CLASSIFIED – INTERNAL USE First Quarter 2016 Results May 17, 2016

2CLASSIFIED – INTERNAL USE Forward-Looking Statements Forward-looking statements in this presentation regarding our strategic initiatives, future performance, revenues, EBITDA, capital investments, anticipated number and timing of new restaurant openings (including Red Robin Burger Works), the anticipated number and timing of restaurant remodels under the Brand Transformation Initiative, anticipated costs, expenses including depreciation, amortization, and interest expense, tax rate, statements under the heading “Outlook for 2016” and all other statements that are not historical facts, are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on assumptions believed by the Company to be reasonable and speak only as of the date on which such statements are made. Without limiting the generality of the foregoing, words such as “expect,” “anticipate,” “intend,” “plan,” “project” or “estimate,” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. We undertake no obligation to update such statements to reflect events or circumstances arising after such date, and we caution investors not to place undue reliance on any such forward-looking statements. Forward- looking statements involve risks and uncertainties that could cause actual results to differ materially from those described in the statements based on a number of factors, including but not limited to the following: the effectiveness of our business improvement initiatives; ability to fulfill planned expansion and restaurant remodeling; the effectiveness of our marketing strategies and initiatives to achieve restaurant sales growth; the cost and availability of key food products, labor, and energy; our ability to achieve anticipated revenue and cost savings from our new technology systems and tools in the restaurants and other initiatives; our ability to increase our to-go and other offerings; availability of capital or credit facility borrowings; the adequacy of cash flows or available debt resources to fund operations and growth opportunities; federal, state, and local regulation of our business; and other risk factors described from time to time in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments to those reports) filed with the U.S. Securities and Exchange Commission. This presentation may also contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to- period comparisons. For a reconciliation of non-GAAP measures presented in this document, see the Appendix of this presentation or the Schedules to the Q1 press release posted on redrobin.com.

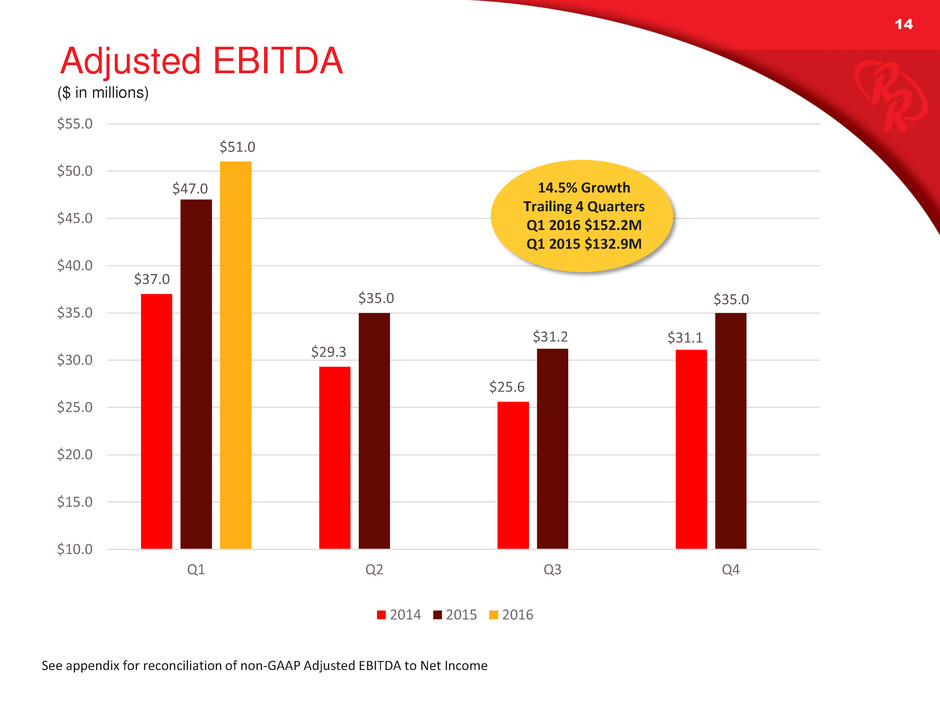

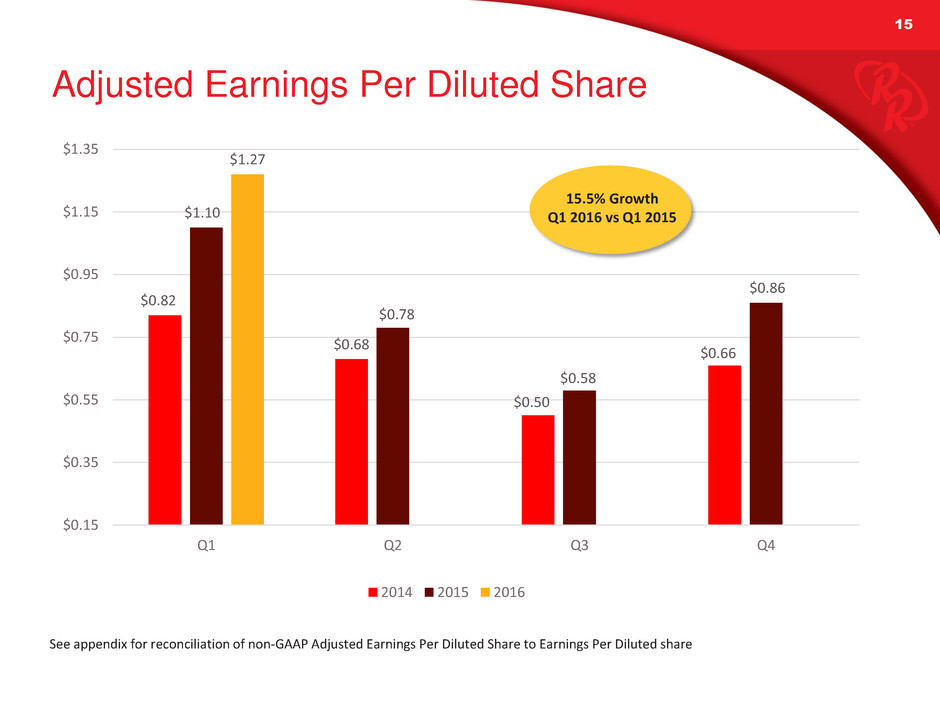

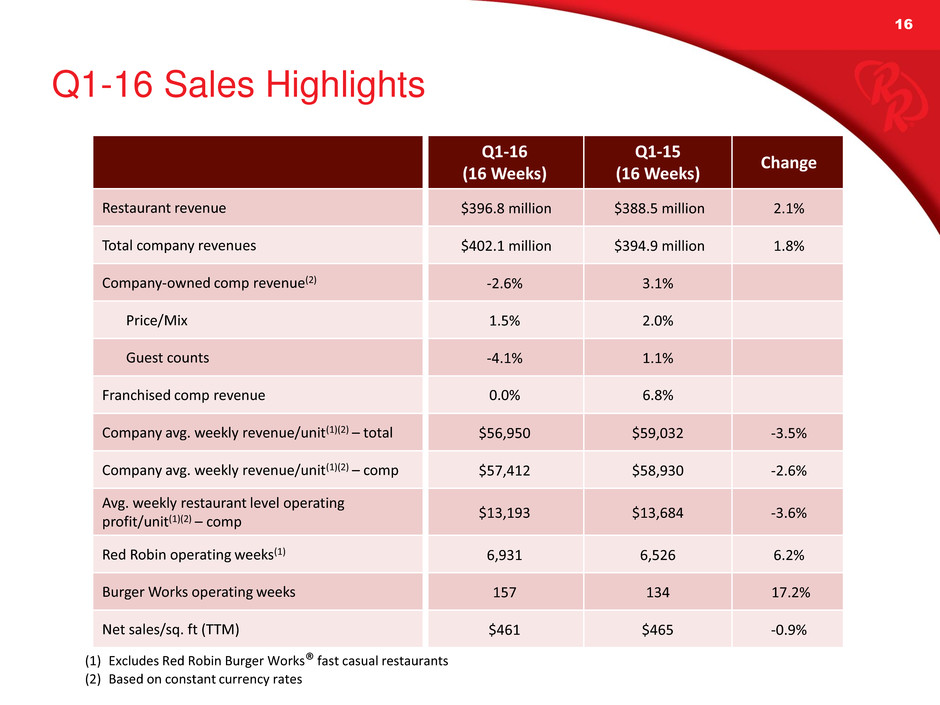

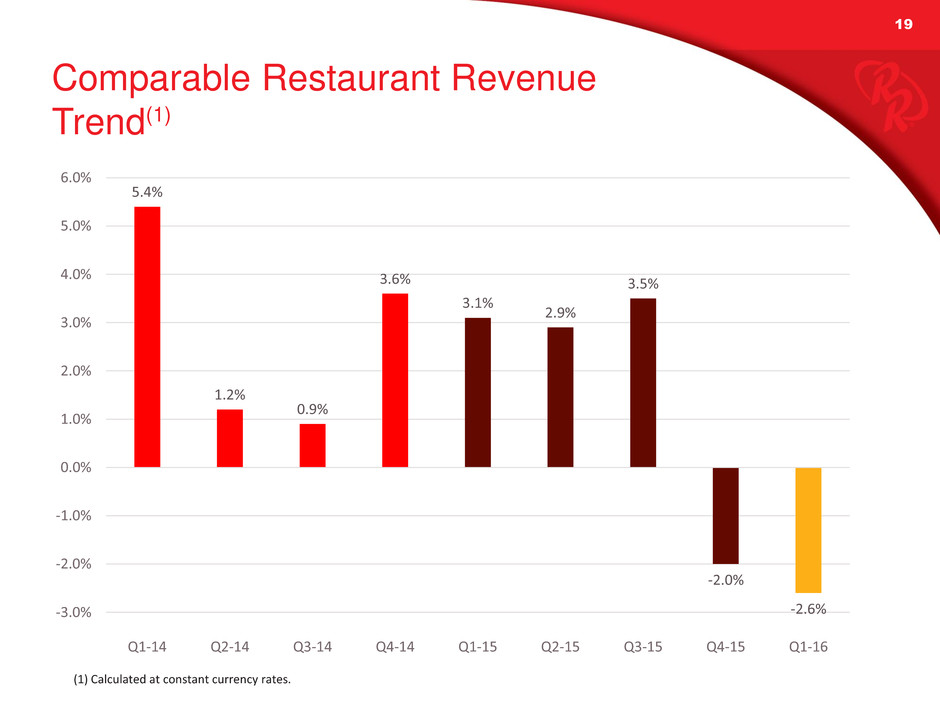

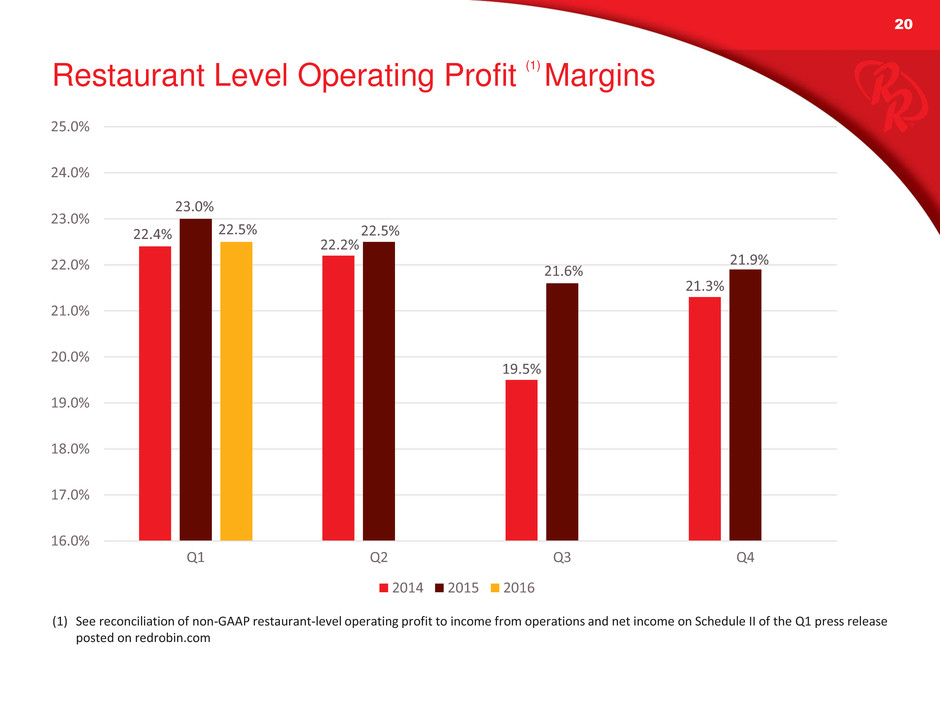

3CLASSIFIED – INTERNAL USE Red Robin Q1-2016 Results • Total revenues increased 1.8% • Comparable restaurant revenue down 2.6%, at constant currency rates • Guest counts decreased 4.1%, 90 basis points below casual dining peers • Restaurant-level operating profit was 22.5% compared to 23.0% in prior year • Adjusted diluted EPS was $1.27, an increase of 15.5% over prior year • Adjusted EBITDA was $51.0 million, an increase of 8.5% over prior year • Opened 2 Red Robin® restaurants, opened 1 and relocated 1 Red Robin Burger Works ® • Acquired 13 franchised restaurants in Texas NOTE: See reconciliations of restaurant-level operating profit in Appendix.

4CLASSIFIED – INTERNAL USE 6 GOAL: DOUBLE EBITDA OVER 5 YEARS • Seating Utilization/Turns • 12+12 Brews Initiative • To-Go • Burger Works – channel growth • Catering • Hispanic Market • Order-Ahead • Delivery • Complete BTI remodels • Restaurant-level Technology • Midsize Unit Emphasis • Franchise Acquisitions • Stock Buy-Backs • Increased Pace of Growth • Supply Chain Management System • Cost-saving Initiatives • Labor Models • G&A Leverage Revenue Expense Capital Deployment Project RED²

5CLASSIFIED – INTERNAL USE Making Progress on RED Initiatives Revenue Growth • KDS and table management software • To-Go and online ordering Expense Management • Cloud-based repair and maintenance application • Supply chain management software • Project Blueprint cost-saving initiatives Deployment of Capital • Completion of brand transformation remodels in 2016 • Acquisition of 13 franchised restaurants in Texas • Solid returns on new restaurants ²

CLASSIFIED – INTERNAL USE 6 Marketing Update

7CLASSIFIED – INTERNAL USE A Strong Brand Foundation

8CLASSIFIED – INTERNAL USE Double Tavern Double Plus Promo

9CLASSIFIED – INTERNAL USE Bottomless Kids Pasta Red Robin bottomless video at: https://www.youtube.com/watch?v=ngt6azYQBt8

10CLASSIFIED – INTERNAL USE Q1 Product News

11CLASSIFIED – INTERNAL USE Our competitive edge: A great Team and can-do culture!

12CLASSIFIED – INTERNAL USE Carin Stutz, EVP & Chief Operating Officer • Recognized industry leader • More than 30 years of restaurant operations experience • Served in leadership roles for top casual dining and fast casual brands • Past board chair and member of board of directors for Woman’s Foodservice Forum Carin Stutz

CLASSIFIED – INTERNAL USE 13 Financial Update

14CLASSIFIED – INTERNAL USE $37.0 $29.3 $25.6 $31.1 $47.0 $35.0 $31.2 $35.0 $51.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 $50.0 $55.0 Q1 Q2 Q3 Q4 2014 2015 2016 14.5% Growth Trailing 4 Quarters Q1 2016 $152.2M Q1 2015 $132.9M Adjusted EBITDA ($ in millions) 14 See appendix for reconciliation of non-GAAP Adjusted EBITDA to Net Income

15CLASSIFIED – INTERNAL USE Adjusted Earnings Per Diluted Share $0.82 $0.68 $0.50 $0.66 $1.10 $0.78 $0.58 $0.86 $1.27 $0.15 $0.35 $0.55 $0.75 $0.95 $1.15 $1.35 Q1 Q2 Q3 Q4 2014 2015 2016 15 See appendix for reconciliation of non-GAAP Adjusted Earnings Per Diluted Share to Earnings Per Diluted share 15.5% Growth Q1 2016 vs Q1 2015

16CLASSIFIED – INTERNAL USE Q1-16 Sales Highlights Q1-16 (16 Weeks) Q1-15 (16 Weeks) Change Restaurant revenue $396.8 million $388.5 million 2.1% Total company revenues $402.1 million $394.9 million 1.8% Company-owned comp revenue(2) -2.6% 3.1% Price/Mix 1.5% 2.0% Guest counts -4.1% 1.1% Franchised comp revenue 0.0% 6.8% Company avg. weekly revenue/unit(1)(2) – total $56,950 $59,032 -3.5% Company avg. weekly revenue/unit(1)(2) – comp $57,412 $58,930 -2.6% Avg. weekly restaurant level operating profit/unit(1)(2) – comp $13,193 $13,684 -3.6% Red Robin operating weeks(1) 6,931 6,526 6.2% Burger Works operating weeks 157 134 17.2% Net sales/sq. ft (TTM) $461 $465 -0.9% (1) Excludes Red Robin Burger Works® fast casual restaurants (2) Based on constant currency rates

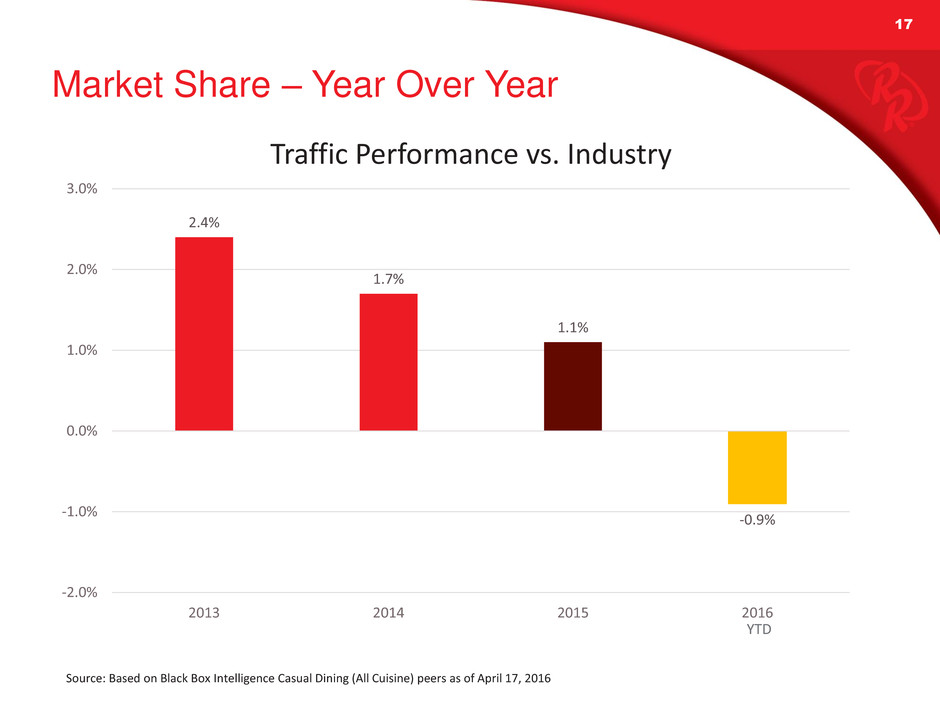

17CLASSIFIED – INTERNAL USE Market Share – Year Over Year 2.4% 1.7% 1.1% -0.9% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 2013 2014 2015 2016 Traffic Performance vs. Industry Source: Based on Black Box Intelligence Casual Dining (All Cuisine) peers as of April 17, 2016 YTD

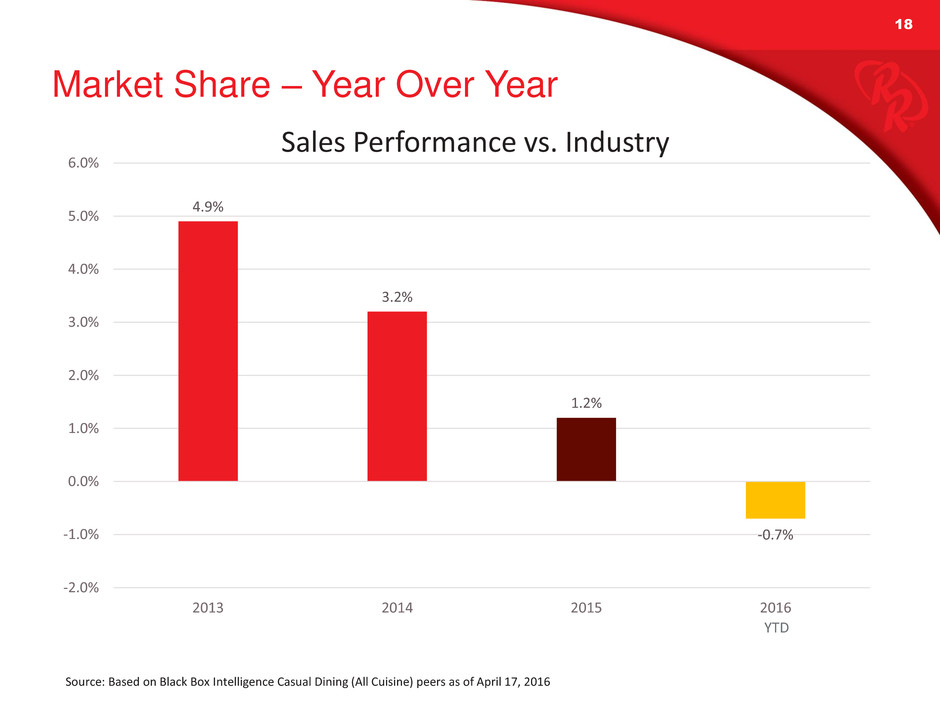

18CLASSIFIED – INTERNAL USE Market Share – Year Over Year 4.9% 3.2% 1.2% -0.7% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 2013 2014 2015 2016 Sales Performance vs. Industry Source: Based on Black Box Intelligence Casual Dining (All Cuisine) peers as of April 17, 2016 YTD

19CLASSIFIED – INTERNAL USE Comparable Restaurant Revenue Trend(1) 5.4% 1.2% 0.9% 3.6% 3.1% 2.9% 3.5% -2.0% -2.6%-3.0% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% Q1-14 Q2-14 Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 (1) Calculated at constant currency rates.

20CLASSIFIED – INTERNAL USE 22.4% 22.2% 19.5% 21.3% 23.0% 22.5% 21.6% 21.9% 22.5% 16.0% 17.0% 18.0% 19.0% 20.0% 21.0% 22.0% 23.0% 24.0% 25.0% Q1 Q2 Q3 Q4 2014 2015 2016 Restaurant Level Operating Profit (1) Margins 20 (1) See reconciliation of non-GAAP restaurant-level operating profit to income from operations and net income on Schedule II of the Q1 press release posted on redrobin.com

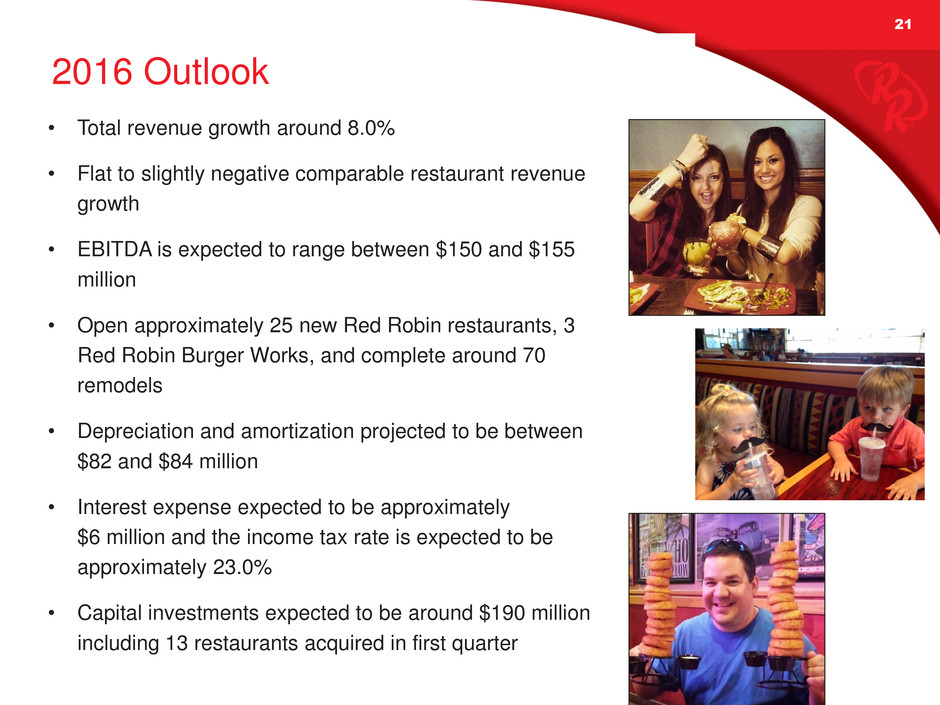

21CLASSIFIED – INTERNAL USE 2016 Outlook • Total revenue growth around 8.0% • Flat to slightly negative comparable restaurant revenue growth • EBITDA is expected to range between $150 and $155 million • Open approximately 25 new Red Robin restaurants, 3 Red Robin Burger Works, and complete around 70 remodels • Depreciation and amortization projected to be between $82 and $84 million • Interest expense expected to be approximately $6 million and the income tax rate is expected to be approximately 23.0% • Capital investments expected to be around $190 million including 13 restaurants acquired in first quarter

22CLASSIFIED – INTERNAL USE In Closing 22

23CLASSIFIED – INTERNAL USE Thank you to all of our Team Members! 17

CLASSIFIED – INTERNAL USE 24 Appendix

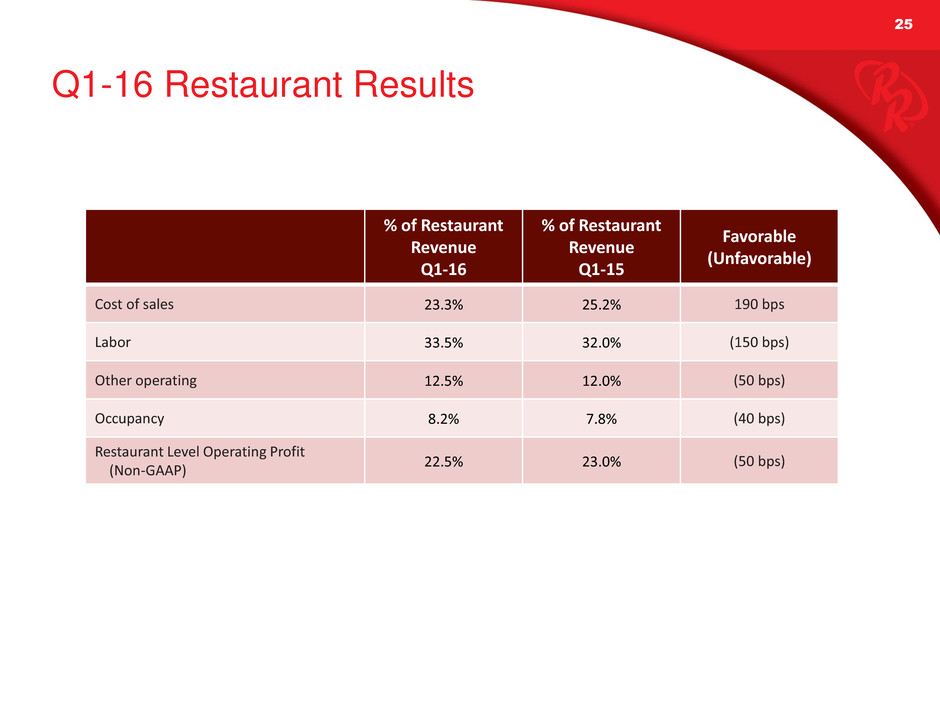

25CLASSIFIED – INTERNAL USE Q1-16 Restaurant Results 25 % of Restaurant Revenue Q1-16 % of Restaurant Revenue Q1-15 Favorable (Unfavorable) Cost of sales 23.3% 25.2% 190 bps Labor 33.5% 32.0% (150 bps) Other operating 12.5% 12.0% (50 bps) Occupancy 8.2% 7.8% (40 bps) Restaurant Level Operating Profit (Non-GAAP) 22.5% 23.0% (50 bps)

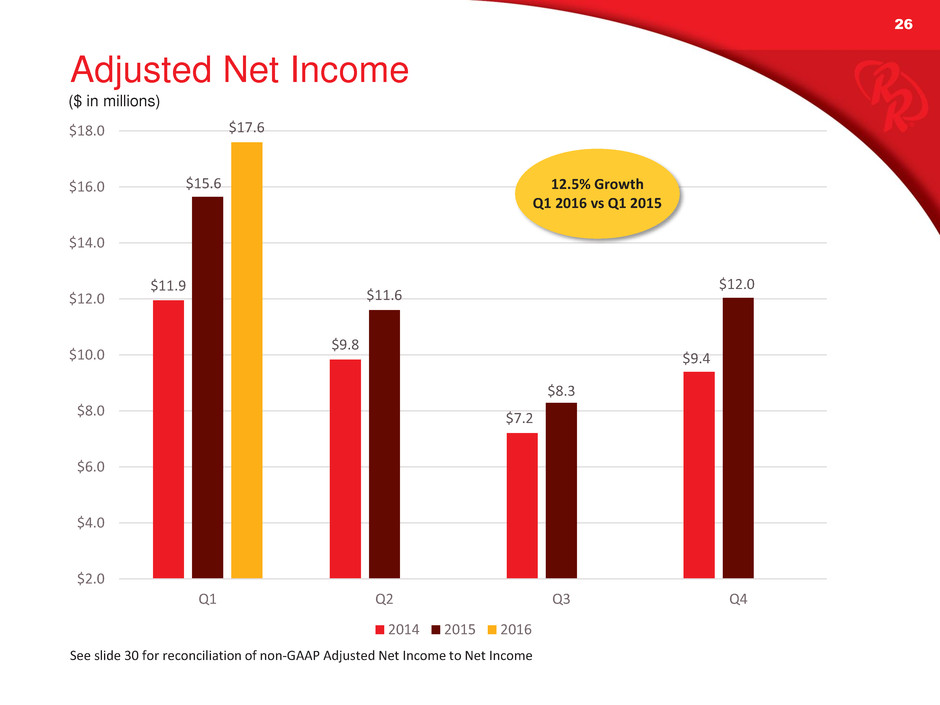

26CLASSIFIED – INTERNAL USE Adjusted Net Income $11.9 $9.8 $7.2 $9.4 $15.6 $11.6 $8.3 $12.0 $17.6 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 Q1 Q2 Q3 Q4 2014 2015 2016 ($ in millions) 26 See slide 30 for reconciliation of non-GAAP Adjusted Net Income to Net Income 12.5% Growth Q1 2016 vs Q1 2015

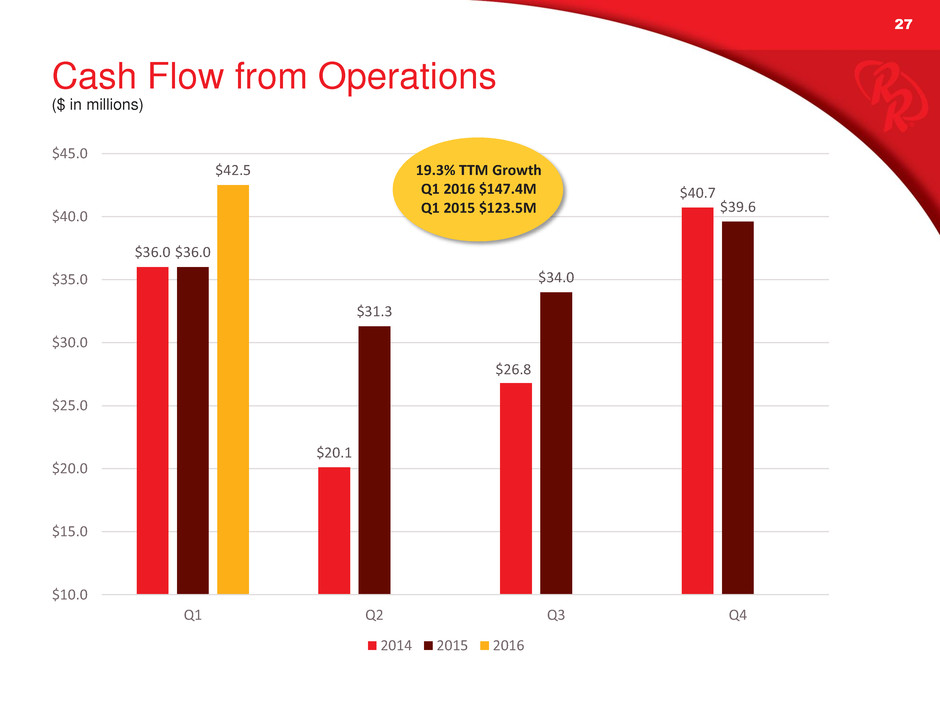

27CLASSIFIED – INTERNAL USE $36.0 $20.1 $26.8 $40.7 $36.0 $31.3 $34.0 $39.6 $42.5 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 Q1 Q2 Q3 Q4 2014 2015 2016 Cash Flow from Operations ($ in millions) 27 19.3% TTM Growth Q1 2016 $147.4M Q1 2015 $123.5M

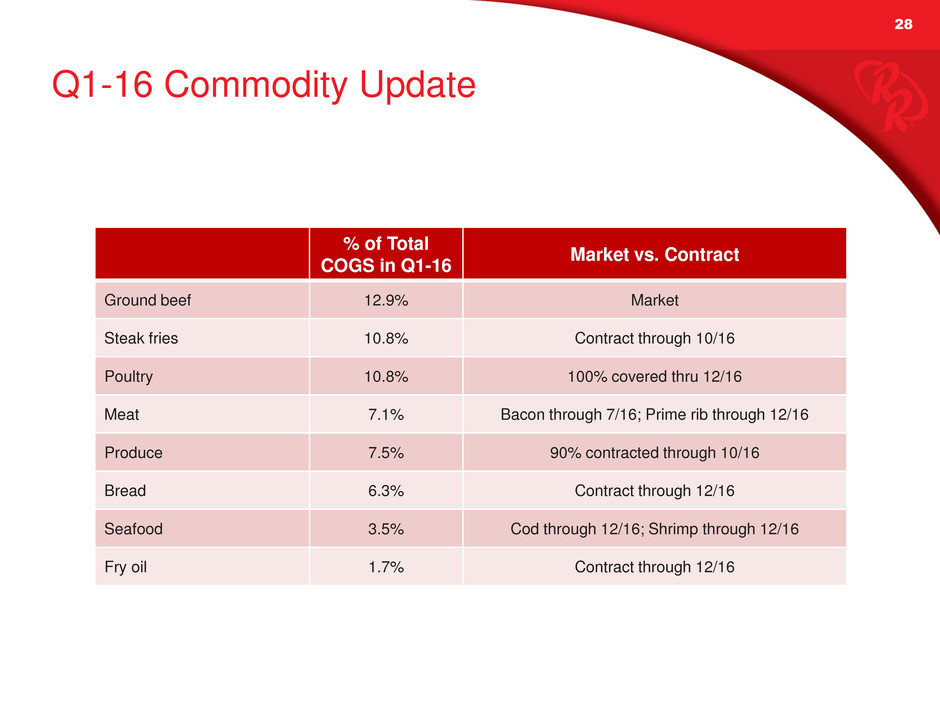

28CLASSIFIED – INTERNAL USE Q1-16 Commodity Update 28 % of Total COGS in Q1-16 Market vs. Contract Ground beef 12.9% Market Steak fries 10.8% Contract through 10/16 Poultry 10.8% 100% covered thru 12/16 Meat 7.1% Bacon through 7/16; Prime rib through 12/16 Produce 7.5% 90% contracted through 10/16 Bread 6.3% Contract through 12/16 Seafood 3.5% Cod through 12/16; Shrimp through 12/16 Fry oil 1.7% Contract through 12/16

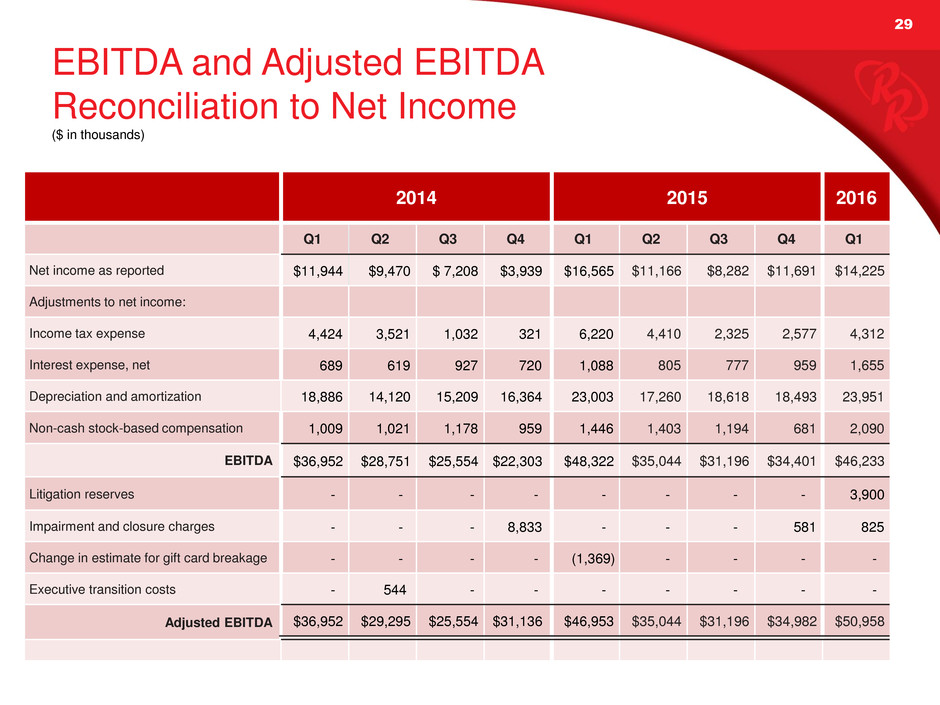

29CLASSIFIED – INTERNAL USE EBITDA and Adjusted EBITDA Reconciliation to Net Income 29 2014 2015 2016 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Net income as reported $11,944 $9,470 $ 7,208 $3,939 $16,565 $11,166 $8,282 $11,691 $14,225 Adjustments to net income: Income tax expense 4,424 3,521 1,032 321 6,220 4,410 2,325 2,577 4,312 Interest expense, net 689 619 927 720 1,088 805 777 959 1,655 Depreciation and amortization 18,886 14,120 15,209 16,364 23,003 17,260 18,618 18,493 23,951 Non-cash stock-based compensation 1,009 1,021 1,178 959 1,446 1,403 1,194 681 2,090 EBITDA $36,952 $28,751 $25,554 $22,303 $48,322 $35,044 $31,196 $34,401 $46,233 Litigation reserves - - - - - - - - 3,900 Impairment and closure charges - - - 8,833 - - - 581 825 Change in estimate for gift card breakage - - - - (1,369) - - - - Executive transition costs - 544 - - - - - - - Adjusted EBITDA $36,952 $29,295 $25,554 $31,136 $46,953 $35,044 $31,196 $34,982 $50,958 ($ in thousands)

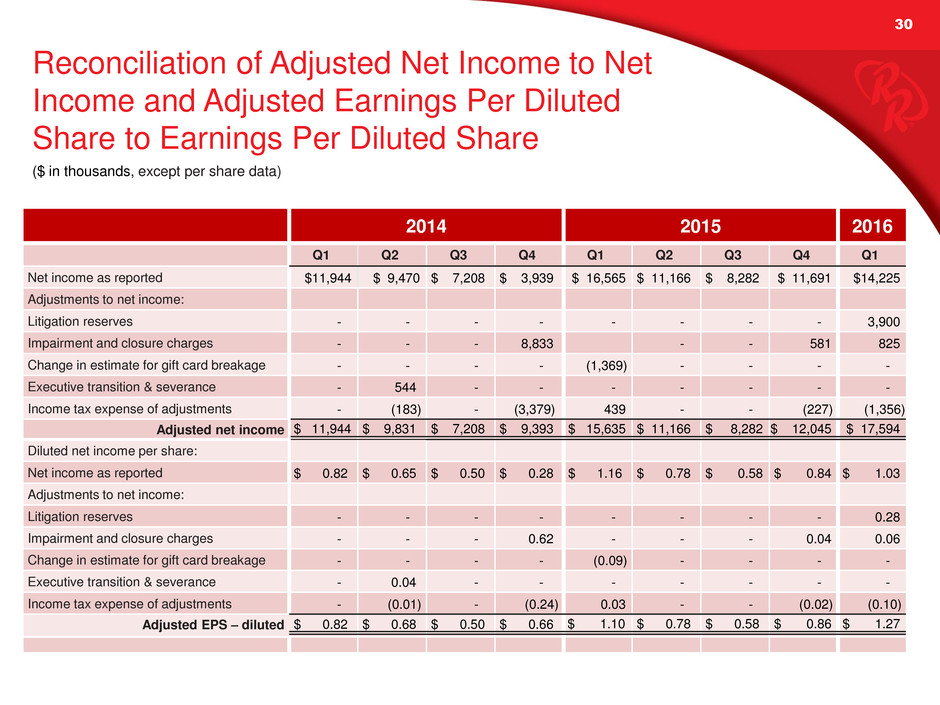

30CLASSIFIED – INTERNAL USE Reconciliation of Adjusted Net Income to Net Income and Adjusted Earnings Per Diluted Share to Earnings Per Diluted Share 30 2014 2015 2016 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Net income as reported $11,944 $ 9,470 $ 7,208 $ 3,939 $ 16,565 $ 11,166 $ 8,282 $ 11,691 $14,225 Adjustments to net income: Litigation reserves - - - - - - - - 3,900 Impairment and closure charges - - - 8,833 - - 581 825 Change in estimate for gift card breakage - - - - (1,369) - - - - Executive transition & severance - 544 - - - - - - - Income tax expense of adjustments - (183) - (3,379) 439 - - (227) (1,356) Adjusted net income $ 11,944 $ 9,831 $ 7,208 $ 9,393 $ 15,635 $ 11,166 $ 8,282 $ 12,045 $ 17,594 Diluted net income per share: Net income as reported $ 0.82 $ 0.65 $ 0.50 $ 0.28 $ 1.16 $ 0.78 $ 0.58 $ 0.84 $ 1.03 Adjustments to net income: Litigation reserves - - - - - - - - 0.28 Impairment and closure charges - - - 0.62 - - - 0.04 0.06 Change in estimate for gift card breakage - - - - (0.09) - - - - Executive transition & severance - 0.04 - - - - - - - Income tax expense of adjustments - (0.01) - (0.24) 0.03 - - (0.02) (0.10) Adjusted EPS – diluted $ 0.82 $ 0.68 $ 0.50 $ 0.66 $ 1.10 $ 0.78 $ 0.58 $ 0.86 $ 1.27 ($ in thousands, except per share data)