CLASSIFIED – INTERNAL USE

Third Quarter 2017 Results

November 6, 2017

2CLASSIFIED – INTERNAL USE

Forward-Looking Statements

Forward-looking statements in this presentation regarding the Company’s future performance, revenues and

timing thereof, service model changes, new restaurant openings, tax rate, sensitivity of earnings per share

and other projected financial measures, statements under the heading “Outlook for 2017”, and all other

statements that are not historical facts, are made under the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These statements are based on assumptions believed by the Company to be

reasonable and speak only as of the date on which such statements are made. Without limiting the generality

of the foregoing, words such as “expect,” “believe,” “anticipate,” “intend,” “plan,” “project,” “will” or “estimate,”

or the negative or other variations thereof or comparable terminology are intended to identify forward-looking

statements. Except as required by law, the Company undertakes no obligation to update such statements to

reflect events or circumstances arising after such date, and cautions investors not to place undue reliance on

any such forward-looking statements. Forward-looking statements involve risks and uncertainties that could

cause actual results to differ materially from those described in the statements based on a number of factors,

including but not limited to the following: the effectiveness of the Company’s business improvement initiatives;

the ability to fulfill planned, and realize the anticipated benefits of completed, expansion and restaurant

remodeling; the effectiveness of our marketing strategies and initiatives to achieve restaurant sales growth;

the cost and availability of key food products, labor, and energy; the ability to achieve anticipated revenue

and cost savings from anticipated new technology systems and tools in the restaurants and other initiatives;

the ability to develop, test, implement and increase online ordering, to-go services, catering and other off-

premise sales; availability of capital or credit facility borrowings; the adequacy of cash flows or available debt

resources to fund operations and growth opportunities; federal, state, and local regulation of the Company’s

business; and other risk factors described from time to time in the Company’s Form 10-K, Form 10-Q, and

Form 8-K reports (including all amendments to those reports) filed with the U.S. Securities and Exchange

Commission.

This presentation may also contain non-GAAP financial information. Management uses this information in its

internal analysis of results and believes that this information may be informative to investors in gauging the

quality of the Company’s financial performance, identifying trends in results, and providing meaningful period-

to-period comparisons. For a reconciliation of non-GAAP measures presented in this document, see the

Appendix of this presentation or the Schedules to the Q3 press release posted on redrobin.com.

3CLASSIFIED – INTERNAL USE

Red Robin Q3-2017 Results

• Total revenues increased 2.3%

• Comparable restaurant revenue down 0.1%

(using constant currency rates)

• Off-premise revenues increased to 7.6% of

total food and beverage sales

• Restaurant-level operating profit(1) was

17.4% compared to 18.6% in the prior year

• Adjusted EBITDA(1) was $25.5 million

• Diluted earnings per share were $0.21

compared to diluted loss per share of $0.10

in Q3 2016. Adjusted diluted EPS(1) were

$0.21 compared to $0.38 in the prior year

• Opened 7 new Red Robin® restaurants

(1) See reconciliations of non-GAAP financial measures to the most

comparable GAAP financial measures in Appendix.

4CLASSIFIED – INTERNAL USE

Red Robin Strategic Priorities

• Maximize brand equities to ensure

a strong foundation

• Rapidly pilot and rollout

transformational changes

• Conceptualize and test

revolutionary new approaches

5CLASSIFIED – INTERNAL USE

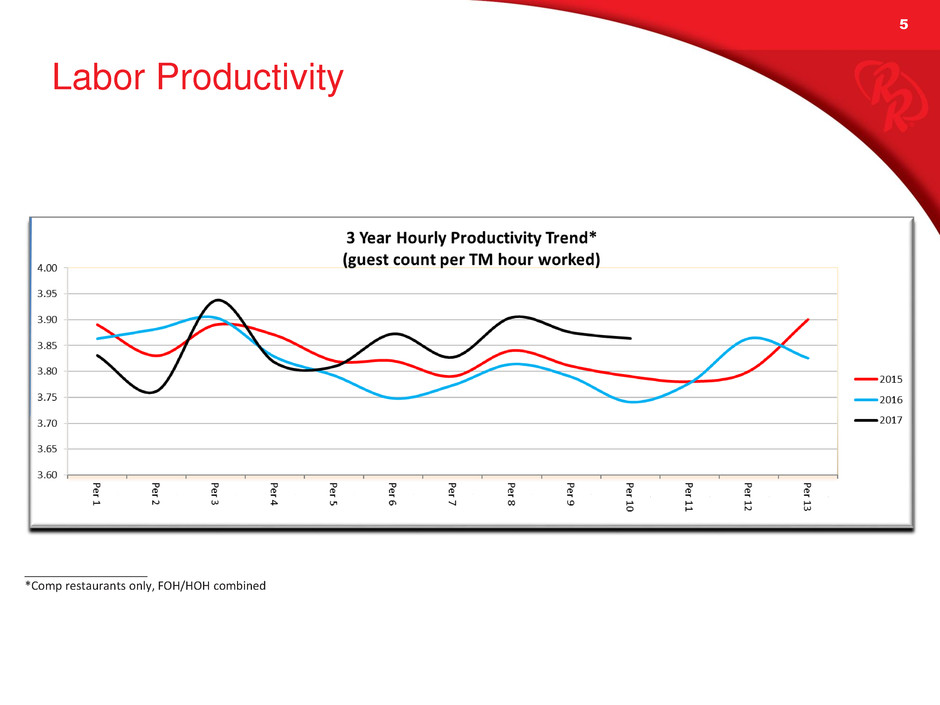

Labor Productivity

_________________

*Comp restaurants only, FOH/HOH combined

6CLASSIFIED – INTERNAL USE

Burger Bar

7CLASSIFIED – INTERNAL USE

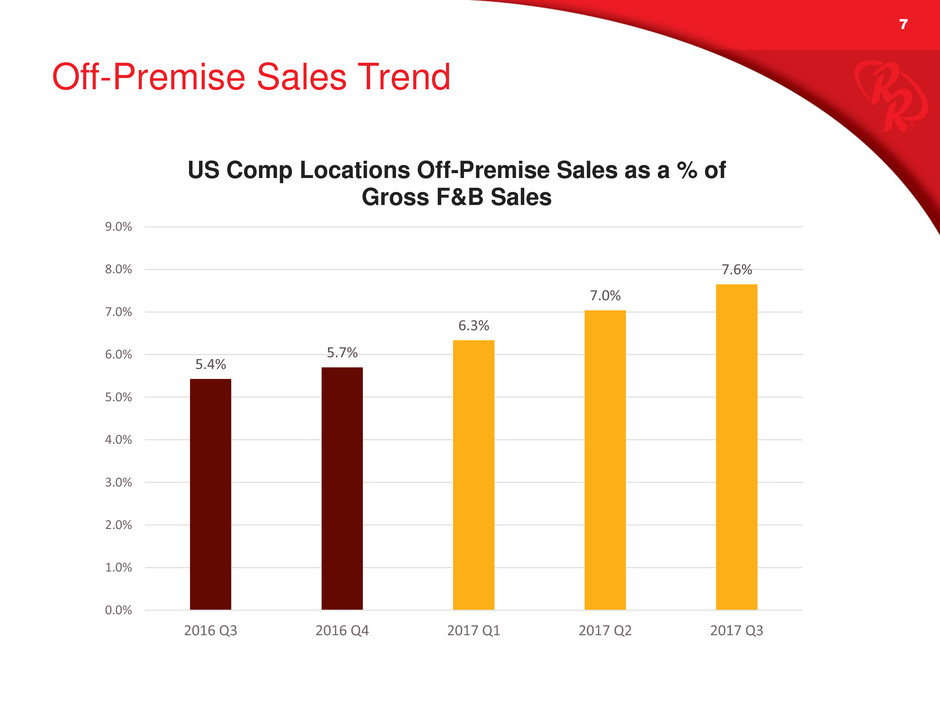

Off-Premise Sales Trend

5.4%

5.7%

6.3%

7.0%

7.6%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

2016 Q3 2016 Q4 2017 Q1 2017 Q2 2017 Q3

US Comp Locations Off-Premise Sales as a % of

Gross F&B Sales

8CLASSIFIED – INTERNAL USE

Traffic vs. Casual Dining (8-quarter trend)

Source: Based on Black Box Intelligence Casual Dining (All Cuisine) peers as of 10/1/2017

-1.5%

-0.9%

-0.6%

1.2%

2.2%

1.2%

3.6%

4.0%

-2.0%

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

CLASSIFIED – INTERNAL USE 9

Financial Update

10CLASSIFIED – INTERNAL USE

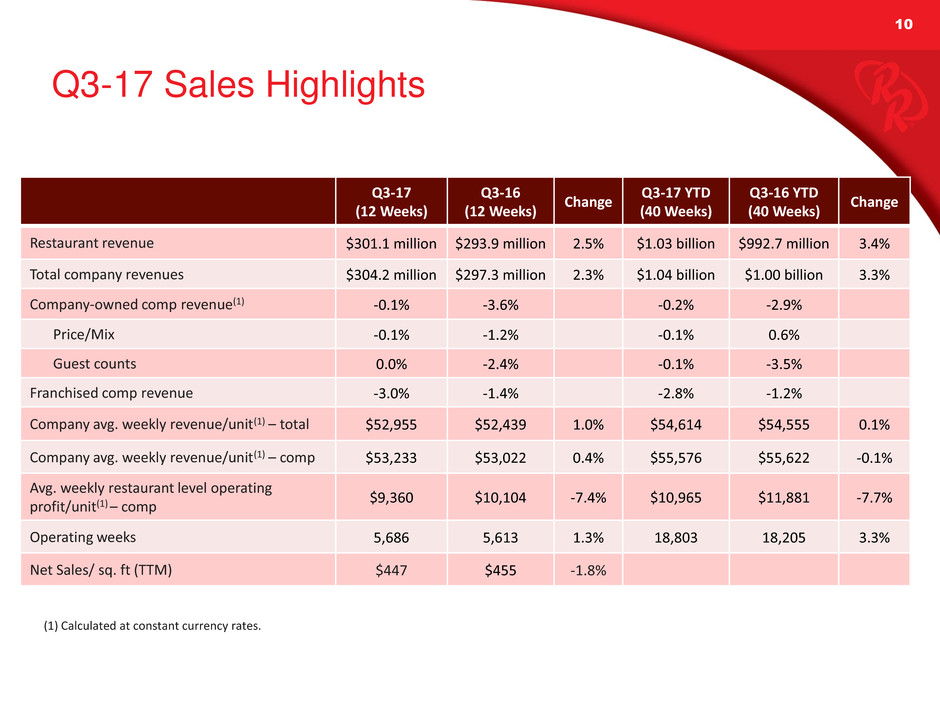

Q3-17 Sales Highlights

Q3-17

(12 Weeks)

Q3-16

(12 Weeks)

Change

Q3-17 YTD

(40 Weeks)

Q3-16 YTD

(40 Weeks)

Change

Restaurant revenue $301.1 million $293.9 million 2.5% $1.03 billion $992.7 million 3.4%

Total company revenues $304.2 million $297.3 million 2.3% $1.04 billion $1.00 billion 3.3%

Company-owned comp revenue(1) -0.1% -3.6% -0.2% -2.9%

Price/Mix -0.1% -1.2% -0.1% 0.6%

Guest counts 0.0% -2.4% -0.1% -3.5%

Franchised comp revenue -3.0% -1.4% -2.8% -1.2%

Company avg. weekly revenue/unit(1) – total $52,955 $52,439 1.0% $54,614 $54,555 0.1%

Company avg. weekly revenue/unit(1) – comp $53,233 $53,022 0.4% $55,576 $55,622 -0.1%

Avg. weekly restaurant level operating

profit/unit(1) – comp

$9,360 $10,104 -7.4% $10,965 $11,881 -7.7%

Operating weeks 5,686 5,613 1.3% 18,803 18,205 3.3%

Net Sales/ sq. ft (TTM) $447 $455 -1.8%

(1) Calculated at constant currency rates.

11CLASSIFIED – INTERNAL USE

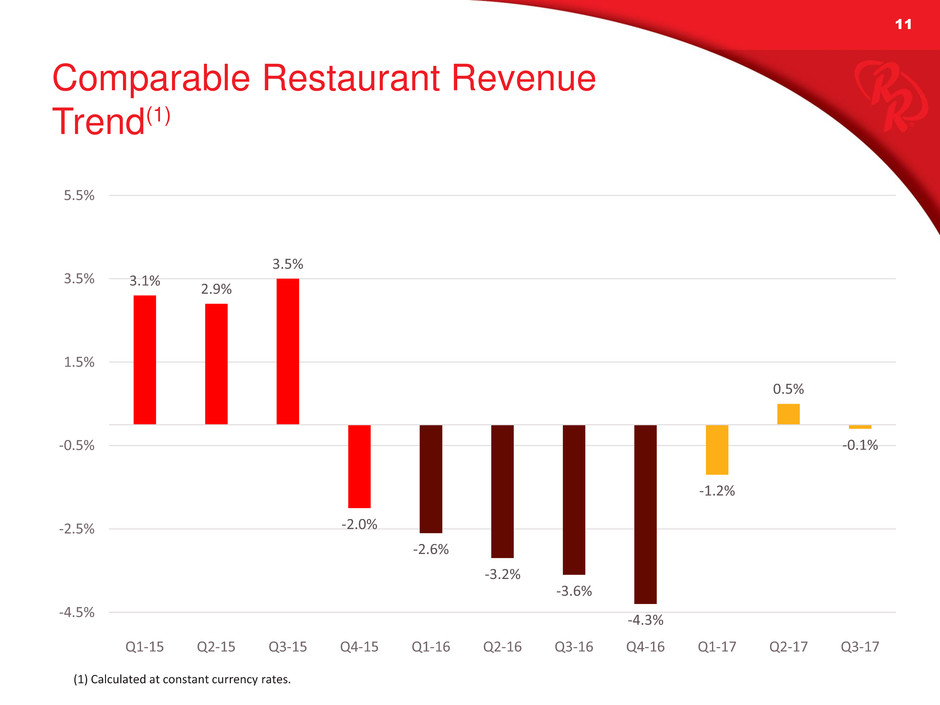

Comparable Restaurant Revenue

Trend(1)

3.1%

2.9%

3.5%

-2.0%

-2.6%

-3.2%

-3.6%

-4.3%

-1.2%

0.5%

-0.1%

-4.5%

-2.5%

-0.5%

1.5%

3.5%

5.5%

Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 Q2-16 Q3-16 Q4-16 Q1-17 Q2-17 Q3-17

(1) Calculated at constant currency rates.

12CLASSIFIED – INTERNAL USE

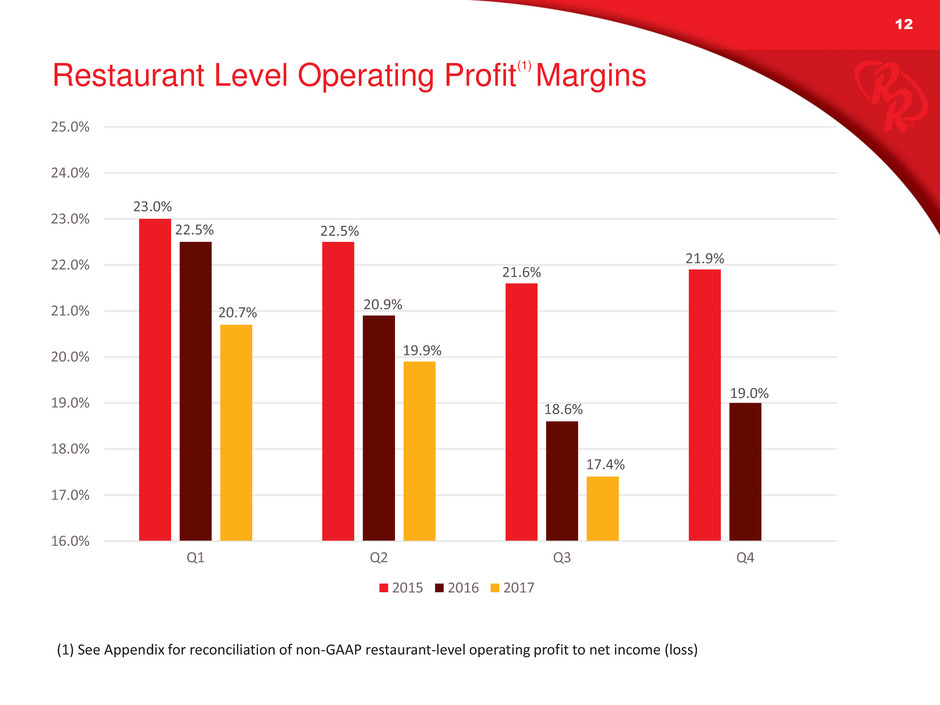

23.0%

22.5%

21.6%

21.9%

22.5%

20.9%

18.6%

19.0%

20.7%

19.9%

17.4%

16.0%

17.0%

18.0%

19.0%

20.0%

21.0%

22.0%

23.0%

24.0%

25.0%

Q1 Q2 Q3 Q4

2015 2016 2017

Restaurant Level Operating Profit

(1)

Margins

12

(1) See Appendix for reconciliation of non-GAAP restaurant-level operating profit to net income (loss)

13CLASSIFIED – INTERNAL USE

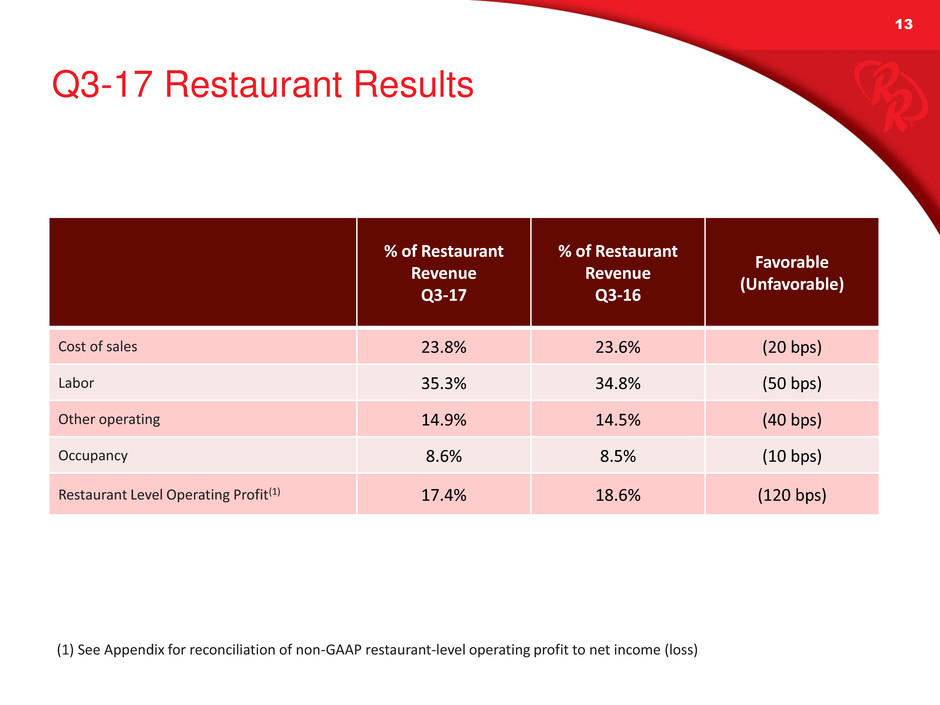

Q3-17 Restaurant Results

13

% of Restaurant

Revenue

Q3-17

% of Restaurant

Revenue

Q3-16

Favorable

(Unfavorable)

Cost of sales 23.8% 23.6% (20 bps)

Labor 35.3% 34.8% (50 bps)

Other operating 14.9% 14.5% (40 bps)

Occupancy 8.6% 8.5% (10 bps)

Restaurant Level Operating Profit(1) 17.4% 18.6% (120 bps)

(1) See Appendix for reconciliation of non-GAAP restaurant-level operating profit to net income (loss)

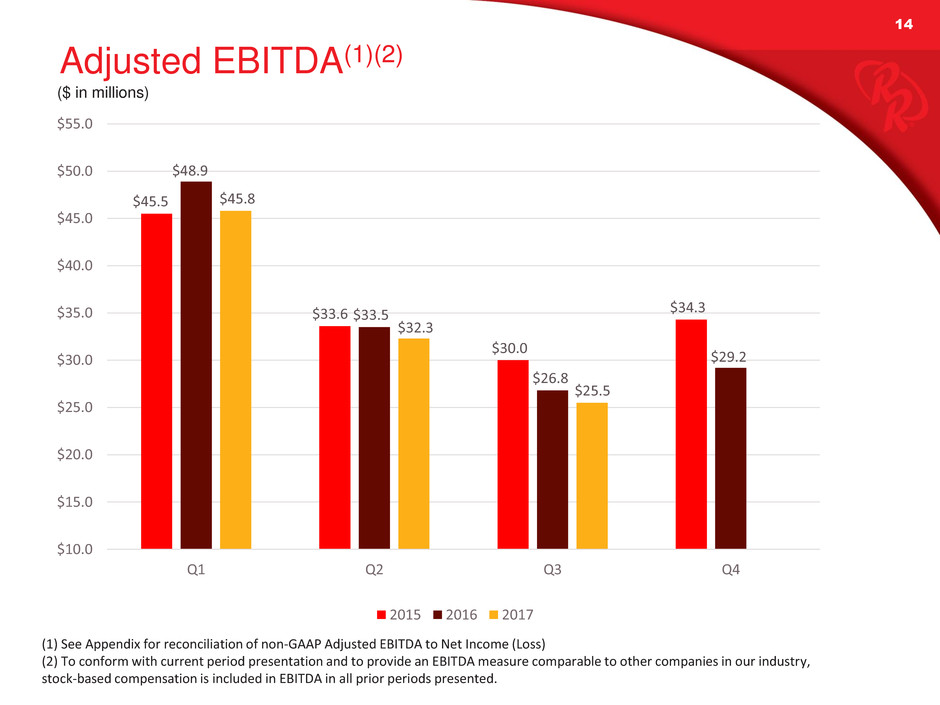

14CLASSIFIED – INTERNAL USE

$45.5

$33.6

$30.0

$34.3

$48.9

$33.5

$26.8

$29.2

$45.8

$32.3

$25.5

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

$45.0

$50.0

$55.0

Q1 Q2 Q3 Q4

2015 2016 2017

Adjusted EBITDA(1)(2)

($ in millions)

14

(1) See Appendix for reconciliation of non-GAAP Adjusted EBITDA to Net Income (Loss)

(2) To conform with current period presentation and to provide an EBITDA measure comparable to other companies in our industry,

stock-based compensation is included in EBITDA in all prior periods presented.

15CLASSIFIED – INTERNAL USE

Adjusted Earnings Per Diluted Share

$1.10

$0.78

$0.58

$0.86

$1.27

$0.75

$0.38

$0.35

$0.89

$0.61

$0.21

$0.15

$0.35

$0.55

$0.75

$0.95

$1.15

$1.35

Q1 Q2 Q3 Q4

2015 2016 2017

15

See Appendix for reconciliation of non-GAAP Adjusted Earnings Per Diluted Share to Earnings (Loss) Per Diluted Share

16CLASSIFIED – INTERNAL USE

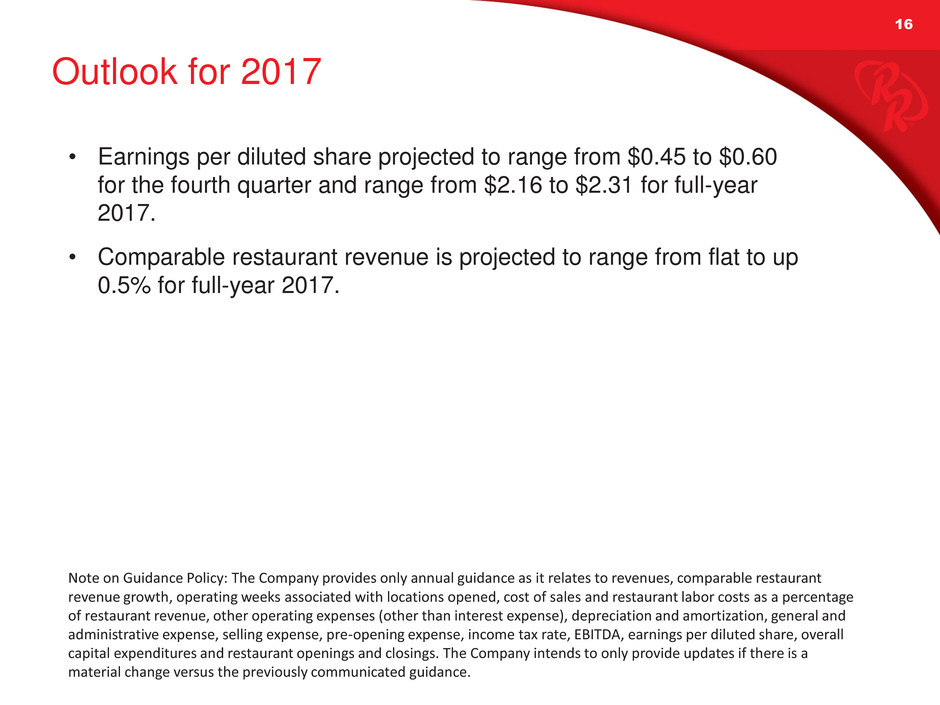

Outlook for 2017

• Earnings per diluted share projected to range from $0.45 to $0.60

for the fourth quarter and range from $2.16 to $2.31 for full-year

2017.

• Comparable restaurant revenue is projected to range from flat to up

0.5% for full-year 2017.

Note on Guidance Policy: The Company provides only annual guidance as it relates to revenues, comparable restaurant

revenue growth, operating weeks associated with locations opened, cost of sales and restaurant labor costs as a percentage

of restaurant revenue, other operating expenses (other than interest expense), depreciation and amortization, general and

administrative expense, selling expense, pre-opening expense, income tax rate, EBITDA, earnings per diluted share, overall

capital expenditures and restaurant openings and closings. The Company intends to only provide updates if there is a

material change versus the previously communicated guidance.

17CLASSIFIED – INTERNAL USE

Our Unique, Differentiating Strengths

• Craveable, customizable burgers

• Reputation for service and speed

that meets the needs of Guests

• Best-in-class value perception

with Bottomless promise,

“affordable abundance”

18CLASSIFIED – INTERNAL USE

Thank you to all of our Team Members!

17

CLASSIFIED – INTERNAL USE 19

Appendix

20CLASSIFIED – INTERNAL USE

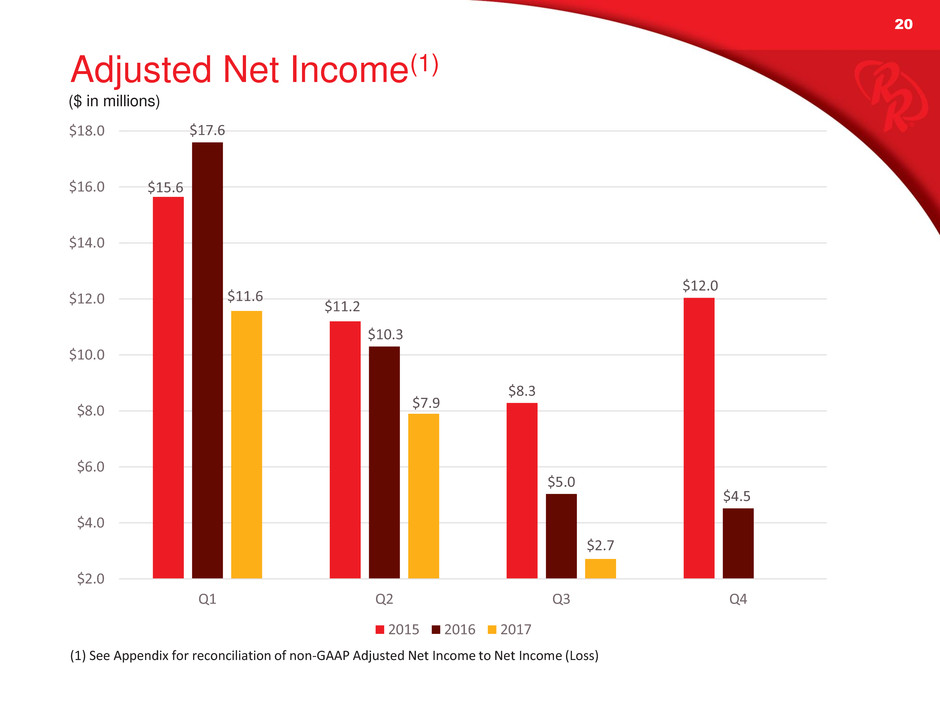

Adjusted Net Income(1)

$15.6

$11.2

$8.3

$12.0

$17.6

$10.3

$5.0

$4.5

$11.6

$7.9

$2.7

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

$18.0

Q1 Q2 Q3 Q4

2015 2016 2017

($ in millions)

20

(1) See Appendix for reconciliation of non-GAAP Adjusted Net Income to Net Income (Loss)

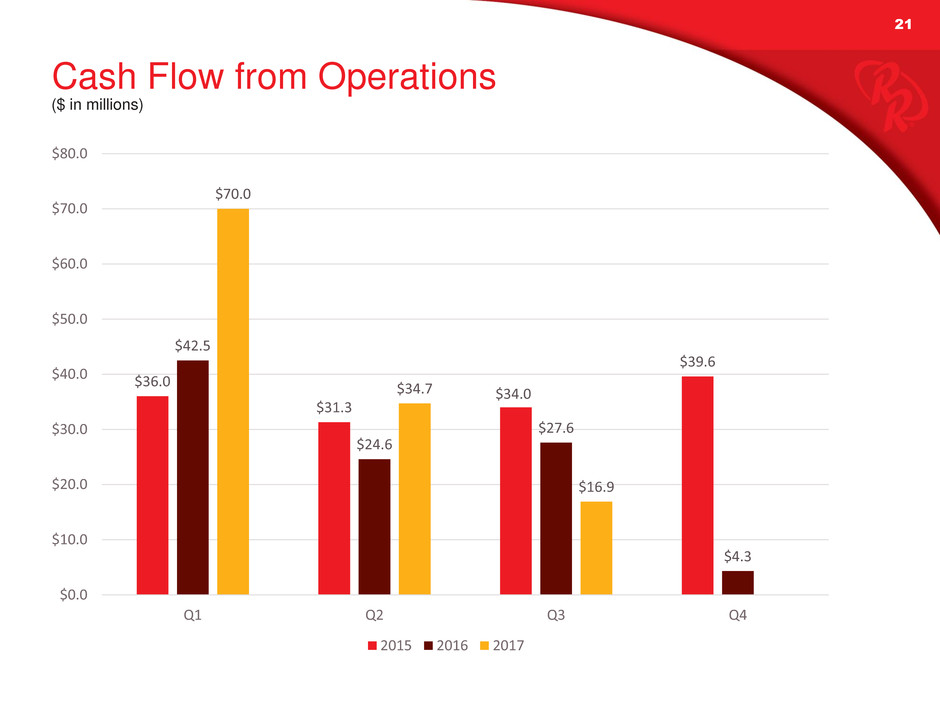

21CLASSIFIED – INTERNAL USE

$36.0

$31.3

$34.0

$39.6

$42.5

$24.6

$27.6

$4.3

$70.0

$34.7

$16.9

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

Q1 Q2 Q3 Q4

2015 2016 2017

Cash Flow from Operations

($ in millions)

21

22CLASSIFIED – INTERNAL USE

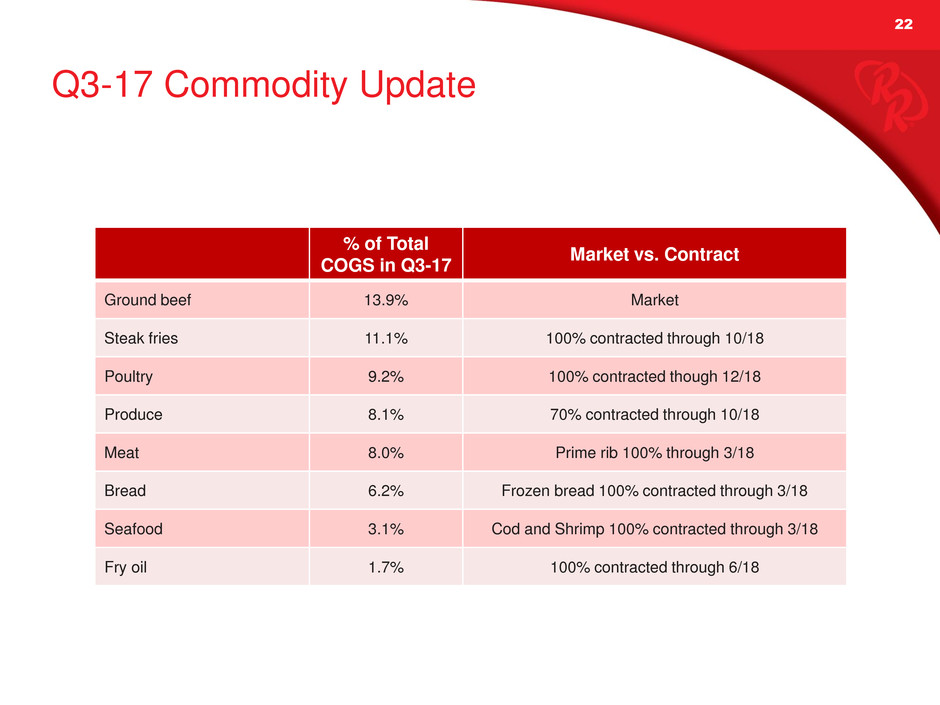

Q3-17 Commodity Update

22

% of Total

COGS in Q3-17

Market vs. Contract

Ground beef 13.9% Market

Steak fries 11.1% 100% contracted through 10/18

Poultry 9.2% 100% contracted though 12/18

Produce 8.1% 70% contracted through 10/18

Meat 8.0% Prime rib 100% through 3/18

Bread 6.2% Frozen bread 100% contracted through 3/18

Seafood 3.1% Cod and Shrimp 100% contracted through 3/18

Fry oil 1.7% 100% contracted through 6/18

23CLASSIFIED – INTERNAL USE

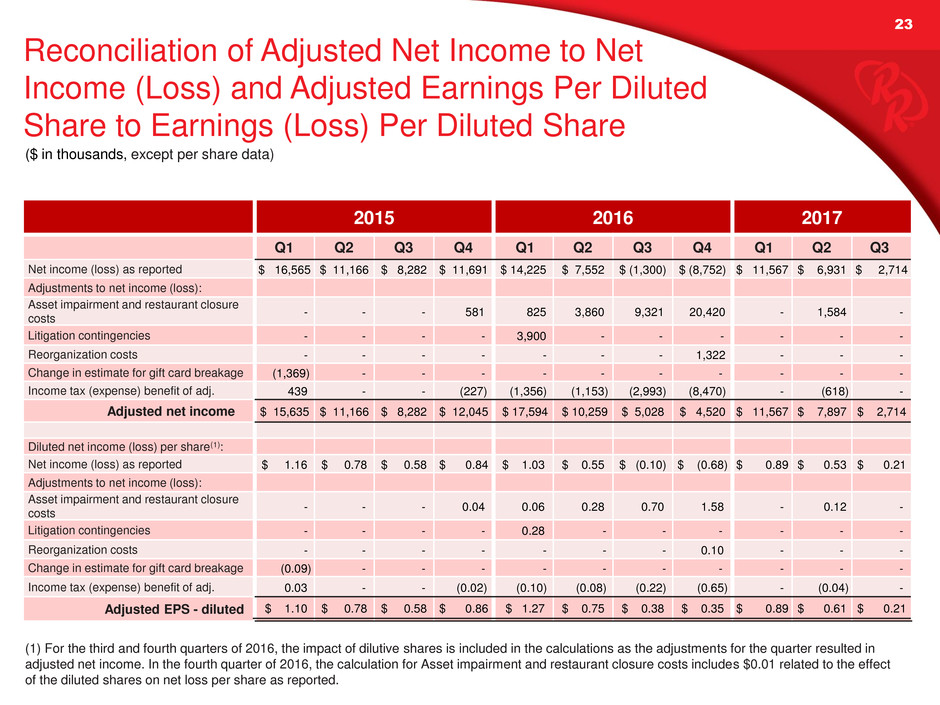

Reconciliation of Adjusted Net Income to Net

Income (Loss) and Adjusted Earnings Per Diluted

Share to Earnings (Loss) Per Diluted Share

23

($ in thousands, except per share data)

2015 2016 2017

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

Net income (loss) as reported $ 16,565 $ 11,166 $ 8,282 $ 11,691 $ 14,225 $ 7,552 $ (1,300) $ (8,752) $ 11,567 $ 6,931 $ 2,714

Adjustments to net income (loss):

Asset impairment and restaurant closure

costs

- - - 581 825 3,860 9,321 20,420 - 1,584 -

Litigation contingencies - - - - 3,900 - - - - - -

Reorganization costs - - - - - - - 1,322 - - -

Change in estimate for gift card breakage (1,369) - - - - - - - - - -

Income tax (expense) benefit of adj. 439 - - (227) (1,356) (1,153) (2,993) (8,470) - (618) -

Adjusted net income $ 15,635 $ 11,166 $ 8,282 $ 12,045 $ 17,594 $ 10,259 $ 5,028 $ 4,520 $ 11,567 $ 7,897 $ 2,714

Diluted net income (loss) per share(1):

Net income (loss) as reported $ 1.16 $ 0.78 $ 0.58 $ 0.84 $ 1.03 $ 0.55 $ (0.10) $ (0.68) $ 0.89 $ 0.53 $ 0.21

Adjustments to net income (loss):

Asset impairment and restaurant closure

costs

- - - 0.04 0.06 0.28 0.70 1.58 - 0.12 -

Litigation contingencies - - - - 0.28 - - - - - -

Reorganization costs - - - - - - - 0.10 - - -

Change in estimate for gift card breakage (0.09) - - - - - - - - - -

Income tax (expense) benefit of adj. 0.03 - - (0.02) (0.10) (0.08) (0.22) (0.65) - (0.04) -

Adjusted EPS - diluted $ 1.10 $ 0.78 $ 0.58 $ 0.86 $ 1.27 $ 0.75 $ 0.38 $ 0.35 $ 0.89 $ 0.61 $ 0.21

(1) For the third and fourth quarters of 2016, the impact of dilutive shares is included in the calculations as the adjustments for the quarter resulted in

adjusted net income. In the fourth quarter of 2016, the calculation for Asset impairment and restaurant closure costs includes $0.01 related to the effect

of the diluted shares on net loss per share as reported.

24CLASSIFIED – INTERNAL USE

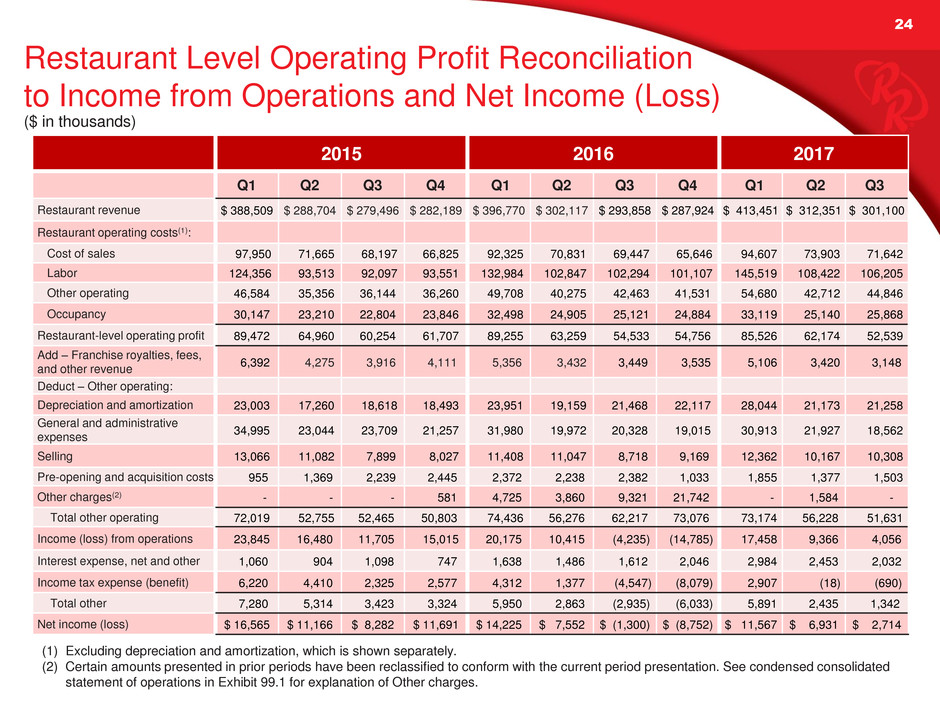

Restaurant Level Operating Profit Reconciliation

to Income from Operations and Net Income (Loss)

($ in thousands)

2015 2016 2017

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

Restaurant revenue $ 388,509 $ 288,704 $ 279,496 $ 282,189 $ 396,770 $ 302,117 $ 293,858 $ 287,924 $ 413,451 $ 312,351 $ 301,100

Restaurant operating costs(1):

Cost of sales 97,950 71,665 68,197 66,825 92,325 70,831 69,447 65,646 94,607 73,903 71,642

Labor 124,356 93,513 92,097 93,551 132,984 102,847 102,294 101,107 145,519 108,422 106,205

Other operating 46,584 35,356 36,144 36,260 49,708 40,275 42,463 41,531 54,680 42,712 44,846

Occupancy 30,147 23,210 22,804 23,846 32,498 24,905 25,121 24,884 33,119 25,140 25,868

Restaurant-level operating profit 89,472 64,960 60,254 61,707 89,255 63,259 54,533 54,756 85,526 62,174 52,539

Add – Franchise royalties, fees,

and other revenue

6,392 4,275 3,916 4,111 5,356 3,432 3,449 3,535 5,106 3,420 3,148

Deduct – Other operating:

Depreciation and amortization 23,003 17,260 18,618 18,493 23,951 19,159 21,468 22,117 28,044 21,173 21,258

General and administrative

expenses

34,995 23,044 23,709 21,257 31,980 19,972 20,328 19,015 30,913 21,927 18,562

Selling 13,066 11,082 7,899 8,027 11,408 11,047 8,718 9,169 12,362 10,167 10,308

Pre-opening and acquisition costs 955 1,369 2,239 2,445 2,372 2,238 2,382 1,033 1,855 1,377 1,503

Other charges(2) - - - 581 4,725 3,860 9,321 21,742 - 1,584 -

Total other operating 72,019 52,755 52,465 50,803 74,436 56,276 62,217 73,076 73,174 56,228 51,631

Income (loss) from operations 23,845 16,480 11,705 15,015 20,175 10,415 (4,235) (14,785) 17,458 9,366 4,056

Interest expense, net and other 1,060 904 1,098 747 1,638 1,486 1,612 2,046 2,984 2,453 2,032

Income tax expense (benefit) 6,220 4,410 2,325 2,577 4,312 1,377 (4,547) (8,079) 2,907 (18) (690)

Total other 7,280 5,314 3,423 3,324 5,950 2,863 (2,935) (6,033) 5,891 2,435 1,342

Net income (loss) $ 16,565 $ 11,166 $ 8,282 $ 11,691 $ 14,225 $ 7,552 $ (1,300) $ (8,752) $ 11,567 $ 6,931 $ 2,714

(1) Excluding depreciation and amortization, which is shown separately.

(2) Certain amounts presented in prior periods have been reclassified to conform with the current period presentation. See condensed consolidated

statement of operations in Exhibit 99.1 for explanation of Other charges.

25CLASSIFIED – INTERNAL USE

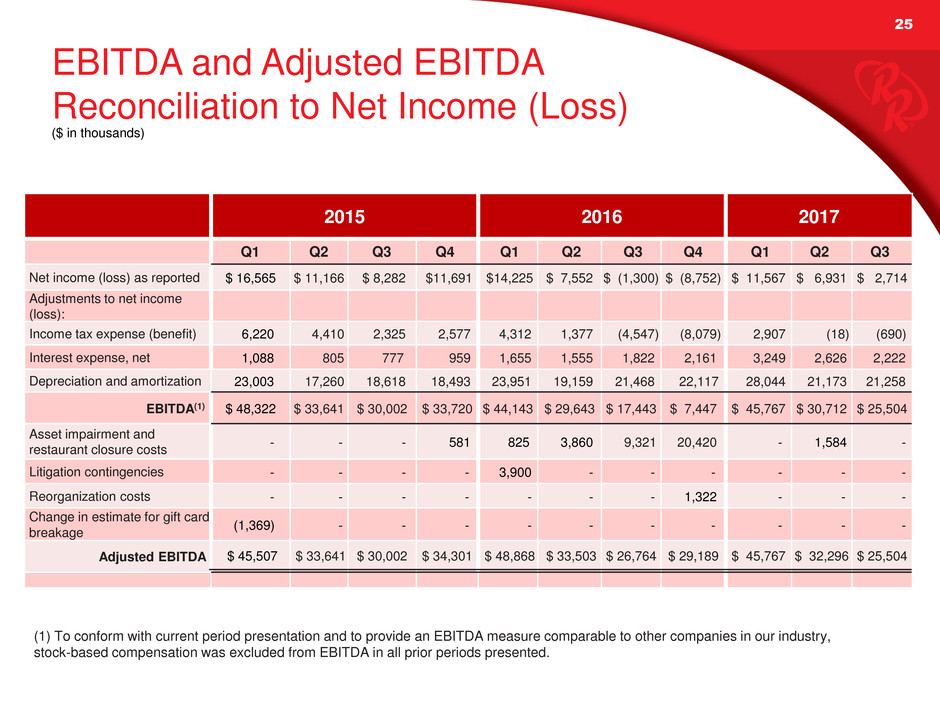

EBITDA and Adjusted EBITDA

Reconciliation to Net Income (Loss)

25

2015 2016 2017

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

Net income (loss) as reported $ 16,565 $ 11,166 $ 8,282 $11,691 $14,225 $ 7,552 $ (1,300) $ (8,752) $ 11,567 $ 6,931 $ 2,714

Adjustments to net income

(loss):

Income tax expense (benefit) 6,220 4,410 2,325 2,577 4,312 1,377 (4,547) (8,079) 2,907 (18) (690)

Interest expense, net 1,088 805 777 959 1,655 1,555 1,822 2,161 3,249 2,626 2,222

Depreciation and amortization 23,003 17,260 18,618 18,493 23,951 19,159 21,468 22,117 28,044 21,173 21,258

EBITDA(1).. $ 48,322 $ 33,641 $ 30,002 $ 33,720 $ 44,143 $ 29,643 $ 17,443 $ 7,447 $ 45,767 $ 30,712 $ 25,504

Asset impairment and

restaurant closure costs

- - - 581 825 3,860 9,321 20,420 - 1,584 -

Litigation contingencies - - - - 3,900 - - - - - -

Reorganization costs - - - - - - - 1,322 - - -

Change in estimate for gift card

breakage

(1,369) - - - - - - - - - -

Adjusted EBITDA $ 45,507 $ 33,641 $ 30,002 $ 34,301 $ 48,868 $ 33,503 $ 26,764 $ 29,189 $ 45,767 $ 32,296 $ 25,504

($ in thousands)

(1) To conform with current period presentation and to provide an EBITDA measure comparable to other companies in our industry,

stock-based compensation was excluded from EBITDA in all prior periods presented.