Red Robin - Continuing the Momentum Investor Presentation ICR Conference January 2016

2 Forward-Looking Statements Forward-looking statements in this presentation regarding our strategic plan and business initiatives, brand transformation efforts, new restaurant development, AUV growth opportunities, certain statements including, but not limited to, those under the headings “Causes Identified – Solves in Place,” “2016 Back on Track,” “Project RED²,” “Growing Free Cash Flow,” and “Key Take-Aways” and all other statements that are not historical facts, are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on assumptions believed by the Company to be reasonable and speak only as of the date on which such statements are made. Without limiting the generality of the foregoing, words such as “complete,” “continue,” “increased,” “emphasize,” “planned,” “developing,” “expanding,” “growing” or “potential,” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. We undertake no obligation to update such statements to reflect events or circumstances arising after such date, and we caution investors not to place undue reliance on any such forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those described in the statements based on a number of factors, including but not limited to the following: the effectiveness of the Company’s business initiatives and strategies related to guest engagement, operational efficiencies and restaurant development; the ability to achieve anticipated revenue and cost savings from these and other initiatives; general economic conditions; competition in the casual dining market and discounting by competitors; changes in commodity prices; the cost and availability of key food products, labor and energy; availability of capital or credit facility borrowings; the adequacy of cash flows or available debt resources to fund operations and growth opportunities; the ability to fulfill planned expansion, including in both new and existing markets; federal, state and local regulation of our business; and other risk factors described from time to time in the Company’s Form 10-K, Form 10-Q and Form 8-K reports (including all amendments to those reports) (“Reports”) filed with the U.S. Securities and Exchange Commission. This presentation also contains non- GAAP financial information including adjusted EBITDA. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. For a reconciliation of non-GAAP measures used in this presentation, see our website at www.redrobin.com under the “Investors” tab. Investors are directed to consult the Company’s Reports for further information.

3 Recognized & Differentiated Burger Authority • 528 casual-dining restaurants in 44 states and 2 Canadian provinces o 429 company-owned o 99 franchised • 10 Red Robin Burger Works fast casual restaurants • Recognized for high-quality, innovative burger creations since 1969 • Strong brand differentiation and recognition • Three levels of burgers – Finest, Gourmet and Tavern • Family focused and adult-friendly Finest Burgers

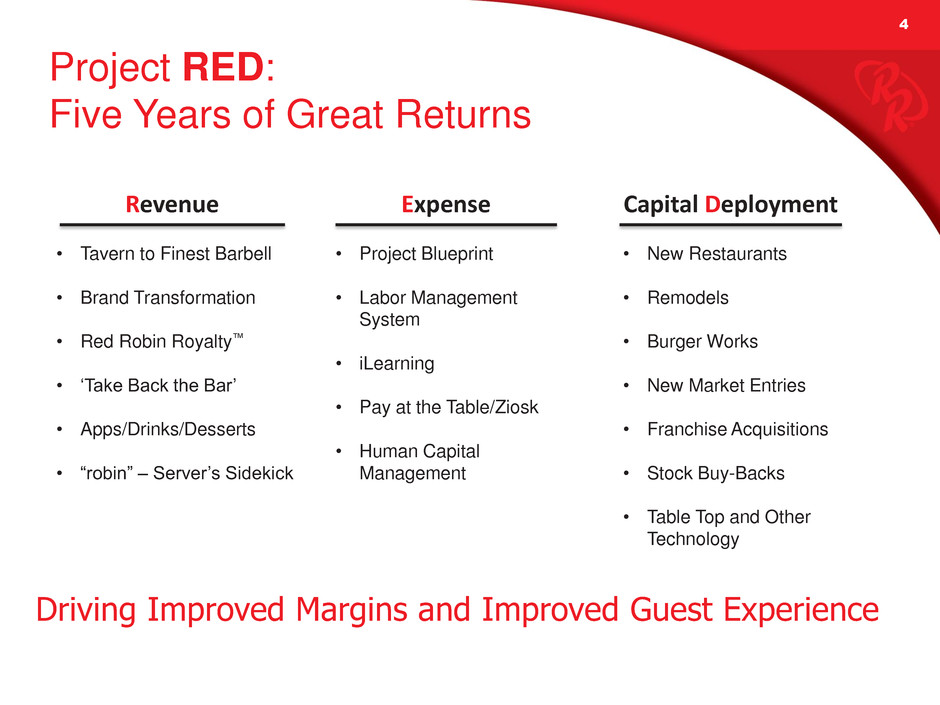

4 Project RED: Five Years of Great Returns • Tavern to Finest Barbell • Brand Transformation • Red Robin Royalty™ • ‘Take Back the Bar’ • Apps/Drinks/Desserts • “robin” – Server’s Sidekick • New Restaurants • Remodels • Burger Works • New Market Entries • Franchise Acquisitions • Stock Buy-Backs • Table Top and Other Technology Revenue Expense Capital Deployment • Project Blueprint • Labor Management System • iLearning • Pay at the Table/Ziosk • Human Capital Management Driving Improved Margins and Improved Guest Experience

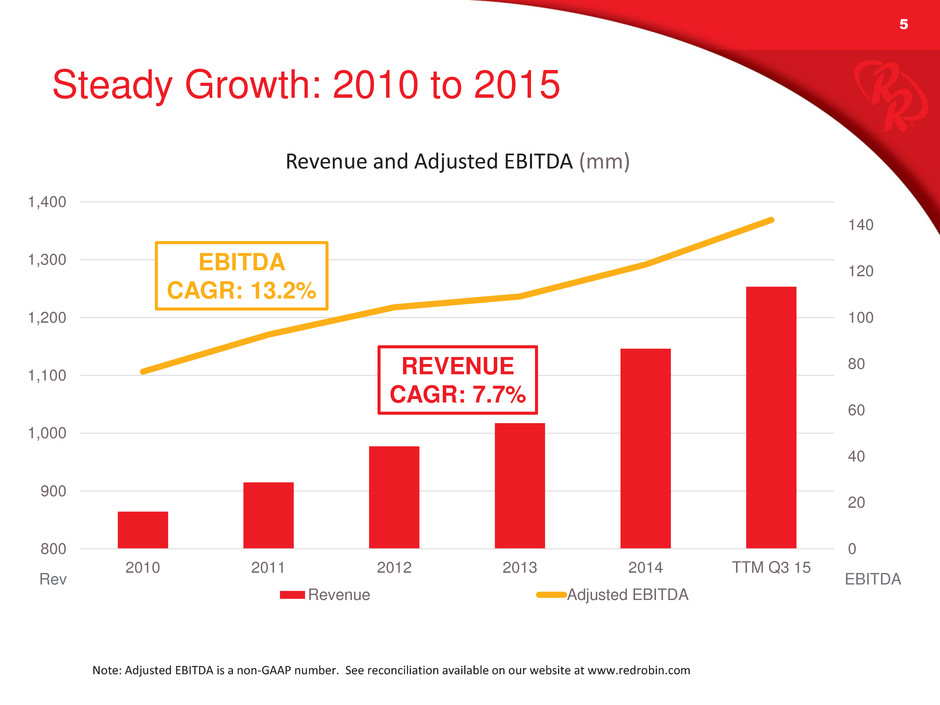

5 Steady Growth: 2010 to 2015 0 20 40 60 80 100 120 140 800 900 1,000 1,100 1,200 1,300 1,400 2010 2011 2012 2013 2014 TTM Q3 15 Revenue and Adjusted EBITDA (mm) Revenue Adjusted EBITDA REVENUE CAGR: 7.7% EBITDA CAGR: 13.2% Rev EBITDA Note: Adjusted EBITDA is a non-GAAP number. See reconciliation available on our website at www.redrobin.com

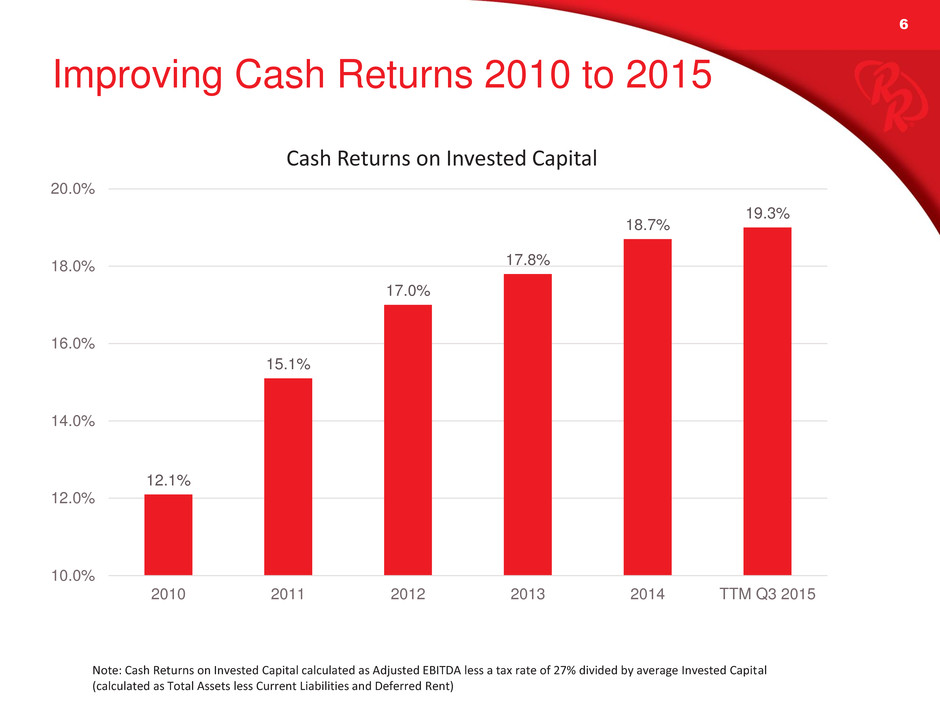

6 Improving Cash Returns 2010 to 2015 12.1% 15.1% 17.0% 17.8% 18.7% 19.3% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 2010 2011 2012 2013 2014 TTM Q3 2015 Cash Returns on Invested Capital Note: Cash Returns on Invested Capital calculated as Adjusted EBITDA less a tax rate of 27% divided by average Invested Capital (calculated as Total Assets less Current Liabilities and Deferred Rent)

7 Opportunities Remain • Supply Chain Management & Cost Controls o Legacy systems constrain ability to harvest Blueprint opportunities o Further margin expansion possible in food and beverage costs • Heart-Of-House Tools o Current tools primarily manual and cumbersome o Speed of service and capacity compromised o Undermines incremental impact of “To-Go” and other initiatives • Capacity Constraints o At effective capacity across dayparts o Barriers to achieving ideal peak hour potential o Limits further guest experience enhancements

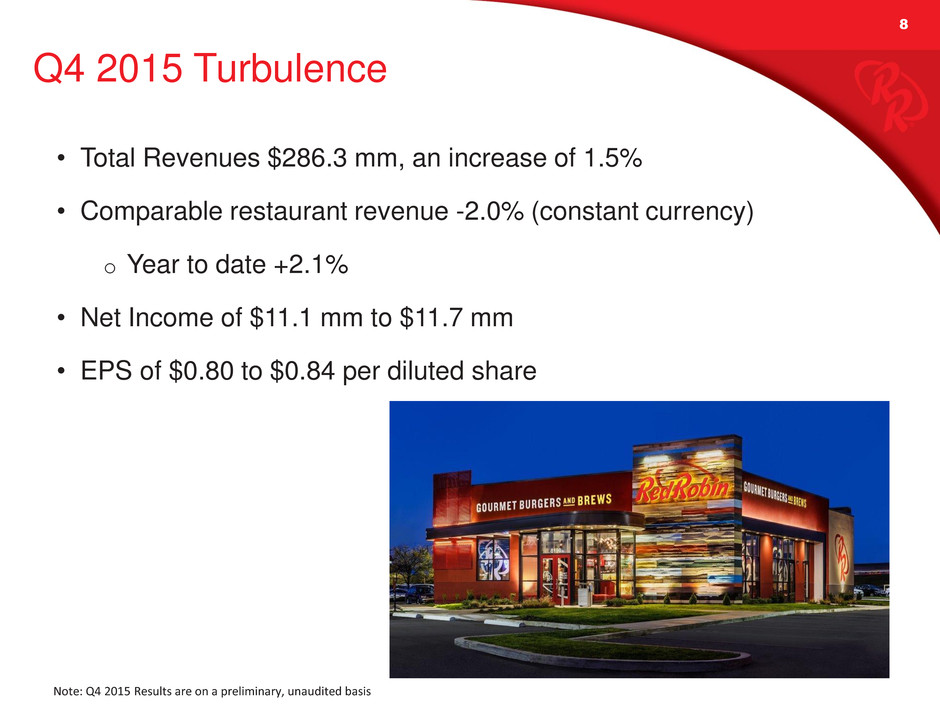

8 Q4 2015 Turbulence • Total Revenues $286.3 mm, an increase of 1.5% • Comparable restaurant revenue -2.0% (constant currency) o Year to date +2.1% • Net Income of $11.1 mm to $11.7 mm • EPS of $0.80 to $0.84 per diluted share Note: Q4 2015 Results are on a preliminary, unaudited basis

9 Causes Identified • “Deal” Environment Heated Up Quickly o $6.99 Tavern Double Everyday Value overwhelmed • Lost the “Buzz” of Fun News o Limited conversation since first quarter • Self-Inflicted Damage o Traffic-driving tactics failed to comp sports sponsorships o Eliminated Bottomless Pasta for kids • Implementing New Plans For 2016

10 The Next Five Years – Harvesting the Opportunities 0 20 40 60 80 100 120 140 800 900 1,000 1,100 1,200 1,300 1,400 2010 2011 2012 2013 2014 TTM Q3 15 Revenue and Adjusted EBITDA (mm) Revenue Adjusted EBITDA Note: Adjusted EBITDA is a non-GAAP number. See reconciliation available on www.redrobin.com • Expand EBITDA Margins 200 bps+ • Grow Four Wall Volumes • Accelerate New Unit Growth

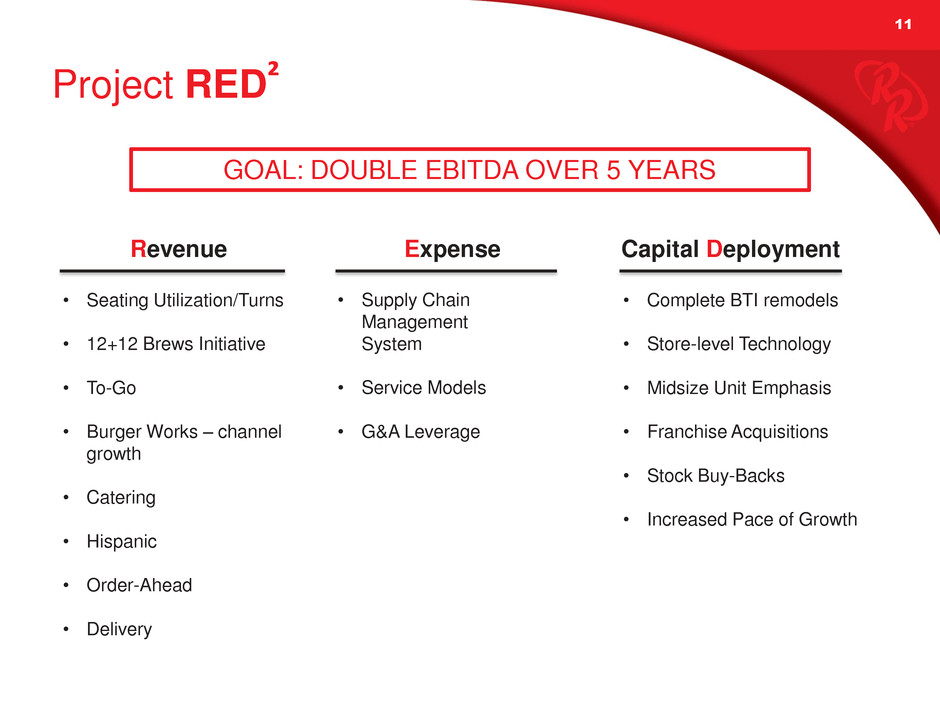

11 6 GOAL: DOUBLE EBITDA OVER 5 YEARS • Seating Utilization/Turns • 12+12 Brews Initiative • To-Go • Burger Works – channel growth • Catering • Hispanic • Order-Ahead • Delivery • Complete BTI remodels • Store-level Technology • Midsize Unit Emphasis • Franchise Acquisitions • Stock Buy-Backs • Increased Pace of Growth • Supply Chain Management System • Service Models • G&A Leverage Revenue Expense Capital Deployment Project RED²

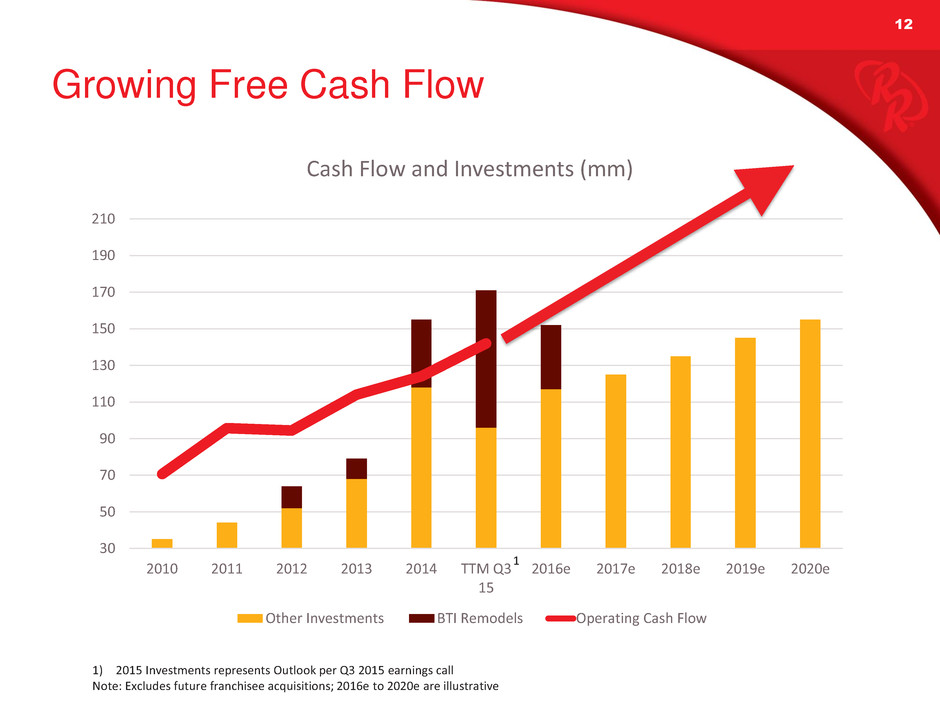

12 Growing Free Cash Flow 30 50 70 90 110 130 150 170 190 210 2010 2011 2012 2013 2014 TTM Q3 15 2016e 2017e 2018e 2019e 2020e Cash Flow and Investments (mm) Other Investments BTI Remodels Operating Cash Flow 1) 2015 Investments represents Outlook per Q3 2015 earnings call Note: Excludes future franchisee acquisitions; 2016e to 2020e are illustrative 1

13 Key Take-Aways • Five-year track record of increasing guest engagement and returns • Q4 turbulence – a call to action • RED – Double EBITDA over 5 years • Robust multi-year plan mapped out with significant opportunities • Considerable white space for development • Significant free cash flow engine 2017 and beyond • Organization that delivers ²

14 APPENDIX

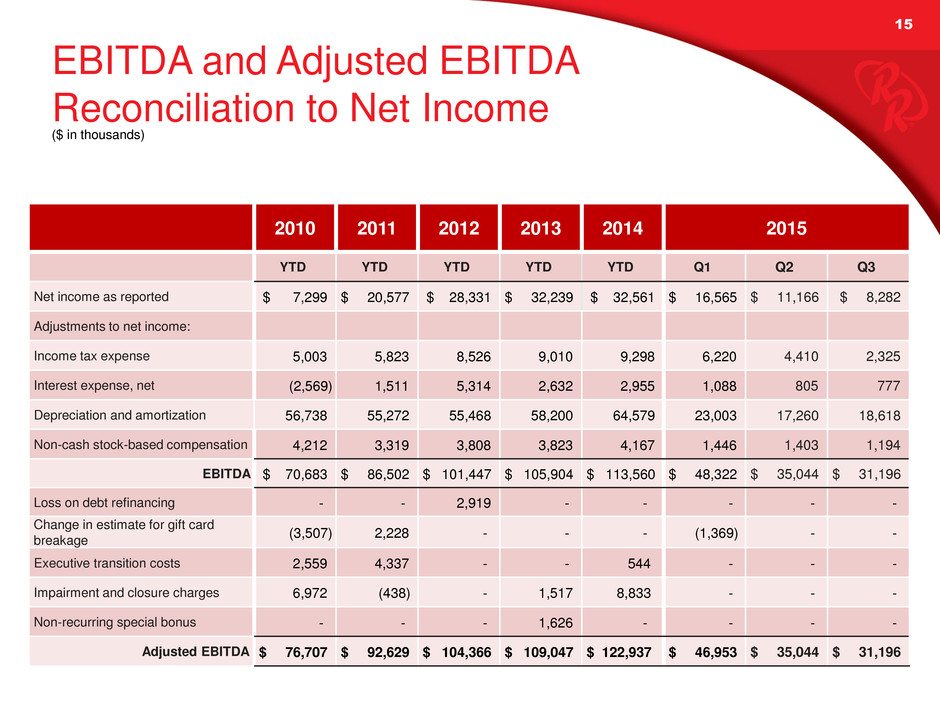

15 EBITDA and Adjusted EBITDA Reconciliation to Net Income 15 2010 2011 2012 2013 2014 2015 YTD YTD YTD YTD YTD Q1 Q2 Q3 Net income as reported $ 7,299 $ 20,577 $ 28,331 $ 32,239 $ 32,561 $ 16,565 $ 11,166 $ 8,282 Adjustments to net income: Income tax expense 5,003 5,823 8,526 9,010 9,298 6,220 4,410 2,325 Interest expense, net (2,569) 1,511 5,314 2,632 2,955 1,088 805 777 Depreciation and amortization 56,738 55,272 55,468 58,200 64,579 23,003 17,260 18,618 Non-cash stock-based compensation 4,212 3,319 3,808 3,823 4,167 1,446 1,403 1,194 EBITDA $ 70,683 $ 86,502 $ 101,447 $ 105,904 $ 113,560 $ 48,322 $ 35,044 $ 31,196 Loss on debt refinancing - - 2,919 - - - - - Change in estimate for gift card breakage (3,507) 2,228 - - - (1,369) - - Executive transition costs 2,559 4,337 - - 544 - - - Impairment and closure charges 6,972 (438) - 1,517 8,833 - - - Non-recurring special bonus - - - 1,626 - - - - Adjusted EBITDA $ 76,707 $ 92,629 $ 104,366 $ 109,047 $ 122,937 $ 46,953 $ 35,044 $ 31,196 ($ in thousands)