markets, which may cause our new restaurants to be less successful than

restaurants in our existing markets. An additional risk in expansion into new markets is the lack of market awareness of the Red Robin brand. Restaurants opened in new markets typically open at lower average weekly sales volumes than do restaurants

opened in existing markets, initially resulting in higher restaurant-level operating expense ratios than in existing markets. Sales at restaurants opened in new markets may take longer to reach average annual company-owned restaurant sales, if at

all, thereby affecting the profitability of these restaurants.

Our expansion may strain our infrastructure and other resources, which could slow our restaurant

development or cause other problems.

We face the risk that our existing systems and procedures, restaurant management

systems, financial controls, information systems, management resources and human resources will be inadequate to support our planned expansion of company-owned and franchised restaurants. We may not be able to respond on a timely basis to all of the

changing demands that our planned expansion will impose on our infrastructure and other resources. If we fail to continue to improve our infrastructure or to manage other factors necessary for us to achieve our expansion objectives, our operating

results could be materially negatively affected.

Our ability to raise capital in the future may be limited, which could adversely impact our business.

Changes in our operating plans, acceleration of our expansion plans, lower than anticipated sales, increased expenses or

other events, including those described in this section, may cause us to need to seek additional debt or equity financing on an accelerated basis. Financing may not be available on acceptable terms, or at all, and our failure to raise capital when

needed could negatively impact our growth and other plans as well as our financial condition and results of operations. Additional equity financing may be dilutive to the holders of our common stock and debt financing, if available, may involve

significant cash payment obligations and covenants and/or financial ratios that restrict our ability to operate our business. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and

Capital Resources.”

If our franchisees cannot develop or finance new restaurants or build them on suitable sites or open them on schedule, our growth and

success may be impeded.

Under our current form of area development agreement, franchisees must develop a predetermined

number of restaurants in their area according to a schedule that lasts for the term of their development agreement. Franchisees may not have access to the financial or management resources that they need to open the restaurants required by their

development schedules, or be able to find suitable sites on which to develop them. Franchisees may not be able to negotiate acceptable lease or purchase terms for the sites, obtain the necessary permits and government approvals or meet construction

schedules. In the past, we have agreed to extend or modify development schedules for certain areas developers, and we may do so in the future. Any of these problems could slow our growth and reduce our franchise revenues.

8

Additionally, our franchisees depend upon financing from banks and other financial institutions

in order to construct and open new restaurants. Over the past several years, financing has been difficult for small operators to obtain. Should these conditions continue into the future, the lack of adequate availability of debt financing could

adversely affect the number and rate of new restaurant openings by our franchisees and adversely affect our future franchise revenues.

Our franchisees could

take actions that could harm our business.

Franchisees are independent contractors and are not our employees. We provide

training and support to franchisees, but the quality of franchised restaurant operations may be diminished by any number of factors beyond our control. Consequently, franchisees may not successfully operate restaurants in a manner consistent with

our standards and requirements, or may not hire and train qualified managers and other restaurant personnel. If franchisees do not, our image and reputation, and the image and reputation of other franchisees, may suffer materially and system-wide

sales could significantly decline.

The acquisition of existing restaurants from our franchisees may have unanticipated consequences that could harm our

business and the financial condition.

We may seek to selectively acquire existing restaurants from our franchisees. To do

so, we would need to identify suitable acquisition candidates, negotiate acceptable acquisition terms and obtain appropriate financing. Any acquisition that we pursue, whether or not successfully completed, may involve risks, including:

| |

• |

|

material adverse effects on our operating results, particularly in the fiscal quarters immediately following the acquisition as it is integrated into our operations;

|

| |

• |

|

risks associated with entering into markets or conducting operations where we have no or limited prior experience; and |

| |

• |

|

the diversion of management’s attention from other business concerns. |

Future acquisitions of existing restaurants from our franchisees, which may be accomplished through a cash purchase transaction or the issuance of our equity securities, or a combination

of both, could result in potentially dilutive issuances of our equity securities, the incurrence of debt and contingent liabilities and impairment charges related to goodwill and other intangible assets, any of which could harm our business and

financial condition.

Our operations are susceptible to changes in food availability and costs which could adversely affect our operating results.

Our profitability depends in part on our ability to anticipate and react to changes in food costs. We rely on SYSCO

Corporation, a national food distributor, as the primary supplier of our food. Any increase in distribution prices or failure to perform by SYSCO could cause our food costs to increase. There also could be a significant short-term disruption in our

supply chain if SYSCO failed to meet our distribution requirements or our relationship was terminated. Further, various factors beyond our control, including adverse weather conditions, governmental regulation, production, availability and

seasonality may affect our food costs or cause a disruption in our supply chain. Chicken represented approximately 19.6% and beef represented approximately 10.0% of our food purchases in 2001. We enter into annual contracts with our beef and chicken

suppliers. Our contracts for chicken are fixed price contracts. Our contracts for beef are generally based on current market prices plus a processing fee. Changes in the price or availability of chicken or beef could materially adversely affect our

profitability. We cannot predict whether we will be able to anticipate and react to changing food costs by adjusting our purchasing practices and menu prices, and a failure to do so could adversely affect our operating results. In addition, because

we provide a “value-priced” product, we may not be able to pass along price increases to our guests.

9

Our quarterly operating results may fluctuate significantly and could fall below the expectations of securities analysts and

investors due to seasonality and other factors, resulting in a decline in our stock price.

Our quarterly operating results

may fluctuate significantly because of several factors, including:

| |

• |

|

the timing of new restaurant openings and related expenses; |

| |

• |

|

restaurant operating costs and pre-opening costs for our newly-opened restaurants, which are often materially greater during the first several months of operation than

thereafter; |

| |

• |

|

labor availability and costs for hourly and management personnel; |

| |

• |

|

profitability of our restaurants, especially in new markets; |

| |

• |

|

franchise development costs; |

| |

• |

|

increases and decreases in comparable restaurant sales; |

| |

• |

|

impairment of long-lived assets, including goodwill, and any loss on restaurant closures; |

| |

• |

|

general economic conditions; |

| |

• |

|

changes in consumer preferences and competitive conditions; and |

| |

• |

|

fluctuations in commodity prices. |

Our business is also subject to seasonal fluctuations. Historically, sales in most of our restaurants have been higher during the summer months and winter holiday season of each fiscal year. As a result, our quarterly and annual operating

results and comparable restaurant sales may fluctuate significantly as a result of seasonality and the factors discussed above. Accordingly, results for any one quarter are not necessarily indicative of results to be expected for any other quarter

or for any year and comparable restaurant sales for any particular future period may decrease. In the future, operating results may fall below the expectations of securities analysts and investors. In that event, the price of our common stock would

likely decrease.

A decline in visitors to any of the retail centers, big box shopping centers or entertainment centers near the locations of our restaurants

could negatively affect our restaurant sales.

Our restaurants are primarily located near high activity areas such as retail

centers, big box shopping centers and entertainment centers. We depend on high visitor rates at these centers to attract guests to our restaurants. If visitors to these centers decline due to economic conditions, changes in consumer preferences or

shopping patterns, changes in discretionary consumer spending or otherwise, our restaurant sales could decline significantly and adversely affect our results of operations.

If we lose the services of any of our key management personnel, our business could suffer.

Our

future success significantly depends on the continued services and performance of our key management personnel, particularly Mike Snyder, our chief executive officer and president; Jim McCloskey, our chief financial officer; Mike Woods, our senior

vice president of franchise development; Bob Merullo, our senior vice president of restaurant operations; Todd Brighton, our vice president of development; and Eric Houseman, our vice president of restaurant operations. Our future performance will

depend on our ability to motivate and retain these and other executive officers and key team members, particularly regional operations directors, restaurant general managers and kitchen managers. Competition for these employees is intense. The loss

of the services of members of our senior management or key team members or the inability to attract additional qualified personnel as needed could materially harm our business.

Approximately 85.1% of our company-owned restaurants are located in the Western United States and, as a result, we are sensitive to economic and other trends and developments in this region.

We currently operate a total of 74 company-owned restaurants in the Western United States. As a result, we are particularly susceptible to adverse

trends and economic conditions in this region, including its labor market.

10

In addition, given our geographic concentration, negative publicity regarding any of our restaurants in the Western United States could have a material adverse effect on our business and

operations, as could other regional occurrences such as local strikes, energy shortages or increases in energy prices, droughts or earthquakes or other natural disasters.

Our future success depends on our ability to protect our proprietary information.

Our business prospects will

depend in part on our ability to develop favorable consumer recognition of the Red Robin name and logo. Although Red Robin®, America’s Gourmet Burgers & Spirits® and Mad Mixology® are federally registered trademarks with the United States Patent and Trademark Office and in Canada, our trademarks could be

infringed in ways that leave us without redress, such as by imitation. In addition, we rely on trade secrets and proprietary know-how, and we employ various methods, to protect our concepts and recipes. However, such methods may not afford adequate

protection and others could independently develop similar know-how or obtain access to our know-how, concepts and recipes. Moreover, we may face claim(s) of infringement that could interfere with both our use of our proprietary know-how, concepts,

recipes or trade secrets. Defending against such claim(s) may be costly and, if unsuccessful, may prevent us from continuing to use such proprietary information in the future. We do not maintain confidentiality and non-competition agreements with

all of our executives, key personnel or suppliers. In the event competitors independently develop or otherwise obtain access to our know-how, concepts, recipes or trade secrets, the appeal of our restaurants could be reduced and our business could

be harmed. We franchise our system to various franchisees. While we try to ensure that the quality of our brand and compliance with our operating standards, and the confidentiality thereof are maintained by all of our franchisees, we cannot assure

that our franchisees will avoid actions that adversely affect the reputation of Red Robin or the value of our proprietary information.

Risks related to the food service industry

Changes in consumer preferences or discretionary consumer spending could negatively impact our results of operations.

Our restaurants feature burgers, salads, soups, appetizers, other entrees such as rice bowls and pasta, desserts and our signature Mad Mixology® alcoholic and non-alcoholic beverages in a family-friendly atmosphere. Our continued success depends, in part, upon the popularity of these foods and this style of casual dining. Shifts in

consumer preferences away from this cuisine or dining style could materially adversely affect our future profitability. The restaurant industry is characterized by the continual introduction of new concepts and is subject to rapidly changing

consumer preferences, tastes and eating and purchasing habits. While burger consumption in the United States has grown over the past 20 years, the demand may not continue to grow or taste trends may change. Our success will depend in part on our

ability to anticipate and respond to changing consumer preferences, tastes and eating and purchasing habits, as well as other factors affecting the food service industry, including new market entrants and demographic changes. Also, our success

depends to a significant extent on numerous factors affecting discretionary consumer spending, including economic conditions, disposable consumer income and consumer confidence. Adverse changes in these factors could reduce guest traffic or impose

practical limits on pricing, either of which could harm our results of operations.

Health concerns relating to the consumption of beef or other food products

could affect consumer preferences and could negatively impact our results of operations.

Like other restaurant chains,

consumer preferences could be affected by health concerns about the consumption of beef, the key ingredient in many of our menu items, or negative publicity concerning food quality, illness and injury generally, such as negative publicity concerning

e-coli, “mad cow” or “foot-and-mouth” disease, publication of government or industry findings concerning food products served by us, or other health concerns or operating issues stemming from one restaurant or a limited number of

restaurants. This negative publicity may adversely affect demand for our food and could result in a decrease in guest traffic to our

11

restaurants. If we react to the negative publicity by changing our concept or our menu, we may lose guests who do not prefer the new concept or menu, and may not be able to attract a sufficient

new guest base to produce the revenue needed to make our restaurants profitable. In addition, we may have different or additional competitors for our intended guests as a result of a concept change and may not be able to compete successfully against

those competitors. A decrease in guest traffic to our restaurants as a result of these health concerns or negative publicity or as a result of a change in our menu or concept could materially harm our business.

Labor shortages could slow our growth or harm our business.

Our success depends in part upon our ability to attract, motivate and retain a sufficient number of qualified, high energy team members. Qualified individuals of the requisite caliber and number needed to fill these positions are in short

supply in some areas. The inability to recruit and retain these individuals may delay the planned openings of new restaurants or result in high employee turnover in existing restaurants, which could harm our business. Additionally, competition for

qualified team members could require us to pay higher wages to attract sufficient team members, which could result in higher labor costs. Most of our employees are paid in accordance with minimum wage regulations. Accordingly, any increase, whether

state or federal, could have a material adverse impact on our business.

We are subject to extensive government laws and regulations that govern various aspects

of our business. Our operations and our ability to expand and develop our restaurants may be adversely affected by these laws and regulations, which could cause our revenues to decline and adversely affect our growth strategy.

The restaurant industry is subject to various federal, state and local government regulations, including those relating to the sale of food

and alcoholic beverages. While at this time we have been able to obtain and maintain the necessary governmental licenses, permits and approvals, the failure to maintain these licenses, permits and approvals, including food and liquor licenses, could

adversely affect our operating results. Difficulties or failure in obtaining the required licenses and approvals could delay or result in our decision to cancel the opening of new restaurants. Local authorities may suspend or deny renewal of our

food and liquor licenses if they determine that our conduct does not meet applicable standards or if there are changes in regulations.

We are subject to “dram shop” statutes in some states. These statutes generally allow a person injured by an intoxicated person to recover damages from an establishment that wrongfully served alcoholic beverages to the intoxicated

person. A judgment substantially in excess of our insurance coverage could harm our financial condition.

Various federal and

state labor laws govern our relationship with our employees and affect operating costs. These laws include minimum wage requirements, overtime pay, unemployment tax rates, workers’ compensation rates, citizenship requirements and sales taxes.

Additional government-imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, increased tax reporting and tax payment requirements for employees who receive gratuities, or a reduction in the number of

states that allow tips to be credited toward minimum wage requirements could harm our operating results.

The Federal Americans

with Disabilities Act prohibits discrimination on the basis of disability in public accommodations and employment. Although our restaurants are designed to be accessible to the disabled, we could be required to make modifications to our restaurants

to provide service to, or make reasonable accommodations for, disabled persons.

We are also subject to federal regulation and

state laws that regulate the offer and sale of franchises and aspects of the licensor-licensee relationship. Many state franchise laws impose restrictions on the franchise agreement, including limitations on non-competition provisions and the

termination or non-renewal of a franchise. Some states require that franchise materials be registered before franchises can be offered or sold in the state.

12

A significant increase in litigation could have a material adverse effect on our results of operations, financial condition and

business prospects.

As a participant in the restaurant industry, we are sometimes the subject of complaints or litigation

from guests alleging illness, injury or other food quality, health or operational concerns. Adverse publicity resulting from these allegations could harm our restaurants, regardless of whether the allegations are valid or whether we are liable. In

fact, we are subject to the same risks of adverse publicity resulting from these sorts of allegations even if the claim actually involves one of our franchisees. Further, employee claims against us based on, among other things, discrimination,

harassment or wrongful termination may divert our financial and management resources that would otherwise be used to benefit the future performance of our operations.

Our success depends on our ability to compete effectively in the restaurant industry.

Competition in the

restaurant industry is increasingly intense. We compete on the basis of the taste, quality, and price of food offered, guest service, ambiance and overall dining experience. We believe that our operating concept, attractive dining value and quality

of food and guest service, enable us to differentiate ourselves from our competitors. Our competitors include a large and diverse group of restaurant chains and individual restaurants that range from independent local operators that have opened

restaurants in various markets, to well-capitalized national restaurant companies. In addition, we compete with other restaurants and with retail establishments for real estate. Many of our competitors are well-established in the casual dining

market segment and some of our competitors have substantially greater financial, marketing and other resources than do we.

Risks related to this offering

Our stock price

may be volatile, and you may not be able to resell your shares at or above the initial offering price.

Prior to this

offering, there has been no public market for shares of our common stock. An active trading market may not develop or be sustained following completion of this offering. The initial public offering price of the shares has been determined by

negotiations between us and representatives of the underwriters. The price may bear no relationship to the price at which our common stock will trade upon completion of this offering. The stock market has experienced significant price and volume

fluctuations. Fluctuations or decreases in the trading price of our common stock may adversely affect your ability to trade your shares.

In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has often been instituted. A securities class action suit against us could result in substantial costs and

divert management’s attention and resources that would otherwise be used to benefit the future performance of our operations.

Approximately % of our outstanding shares of common stock may be sold into the public market in the future, which could depress our stock price.

The shares of common stock sold in this offering (and any shares

sold upon exercise of the underwriters’ over-allotment option) will be freely tradable without restriction under the Securities Act of 1933, except for any shares held by our officers, directors and principal stockholders. As of March 24, 2002,

approximately an additional 1,934,078 shares of common stock are currently freely tradable under Rule 144(k) under the Securities Act, unless any of such shares are purchased by one of our existing affiliates as that term is defined in Rule 144

under the Securities Act.

As of March 24, 2002, approximately 27,163,328 shares of our common stock which are outstanding and

held by our affiliates are subject to the volume and other limitations of Rule 144 or Rule 701 under the Securities Act. Approximately shares of our common stock are subject to lock-up agreements under which the holders have

13

agreed not to sell or otherwise dispose of any of their shares for a period of 180 days after the date of this prospectus without the prior written consent of Banc of America Securities LLC. In

its sole discretion and at any time without notice, Banc of America Securities LLC may release all or any portion of the shares subject to the lock-up agreements. All of the shares subject to lock-up agreements will become available for sale in the

public market immediately following expiration of the 180 day lock-up period, subject (to the extent applicable) to the volume and other limitations of Rule 144 or Rule 701 under the Securities Act. After expiration of the lock-up period, some of

our stockholders have the contractual right to require us to register some of their shares of common stock for future sale. In addition, options to purchase 4,240,950 shares of our common stock are outstanding as of March 24, 2002. Following this

offering, we expect to register the shares underlying these options. Subject to the exercise of these options, shares included in such registration will be available for sale in the public market immediately after the 180-day lock-up period expires.

Sales of substantial amounts of common stock in the public market, or the perception that these sales may occur, could

adversely affect the prevailing market price of our common stock and our ability to raise capital through a public offering of our equity securities. See “Shares Eligible for Future Sale” which describes the circumstances under which

restricted shares or shares held by affiliates may be sold in the public market.

Some of our stockholders can exert control over us, and may not make decisions

that are in the best interests of all stockholders.

After this offering, Quad-C, through its affiliates, will own

approximately % of our outstanding common stock, and our officers, directors and principal stockholders, i.e., stockholders holding more than 5.0% of our common stock, including Quad-C, will together control

approximately % of our outstanding common stock. As a result, Quad-C and these other stockholders, acting individually or together, could exert significant influence over all matters requiring stockholder approval, including

the election of directors and approval of significant corporate transactions. In addition, this concentration of ownership may delay or prevent a change in control of our company, and make some transactions more difficult or impossible without the

support of these stockholders. Also, the interests of Quad-C and these other stockholders may not always coincide with our interests as a company or the interest of other stockholders. Accordingly, Quad-C and these other stockholders could cause us

to enter into transactions or agreements that you would not approve.

As a new investor, you will experience immediate and substantial dilution in net tangible

book value.

Investors purchasing shares of our common stock in this offering will pay more for their shares than the amount

paid by existing stockholders who acquired shares prior to this offering. Accordingly, if you purchase common stock in this offering, you will incur immediate dilution in pro forma net tangible book value of approximately $

per share. If the holders of outstanding options or warrants exercise these options or warrants, you will incur further dilution. See “Dilution.”

Provisions in Delaware law and our charter may prevent or delay a change of control, even if that change of control may be beneficial to our stockholders.

We are subject to the Delaware anti-takeover laws regulating corporate takeovers. These anti-takeover laws prevent Delaware corporations from engaging in business combinations with any

stockholder, including all affiliates and associates of the stockholder, who owns 15.0% or more of the corporations’ outstanding voting stock, for three years following the date that the stockholder acquired 15.0% or more of the

corporation’s voting stock unless specified conditions are met, as further described in “Description of Capital Stock.”

14

Prior to the consummation of this offering, we intend to amend and restate our certificate of

incorporation and bylaws. Our amended and restated certificate of incorporation and bylaws will include a number of provisions that may deter or impede hostile takeovers or changes of control of management. These provisions will:

| |

• |

|

authorize our board of directors to establish one or more series of preferred stock, the terms of which can be determined by the board of directors at the time of issuance;

|

| |

• |

|

divide our board of directors into three classes of directors, with each class serving a staggered three-year term. As the classification of the board of directors generally

increases the difficulty of replacing a majority of the directors, it may tend to discourage a third party from making a tender offer or otherwise attempting to obtain control of us and may maintain the composition of the board of directors;

|

| |

• |

|

prohibit cumulative voting in the election of directors unless required by applicable law. Under cumulative voting, a minority stockholder holding a sufficient percentage of a

class of shares may be able to ensure the election of one or more directors; |

| |

• |

|

provide that a director may be removed from our board of directors only for cause, and then only by a supermajority vote of the outstanding shares;

|

| |

• |

|

require that any action required or permitted to be taken by our stockholders must be effected at a duly called annual or special meeting of stockholders and may not be

effected by any consent in writing; |

| |

• |

|

state that special meetings of our stockholders may be called only by the chairman of the board of directors, our chief executive officer, by the board of directors after a

resolution is adopted by a majority of the total number of authorized directors, or by the holders of not less than 10.0% of our outstanding voting stock; |

| |

• |

|

provide that the chairman or other person presiding over any stockholder meeting may adjourn the meeting whether or not a quorum is present at the meeting;

|

| |

• |

|

establish advance notice requirements for submitting nominations for election to the board of directors and for proposing matters that can be acted upon by stockholders at a

meeting; |

| |

• |

|

provide that certain provisions of our certificate of incorporation can be amended only by supermajority vote of the outstanding shares, and that our bylaws can be amended only

by supermajority vote of the outstanding shares or our board of directors; |

| |

• |

|

allow our directors, not our stockholders, to fill vacancies on our board of directors; and |

| |

• |

|

provide that the authorized number of directors may be changed only by resolution of the board of directors. |

15

This prospectus contains forward-looking statements. These statements

relate to future events or our future financial performance. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should” or “will” or the negative of these terms or other comparable terminology.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including those

relating to:

| |

Ÿ |

|

our ability to achieve and manage our planned expansion; |

| |

Ÿ |

|

our ability to raise capital in the future; |

| |

Ÿ |

|

the ability of our franchisees to open and manage new restaurants; |

| |

Ÿ |

|

our franchisees’ adherence to our practices, policies and procedures; |

| |

Ÿ |

|

changes in the availability and costs of food; |

| |

Ÿ |

|

potential fluctuation in our quarterly operating results due to seasonality and other factors; |

| |

Ÿ |

|

the continued service of key management personnel; |

| |

Ÿ |

|

the concentration of our restaurants in the Western United States; |

| |

Ÿ |

|

our ability to protect our name and logo and other proprietary information; |

| |

Ÿ |

|

changes in consumer preferences or consumer discretionary spending; |

| |

Ÿ |

|

health concerns about our food products; |

| |

Ÿ |

|

our ability to attract, motivate and retain qualified team members; |

| |

Ÿ |

|

the impact of federal, state or local government regulations relating to our team members or the sale of food and alcoholic beverages; |

| |

Ÿ |

|

the impact of litigation; and |

| |

Ÿ |

|

the effect of competition in the restaurant industry. |

Other risks, uncertainties and factors, including those discussed under “Risk Factors,” could cause our actual results to differ materially from those projected in any forward-looking statements we make.

We assume no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons

actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

16

We estimate that we will receive net proceeds from the sale of

shares of common stock in this offering of $ million, based on the initial public offering price of $ per share,

$ million if the underwriters’ over-allotment option is exercised in full, after deducting underwriting discounts and commissions and estimated offering expenses. We will not receive any proceeds

from the sale of shares by the selling stockholders.

We intend to use the net proceeds of this offering as follows:

| |

Ÿ |

|

approximately $ million to repay the outstanding amounts under our term loan with Finova Capital Corporation, including a prepayment penalty of 4.0%,

which bears interest at 9.9% and has a maturity date of September 1, 2012. |

| |

Ÿ |

|

approximately $ million to repay the outstanding amounts under our revolving credit facility with U.S. Bank National Association, which bears interest

at the London Interbank Offered Rate, or LIBOR, plus 3.0% and has a maturity date of March 31, 2003. We entered into this revolving credit facility for working capital and capital expenditure needs. |

| |

Ÿ |

|

approximately $ million to repay the outstanding amounts under one real estate loan with Captec Financial Group, including a prepayment penalty of 1.0%,

which bears interest at 10.1% and has a maturity date of January 1, 2012. |

| |

Ÿ |

|

approximately $ million to repay the outstanding amounts under two equipment loans with Captec and one equipment loan with General Electric Capital

Corporation, which bear interest at rates ranging from 9.6% to 11.6% and have maturity dates between April 1, 2003 and December 1, 2003. |

We intend to use the balance of the net proceeds of the offering for general corporate purposes, including opening new restaurants and acquiring existing restaurants from franchisees. We regularly consider these

acquisitions in the ordinary course of business, although we currently have no agreements regarding any future acquisitions. Pending use for general corporate purposes, opening new restaurants or making acquisitions, we intend to invest the net

proceeds in short-term, investment-grade, interest-bearing securities. We cannot predict whether the proceeds invested will yield a favorable return. See “Management’s Discussion and Analysis of Financial Condition and Results of

Operations—Liquidity and Capital Resources” for additional information regarding our sources and uses of capital.

17

We did not declare or pay any cash dividends on our common stock in 2000 or 2001. We

currently anticipate that we will retain any future earnings for the operation and expansion of our business. Accordingly, we do not anticipate declaring or paying any cash dividends on our common stock in the foreseeable future.

Our credit agreements prohibit us from declaring or paying any dividends or paying any dividends or other distributions on any shares of our

capital, subject to specified exceptions.

Any future determination relating to our dividend policy will be made at the

discretion of our board of directors and will depend on then existing conditions, including our financial condition, results of operations, contractual restrictions, capital requirements, business prospects and other factors our board of directors

may deem relevant.

18

The following table sets forth our cash, cash equivalents and capitalization as of

December 30, 2001:

| |

• |

|

on an actual basis; and |

| |

• |

|

on an as adjusted basis to reflect the sale of shares of our common stock offered by us in this offering at an offering price of

$ per share, less the underwriting discount and estimated offering expenses payable by us, and the use of proceeds from this offering to repay approximately $ million of indebtedness under our term

loan, including related fees, approximately $ million of indebtedness under our revolving credit facility and approximately $ of indebtedness under one real estate and three equipment loans, including

related fees. |

You should read the following table in conjunction with “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus.

| |

|

December 30, 2001

|

| |

|

Actual

|

|

|

As Adjusted

|

| |

|

|

|

|

(unaudited) |

| |

|

(in thousands) |

| Cash and cash equivalents |

|

$ |

18,992 |

|

|

$ |

|

| |

|

|

|

|

|

|

|

| Current portion of long-term debt (1) (2) |

|

$ |

5,077 |

|

|

$ |

|

| Long-term debt (1) (2) |

|

|

75,010 |

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

| Common stock, $.001 par value: 50,000,000 shares authorized, 29,261,906 shares issued and outstanding, actual;

shares authorized, shares issued and outstanding, as adjusted (3) |

|

|

29 |

|

|

|

|

| Additional paid-in capital |

|

|

53,436 |

|

|

|

|

| Retained earnings (accumulated deficit) |

|

|

(5,887 |

) |

|

|

|

| |

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

47,578 |

|

|

|

|

| |

|

|

|

|

|

|

|

| Total capitalization |

|

$ |

127,665 |

|

|

$ |

|

| |

|

|

|

|

|

|

|

(1) |

|

We are currently in discussions with lenders to enter into a new credit facility contingent upon the consummation of this offering. |

(2) |

|

Long-term debt includes capital leases. |

(3) |

|

Excludes 4,097,600 shares of common stock issuable on the exercise of stock options outstanding as of December 30, 2001. |

19

Our net tangible book value at December 30, 2001 was approximately $18.0 million, or

approximately $0.62 per share. Net tangible book value per share represents the amount of our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding as of December 30, 2001. Our pro forma net

tangible book value per share as of December 30, 2001 would have been approximately $ million or approximately $ per share after giving effect to the sale of shares of common stock offered by us at an

assumed initial public offering price of $ and our receipt of the estimated net proceeds after deducting estimated underwriting discounts and estimated offering expenses and repayment of approximately

$ million of indebtedness under our term loan, including related fees, approximately $ million of indebtedness under our revolving credit facility and approximately $ million of

indebtedness under one real estate and three equipment loans, including related fees. This represents an immediate increase in net tangible book value of $ per share to existing stockholders and an immediate dilution of

$ per share to new investors purchasing shares of common stock in this offering. If the initial public offering price is higher or lower, the dilution to investors will be greater or less. The following table illustrates this

per share dilution.

| Assumed initial public offering price per share |

|

|

|

$ |

|

| |

|

|

|

|

|

| Net tangible book value per share as of December 30, 2001 |

|

$ 0.62 |

|

|

|

| |

|

|

|

|

|

| Increase in net tangible book value per share attributable to new investors |

|

|

|

|

|

| |

|

|

|

|

|

| Pro forma net tangible book value per share after the offering |

|

|

|

|

|

| |

|

|

|

|

|

| Dilution per share to new investors |

|

|

|

$ |

|

| |

|

|

|

|

|

The following table summarizes the difference between the existing stockholders

and new stockholders with respect to the number of shares of common stock purchased from us, the total consideration paid to us, and the average price per share paid. The information is presented as of December 30, 2001 and is based on an assumed