QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________________

FORM 10-K

|

| | |

ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 30, 2018

|

| | |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-34851

______________________________________________________________

RED ROBIN GOURMET BURGERS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State or other jurisdiction of incorporation or organization) | | 84-1573084 (I.R.S. Employer Identification No.) |

6312 S Fiddler’s Green Circle, Suite 200N | | |

Greenwood Village, CO | | 80111 |

(Address of principal executive offices) | | (Zip Code) |

(303) 846-6000

(Registrant's telephone number, including area code)

______________________________________________________________

Securities Registered Pursuant to Section 12(b) of the Act:

Common Stock, $0.001 par value

Name of each exchange on which registered: NASDAQ (Global Select Market)

Securities Registered Pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | |

Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o

| | Smaller reporting company o | | Emerging growth company o |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the voting and non-voting common stock held by non-affiliates (based on the closing price on the last business day of the registrant's most recently completed second fiscal quarter on The NASDAQ Global Select Market) was $632.8 million. All executive officers and directors of the registrant have been deemed, solely for the purpose of the foregoing calculation, to be "affiliates" of the registrant.

There were 12,964,577 shares of common stock outstanding as of February 25, 2019.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required for Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K is incorporated by reference to the registrant's definitive proxy statement for the 2019 annual meeting of stockholders.

RED ROBIN GOURMET BURGERS, INC.

TABLE OF CONTENTS

|

| | |

| | Page |

PART I |

| | |

| | |

| | |

| | |

| | |

| | |

PART II |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

PART III |

| | |

| | |

| | |

| | |

| | |

PART IV |

| | |

| |

PART I

ITEM 1. Business

Overview

Red Robin Gourmet Burgers, Inc., together with its subsidiaries, primarily develops, operates, and franchises full-service restaurants in North America and focuses on serving an imaginative selection of high quality gourmet burgers in a fun environment welcoming to Guests of all ages. We opened the first Red Robin® restaurant in Seattle, Washington in September 1969. In 1979, the first franchised Red Robin restaurant was opened in Yakima, Washington. In 2001, we formed Red Robin Gourmet Burgers, Inc., a Delaware corporation, and consummated a reorganization of the Company. Since that time, Red Robin Gourmet Burgers, Inc. has owned, either directly or indirectly, all of the outstanding capital stock or membership interests, respectively, of Red Robin International, Inc. and our other operating subsidiaries through which we operate our Company-owned restaurants. Unless otherwise provided in this Annual Report on Form 10-K, references to “Red Robin,” “we,” “us,” “our” or the “Company” refer to Red Robin Gourmet Burgers, Inc. and our consolidated subsidiaries. As of the end of our fiscal year on December 30, 2018, there were 573 Red Robin restaurants, of which 484 were Company-owned and 89 were operated by franchisees. Our franchisees are independent organizations to whom we provide certain support. See “Restaurant Franchise and Licensing Arrangements” for additional information about our franchise program. As of December 30, 2018, there were Red Robin restaurants in 44 states and two Canadian provinces.

Financial information for our single operating segment is included in Notes to the Consolidated Financial Statements in Part II, Item 8 of this report.

The Company’s fiscal year is 52 or 53 weeks ending the last Sunday of the calendar year. Fiscal year 2018 included 52 weeks, ending on December 30, 2018. Fiscal year 2017 included 53 weeks, ending on December 31, 2017. Fiscal years 2016, 2015, and 2014 each included 52 weeks, ending on December 25, 2016, December 27, 2015, and December 28, 2014. Fiscal year 2019 will include 52 weeks, ending on December 29, 2019. We refer to our fiscal years as 2019, 2018, 2017, 2016, 2015, and 2014 throughout this Annual Report on Form 10-K.

Business Strategy

Red Robin’s goal is to differentiate itself from casual dining establishments based on attributes our most loyal Guests give us credit for: Quality, Service, and Value. To differentiate on Quality, we offer a large and varied selection of craveable and highly customizable burgers. To differentiate on Service, our goal is to serve food and beverages quickly and attentively so Guests can spend more time enjoying their food and less time waiting. We also strive to deliver competitive Value by providing abundant portions at a range of price points. Red Robin Team Members seek to live our B.U.R.G.E.R. values everyday: Bottomless Fun, Unwavering Integrity, Relentless Focus on Improvement, Genuine Spirit of Service, Extraordinary People, and Recognized Burger Authority.

In addition to caring for those Guests who choose to dine in at Red Robin, we are also expanding our reach to those Guests who choose to carry-out a meal, use a third-party delivery service, or cater a meeting or event. These platforms are rapidly growing and it is our goal to move Red Robin from being a destination for dining-in to a destination and a source for dining wherever the Guests want to go.

To ensure the success of Red Robin in a rapidly evolving marketplace, we are focused on quickly turning business performance around by urgently executing the business fundamentals that include building profitable sales and delivering a consistent, high quality guest experience through exceptional operations. Our long-term strategy includes four strategic pillars:

| |

• | Attract, Retain, and Engage High Performance Teams. We emphasize and support Team Member engagement, retention, and culture that will foster the development of great leaders. Our goal is to enhance clarity with our Team Members by consistently communicating our strategy through a common playbook and ensuring we remain narrowly focused on our key initiatives. We continually strive to develop extraordinary people and encourage Team Member performance through appreciation, recognition, and respect. In an effort to continue to develop leadership strength, we are focused on executing dynamic succession planning, and innovative recruiting and talent development. See “Learning and Development” below for additional information about our Team Member development initiatives. |

| |

• | Evolve to Better Serve Middle Income Families. We actively seek to enhance Value through a balance of quality, quantity, price, and experience. This includes providing high quality menu items, offering new products at everyday value prices and delivering on abundance through a wide choice of bottomless sides and beverages. We frequently enhance our Red Robin Royalty™ program to drive guest traffic through frequent buyer rewards. Additionally, we are |

focused on driving guest preference at any occasion by offering our products through alternate modes of access. As part of this strategy, we offer online ordering for carry-out, delivery access in the majority of our locations via multiple third party services, and catering. We are also currently testing self-delivery for potential deployment in future years.

| |

• | Embrace the "Gift of Time" as a Key Differentiator. Our strategy in regaining our operational edge includes serving consistently great burgers, accurately customized, and served quickly by our caring Team Members whether the Guest chooses to dine in the restaurant or off premise. We respect our Guests’ need for the “gift of time” in an increasingly time-starved culture and remain committed to improving both speed of service and order accuracy. |

| |

• | Improve Company and 4-Wall Economics. We are committed to delivering stockholder value by improving profitability and investing capital wisely. Our goal is to optimize our capital structure, prudently invest in technology and restaurant development that deliver targeted returns on investment, refranchise certain restaurants, and improve our EBITDA margin through sustainable revenue growth and prudent cost management at the restaurant level and above. |

Restaurant Concept

The Red Robin brand has many desirable attributes, including a range of high-quality menu items, a strong guest-focused culture, and a value proposition designed to help our Guests customize their experiences.

We pride ourselves on being THE Burger Authority. Our menu features our signature product, a line of Gourmet Burgers which we make from premium quality, fresh ground beef. To complement our best-selling Gourmet Burgers we offer an everyday-value line of Red’s Tavern Double® burgers, and Red Robin’s Finest line made with premium toppings. We also offer burgers made with chicken breasts (grilled or fried), hand breaded cod and grilled salmon fillets, and turkey patties, as well as a proprietary vegetarian patty. We offer a wide selection of buns, including ciabatta, gluten free, sesame, onion, whole grain, jalapeno, and lettuce wraps, with a variety of toppings, including fresh guacamole, house-made barbeque sauces, grilled pineapple, crispy onion straws, sautéed mushrooms, fried jalapenos, bruschetta salsa, coleslaw, eight different cheese choices, and a fried egg. All of our burgers are served with our all-you-can-eat Bottomless Steak Fries® or a Guest may choose from five other bottomless sides. We specialize in customizing our menu items to meet our Guests’ dietary needs and preferences and have received recognition from experts in the allergy community. In addition to burgers, which accounted for 54% of our total food and beverage sales in 2018, Red Robin serves an array of other items that appeal to a broad range of Guests. These items include a variety of appetizers, salads, soups, seafood, and other entrees. We also offer a range of single-serving and shareable desserts as well as our classic and Finest milkshakes. Our beverages include signature alcoholic and non-alcoholic specialty drinks, cocktails, wine, and a variety of national and craft beers.

We strive to meet the needs of our Guests by offering a choice of experiences and occasions from time-pressured meals to a place to relax and unwind with friends. Red Robin also has an unparalleled and extraordinary approach to guest service and we have cataloged thousands of stories of Red Robin Team Members who live our values. Many examples can be found on our website, www.redrobin.com. We encourage our Team Members to execute on the aspects of service that we have identified to be the biggest drivers of our guest loyalty. Note that our website and the information contained on or connected to our website are not incorporated by reference herein, and our web address is included as an inactive textual reference only.

We also strive to provide our Guests with exceptional dining value and the ability to customize their experience. In 2018, we had an average check per Guest of $12.92 including beverages. We believe this price-to-value relationship, our innovative array of burgers starting at $6.99 and ranging up to $15.49, differentiates us from our casual dining competitors and allows us to appeal to a broad base of middle income, multi-generational consumers.

Operations

Restaurant Management

Our typical restaurant management team consists of a general manager, an assistant general manager, and two or three assistant managers depending on restaurant sales volumes. The management team of each restaurant is responsible for the day-to-day operation of that restaurant, including hiring, training, and coaching of Team Members, as well as operating results. Our typical restaurant employs approximately 58 hourly Team Members, most of whom work part-time.

Learning and Development

We strive to maintain quality and consistency in each of our restaurants through the training and supervision of Team Members and the establishment of, and adherence to, high standards relating to Team Member performance, food and beverage preparation, and the maintenance of our restaurants. Each restaurant maintains a group of certified learning coaches who are tasked with preparing new Team Members for success by providing on-the-job training leading up to a final skills certification for their position. Team Members seeking advancement have the opportunity to join our management development program as a Shift Supervisor.

Shift Supervisors complete an in-depth training curriculum that develops their ability to supervise all aspects of shift execution, including, but not limited to, food safety, food production, coaching, and financial aspects of the business. The Shift Supervisor program is an important stepping stone for hourly Team Members who desire a career in restaurant management.

New restaurant managers participate in our eight-week Management Foundations training program. This program hones each manager’s skills, specifically in two areas: flawless shift execution and effective coaching of Team Members.

Providing our restaurant teams the support and resources they need to be successful requires dedication, an of-service attitude, and the utmost professionalism on the part of our home office team. We ensure the home office Team Members have what they need to meet these demands by offering several avenues to enhance their professional development, including but not limited to an in-house leadership library of over 400 titles, more than 40 on-site and 12 off-site development workshop opportunities, as well as one-on-one coaching.

Food Safety and Purchasing

Our food safety and quality assurance programs help manage our commitment to quality ingredients and food preparation. Our systems are designed to protect our food supply from product receipt through preparation and service. We provide detailed specifications for our food ingredients, products, and supplies to our suppliers. We qualify and audit our key manufacturers and growers and require their certification under the Global Food Safety Initiative. Our restaurant managers are certified in a comprehensive safety and sanitation course by the National Restaurant Association’s ServSafe program. Minimum cooking requirements, specifically safe handling, cooling procedures, and frequent temperature and quality checks, exist for the safety and quality of all food we serve in our restaurants. In order to provide the freshest ingredients and products and to maximize operating efficiencies between purchase and usage, each restaurant’s management team determines the restaurant’s daily usage requirements for food ingredients, products, and supplies, and accordingly, orders from approved suppliers, and distributors. The restaurant management team inspects deliveries to ensure the products received meet our safety and quality specifications. Additionally, we utilize the services of an independent auditing company to perform unannounced comprehensive food safety and sanitation inspections up to four times a year in all Company-owned and franchised restaurants.

To maximize our purchasing efficiencies and obtain the best possible prices for our high-quality ingredients, products, and supplies, our centralized purchasing team negotiates supply agreements which may include fixed price contracts that vary in term lengths or formula-based pricing agreements which can fluctuate on changes in raw material commodity pricing. Of our total cost of goods in 2018, potatoes represented approximately 14%, ground beef represented approximately 13%, and poultry represented approximately 10%. We monitor the primary commodities we purchase and extend contract positions when applicable in order to minimize the impact of fluctuations in price and availability. However, certain commodities, primarily cheese, potatoes, and ground beef remain subject to market price fluctuations. We continue to identify competitively priced, high quality alternative manufacturers, suppliers, growers, and distributors that are available should the need arise; however, we have not experienced significant disruptions in our supply chain. As of December 30, 2018, approximately 62.3% of our estimated annual food and beverage purchases were covered by fixed price contracts, most of which are scheduled to expire at various times through the end of 2019.

Restaurant Development

Red Robin has grown its restaurant base prudently considering a number of factors, including general economic conditions, expected financial performance, availability of appropriate locations, competition in local markets, and the availability of teams to manage new locations. Our site selection criteria focuses on identifying markets, trade areas, and specific sites that are likely to yield the greatest density of desirable demographic characteristics, retail traffic, and visibility. During 2018, we opened eight Company-owned restaurants. Over the past three years, we have opened a total of 52 new restaurants, acquired 13 franchised restaurants, and relocated four restaurants.

During 2019, we will continue to execute our long term growth strategy which includes pausing on new corporate growth as we will carefully address our changing guest base, opportunities to broaden our reach, and execute sustainable growth initiatives that deliver value to our stockholders.

Restaurant Franchise and Licensing Arrangements

As of December 30, 2018, our franchisees operated 89 restaurants in 16 states. Our two largest franchisees own 43 restaurants located in Michigan, Ohio, and eastern and central Pennsylvania. In 2018, certain franchisees opened three new restaurants based on new area development agreements executed in 2017. We expect our franchisees will open new units in 2019 and anticipate franchise unit growth to continue as our franchisees complete required investments to bring existing restaurants to our current brand and design standards. We are identifying additional franchise opportunities to grow our franchise base through existing and new franchisees based on markets of interest.

Franchise Compliance Assurance

We actively work with and monitor our franchisees’ performance to help them develop and operate their restaurants in compliance with Red Robin’s standards, systems, and procedures. During the restaurant development phase, we review the franchisee’s site selection and provide the franchisee with our prototype building plans. We provide trainers to assist the franchisee in opening the restaurant for business. We advise the franchisee on all menu items, management training, and equipment and food purchases.

To continuously improve our marketing programs and operating systems, we maintain a franchise advisory board consisting of franchisee members that meet with the corporate executive team. Through this advisory board, we solicit the input of our franchisees on marketing programs, including their suggestions as to which new menu items we should test and feature in future promotions. We also exchange best operating practices with our franchisees as we strive to improve our operating systems while attaining a high level of franchisee participation.

Information Technology

We rely on information systems in all aspects of our operations, including, but not limited to, point-of-sale transaction processing in our restaurants; operation of our restaurants; management of our inventories; collection of cash; payment of payroll and other obligations; and various other processes and procedures.

Our corporate offices and Company-owned restaurants are enabled with information technology and decision support systems. In our restaurants, these systems are designed to provide operational tools for sales, inventory, and labor management. This technology includes industry-specific, off-the-shelf systems, as well as proprietary software such as tools designed to optimize food and beverage costs and labor costs. These systems are integrated with our point-of-sale systems to provide daily, weekly, and period-to-date information that is important for managers to run an efficient and effective restaurant. We also use other systems to interact with our Guests. These include online and in-restaurant guest feedback systems, which provide real-time results on guest service, food quality, and atmosphere to each of our restaurants.

We utilize centralized financial, accounting, and human resources/personnel systems for Company-owned restaurants. In addition, we use an operations scorecard which integrates data from our centralized systems and distributes information to assist in managing our restaurants. We believe these combined tools are important in analyzing and improving our operations, profit margins, and other results.

In 2018, we invested in technologies and data infrastructure that modernized and upgraded the capacity of our restaurant systems, upgraded our point-of-sale and inventory management systems, and improved flexibility of business operations. We also began work to provide our Guests with improved digital experiences that support in-restaurant and off-premise dining. In 2019 we plan to continue our investments in building innovative digital experiences for our Guests and to improve our ability to manage our technology infrastructure through investments in connectivity, automation, and advanced monitoring.

We accept electronic payment cards from our Guests for payment in our restaurants. We also receive and maintain certain personal information about our Guests and Team Members. We have systems and processes in place that focus on the protection of our Guests’ credit card information and other private information we are required to protect, such as our Team Members’ personal information. We have taken a number of steps to prevent the occurrence of security breaches in this respect. Our systems have been carefully designed and configured to protect against data loss or compromise. For example, because of the number of credit card transactions processed in our Company-owned stores, we are required to maintain the highest level of Payment Card Industry (“PCI”) Data Security Standard compliance at our corporate offices and Company-owned restaurants.

These standards, set by a consortium of the major credit card companies, require certain levels of system security and procedures to protect our customers’ credit card and other personal information.

We also engage security assessors and consultants to review and advise us on our other data security practices with respect to protection of other sensitive personal information that we obtain from Guests and Team Members.

Marketing and Advertising

We build brand equity and awareness primarily through national marketing, including national television, digital media, social media programs, email, loyalty, and public relations initiatives. These programs are funded primarily through cooperative creative development and national media advertising funds.

In recent years, we have undertaken significant market research initiatives to gain feedback and perceptions in order to inform our business decisions. Among other things, we use a guest satisfaction tool in all restaurants that provides feedback from Guests on their experiences. Restaurant managers use this information to help identify areas of focus to strengthen restaurant performance and track progress. We also continually monitor our performance relative to peers and test potential business drivers among both current and potential Guests. We closely track the frequency and purchase behavior of Guests who are members of our Red Robin RoyaltyTM loyalty program.

In 2016, our marketing strategy began to shift toward a concentrated, rather than continuous, media buying approach with a focus on generating significant reach and frequency during on-air advertising periods. We plan to continue with this concentrated marketing approach in 2019, while communicating a clear message focused on craveable burgers, affordable abundance, and attentive service across a variety of advertising media. We will also deploy marketing support for our alternative platforms initiative, including generating Guest awareness of our online ordering, to-go, and catering dining opportunities.

Team Members

As of December 30, 2018, we had 27,283 employees, whom we refer to as Team Members, consisting of 26,935 Team Members at Company-owned restaurants and 348 Team Members at our corporate headquarters and field offices. None of our Team Members are covered by a collective bargaining agreement. We consider our Team Member relations to be good.

We support our Team Members by offering competitive wages and benefits for eligible Team Members, including medical and other insurance, an employee stock purchase plan, and equity-based awards for eligible corporate and operations employees at the director level and above. We motivate and develop our Team Members by providing them with opportunities for increased responsibilities and advancement. At certain levels, we also offer performance-based incentives tied to sales, profitability, and/or certain qualitative measures.

Executive Officers

The following table sets forth information about our executive officers and other key employees:

|

| | | | | |

Name | | Age | | Position |

Denny Marie Post | | 61 |

| | President and Chief Executive Officer(1) |

Beverly K. Carmichael | | 60 |

| | Executive Vice President and Chief People, Culture, and Resource Officer |

Guy J. Constant | | 54 |

| | Executive Vice President and Chief Operating Officer |

Jonathan Muhtar | | 47 |

| | Executive Vice President and Chief Concept Officer |

Lynn S. Schweinfurth | | 51 |

| | Executive Vice President and Chief Financial Officer |

Dean Cookson | | 49 |

| | Senior Vice President and Chief Information Officer |

Michael L. Kaplan | | 50 |

| | Senior Vice President and Chief Legal Officer |

(1) Also a member of the Company’s board of directors.

Denny Marie Post. Ms. Post was appointed Chief Executive Officer in August 2016, and has served as President since February 2016. In addition, Ms. Post served as our interim Chief Operating Officer between September 2018 and January 2019, when Mr. Constant became our Chief Operating Officer. Ms. Post previously served the Company in various roles as its Executive Vice President and Chief Concept Officer, and Senior Vice President and Chief Marketing Officer. Before joining Red Robin, she was the Managing Member of mm&i Consulting LLC, a marketing consulting firm, from June 2010 to July 2011. Ms. Post served as Senior Vice President, Chief Marketing Officer of T-Mobile USA from July 2008 to May 2010, as Senior Vice President, Global Beverage, Food, and Quality at Starbucks Corporation from February 2007 to June 2008, as

Senior Vice President, Chief Concept Officer of Burger King Corp. from April 2004 to January 2007, and prior to that, in various marketing executive roles at YUM! Brands, Inc. from 1996 to 2004.

Beverly K. Carmichael. Ms. Carmichael has served as Executive Vice President and Chief People, Culture, and Resource Officer since December 2017. Ms. Carmichael previously served as Senior Vice President and Chief People Officer of Cracker Barrel Old Country Store from January 2014 to December 2017. Prior to that, she was Founder and President of Star HR, LLC from April 2010 to April 2014. She served as Chief People Officer and Executive Vice President of Human Resources at Ticketmaster from August 2006 to August 2009. Prior to joining Ticketmaster, she was Vice President of HR at Rockwell Collins and spent 10 years at Southwest Airlines in various roles including Senior Vice President of Labor and Employee Relations; Vice President, People (Human Resources); and Chief Counsel, Labor and Employment.

Guy J. Constant. Mr. Constant became Executive Vice President and Chief Operating Officer in January 2019, and previously served as Executive Vice President and Chief Financial Officer since December 2016. Before joining Red Robin, Mr. Constant previously served as Chief Financial Officer, Executive Vice President of Finance and Treasurer of Rent-A-Center, Inc. from June 2014 to December 2016. Prior to that, Mr. Constant was the Chief Financial Officer and Executive Vice President of Brinker International Inc. from September 2010 to March 2014. At Brinker, he also served as Senior Vice President of Finance from May 2008 to September 2010, Vice President of Strategic Planning and Analysis and Investor Relations from September 2005 to May 2008, and Senior Director of Compensation from November 2004 to September 2005. Prior to Brinker, he spent nine years at AMR Corporation, the parent company of American Airlines, in various finance positions of increasing scope and responsibility. Mr. Constant transitioned into the role of Executive Vice President and Chief Operating Officer upon the hiring of Lynn S. Schweinfurth as the Company’s Executive Vice President and Chief Financial Officer, effective as of January 28, 2019.

Jonathan Muhtar. Mr. Muhtar was promoted to Executive Vice President and Chief Concept Officer of the Company, effective January 1, 2018. Mr. Muhtar previously served the Company as Senior Vice President and Chief Marketing Officer from December 2015 until his promotion. Prior to joining the Company, Mr. Muhtar served as Executive Vice President and Chief Marketing Officer of Captain D’s Seafood Restaurant from November 2011 to December 2015, and as Vice President of Global Marketing and Innovation and in other corporate and marketing positions at Burger King Corporation from July 2004 to June 2011.

Lynn S. Schweinfurth. Ms. Schweinfurth joined Red Robin as Executive Vice President and Chief Financial Officer in January 2019. Ms. Schweinfurth previously served as Vice President, Chief Financial Officer and Treasurer of Fiesta Restaurant Group since 2012 and was appointed Senior Vice President of Fiesta Restaurant Group in February 2015. From 2010 to 2012, she served as Vice President of Finance and Treasurer of Winn-Dixie Stores, Inc. Ms. Schweinfurth was Chief Financial Officer of Lone Star Steakhouse and Texas Land & Cattle from 2009 to 2010. She was Vice President, Finance, at Brinker International, Inc. from 2004 to 2009. Prior to 2004, Ms. Schweinfurth served in various corporate finance positions at Yum Brands, Inc. and PepsiCo, Inc.

Dean Cookson. Mr. Cookson joined Red Robin as Senior Vice President and Chief Information Officer in September 2017. Prior to joining Red Robin, Mr. Cookson served as Vice President and Chief Technology Officer of Virgin America Inc. from February 2011 to January 2017. He served as Vice President of Business Development at Basho Technologies, Inc. from April 2010 to February 2011. Prior to joining Basho, he served as Chief of Operations for Snapfish from June 2009 to April 2010. He also served as VP of Systems and Support Operations at Snapfish from February 2007 to June 2009. Prior to joining Snapfish, he served as Director of Production Operations at LookSmart Group, Inc. from 2002 to 2007.

Michael L. Kaplan. Mr. Kaplan joined Red Robin as Senior Vice President, Chief Legal Officer and Secretary in October 2013. Prior to joining the Company, he served as Senior Vice President, General Counsel, Chief Security Officer and Corporate Secretary of DAE Aviation Holdings, Inc. (d/b/a Standard Aero), a privately held global aviation maintenance company, from January 2010 to September 2013, and as a Shareholder at Greenberg Traurig, LLP, an international law firm, from January 2002 to January 2010.

Competition

The restaurant industry is highly competitive and our Guests may choose to purchase food at supermarkets or other food retailers. Although, for some occasions, we compete against other segments of the restaurant industry, including quick-service and fast-casual restaurants, our primary competition is with other sit-down, casual dining restaurants within the casual dining segment. In addition, we compete to attract Guests for off-premise dining occasions, including online ordering, delivery, to-go, and catering. The number, size, and strength of competitors vary by region, concept, market, and even restaurant. We compete on the basis of taste, quality, price of food and related guest value, guest service, ambiance, location, and overall dining experience.

We believe our guest demographics, strong brand recognition, gourmet burger concept, family-friendly atmosphere, attractive price-value relationship, and the quality of our food and service enable us to differentiate ourselves from our full service competitors. We believe we compete favorably with respect to each of these factors. Our competitors include well-established national chains which have more substantial marketing resources. We also compete with many other restaurant and retail establishments for team members.

Seasonality

Our business is subject to seasonal fluctuations. Historically, sales in most of our restaurants have been higher during the summer months and winter holiday season due to factors including our retail-oriented locations and family appeal. As a result, our quarterly and annual operating results and comparable restaurant sales may fluctuate significantly as a result of seasonality. Accordingly, results for any one quarter or year are not necessarily indicative of results to be expected for any other quarter or for any year, and comparable restaurant sales for any particular future period may decrease.

Trademarks

We have a number of registered trademarks and service marks, including the Red Robin®, Red Robin Gourmet Burgers®, Red Robin America’s Gourmet Burgers & Spirits®, Red Robin Burger Works®, “YUMMM®”, Red Robin Gourmet Burgers and BrewsTM, and Red Robin RoyaltyTM names and logos. We have registered or filed applications for trademarks for these marks, among others, with the United States Patent and Trademark Office, and we have applied to register various trademarks in certain other international jurisdictions.

In order to better protect our brand, we have also registered the Internet domain name www.redrobin.com. We believe our trademarks, service marks, and other intellectual property rights have significant value and are important to our brand building efforts and the marketing of our restaurant concept.

Government Regulation

Our restaurants are subject to licensing and regulation by state, province, and local health, safety, fire, and other authorities, including licensing requirements, and regulations for the sale of alcoholic beverages and food. To date, we have been able to obtain and maintain all necessary licenses, permits, and approvals. The development and construction of new restaurants is subject also to compliance with applicable zoning, land use, and environmental regulations. We are also subject to federal regulation and state laws that regulate the offer and sale of franchises and substantive aspects of the franchisor-franchisee relationship. Various federal and state labor laws govern our relationship with our Team Members and affect operating costs. These laws govern minimum wage requirements, overtime pay, meal and rest breaks, unemployment tax rates, health care and benefits, workers’ compensation rates, citizenship or residency requirements, child labor regulations, and discriminatory conduct. Federal, state and local government agencies have established or are in the process of establishing regulations requiring that we disclose to our Guests nutritional information regarding the items we serve.

Available Information

We maintain a link to investor relations information on our website, www.redrobin.com, where we make available, free of charge, our Securities and Exchange Commission (“SEC”) filings, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. All SEC filings are also available at the SEC’s website at www.sec.gov. Our website and the information contained on or connected to our website are not incorporated by reference herein, and our web address is included as an inactive textual reference only.

Forward-Looking Statements

Certain information and statements contained in this report are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) codified at Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. This statement is included for purposes of complying with the safe harbor provisions of the PSLRA. Forward-looking statements include statements regarding our expectations, beliefs, intentions, plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements which are other than statements of historical facts. These statements may be identified, without limitation, by the use of forward-looking terminology such as “anticipate,” “assume,” “believe,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “plan,” “project,” “will,” “would,” and similar expressions. Certain forward-looking statements are included in this Annual Report on Form 10-K, principally in the sections captioned “Business,” “Legal Proceedings,” “Consolidated Financial

Statements,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements relate to, among other things:

| |

• | our business objectives and strategic plans, including growth in guest traffic and revenue, improvements in operational efficiencies and expense management, enhancing our restaurant environments and guest engagement, expanding our restaurant base, and designing, testing, and implementing restaurant development activities; |

| |

• | our ability to grow our average check and increase sales of incremental items; |

| |

• | our focus on attracting new Guests while retaining loyal Guests and our initiatives targeted at adult Guests as our restaurant concept evolves; |

| |

• | our ability to grow sales through menu and service enhancement; |

| |

• | our pricing strategy and any future price increases and their effect on guest traffic and ordering choices, and, as a result, our revenue and profit; |

| |

• | the timing and cost of our investment and implementation of improvements in our information technology systems and data infrastructure to support guest service and engagement and the digital guest experience, and anticipated related benefits; |

| |

• | anticipated Company growth and development strategy, including the anticipated number and type of new restaurants, and the timing of such openings; |

| |

• | anticipated restaurant operating costs, including commodity and food prices, labor and energy costs, and selling, general, and administrative expenses, as well as the effect of inflation on such costs and our ability to reduce overhead costs and improve efficiencies; |

| |

• | anticipated legislation and other regulation of our business, including minimum wage standards; |

| |

• | our brand transformation initiatives, including the anticipated number and timing of restaurant remodels, and expected financial performance of remodeled restaurants; |

| |

• | developing, testing, and implementing more recent initiatives, such as online ordering services, third-party delivery services, utilizing an offsite call center to handle to-go orders, developing new to-go packaging, and catering services, and addressing operating issues associated with these initiatives; |

| |

• | the amount of capital expenditures in 2019; |

| |

• | our expectation that we will have adequate cash from operations and credit facility borrowings to meet all future debt service, capital expenditures, and working capital requirements in 2019 and beyond; |

| |

• | anticipated retention of future cash flows to fund our operations and expansion of our business, to fund growth opportunities, to pay down debt, or to repurchase stock; |

| |

• | the sufficiency of the supply of our food, supplies, and labor pool to carry on our business; |

| |

• | our franchise program, franchisee new restaurant openings and remodels, potential expansion and other changes to our franchise program, and refranchising efforts; |

| |

• | the continuation of our share repurchase program, and other capital deployment opportunities; |

| |

• | expectations regarding our operations in Canada and the resulting currency fluctuation risk related thereto; |

| |

• | expectations about any future interest rate swap; |

| |

• | the effect of the adoption of new accounting standards on our financial and accounting systems and analysis programs; |

| |

• | expectations regarding competition and our competitive advantages against our casual dining peers; and |

| |

• | expectations regarding consumer preferences and consumer discretionary spending. |

Although we believe the expectations reflected in our forward-looking statements are based on reasonable assumptions, such expectations may prove to be materially incorrect due to known and unknown risks and uncertainties.

In some cases, information regarding certain important factors that could cause actual results to differ materially from a forward-looking statement appears together with such statement. In addition, the factors described under Critical Accounting Policies and Estimates and Risk Factors, as well as other possible factors not listed, could cause actual results to differ materially from those expressed in forward-looking statements, including, without limitation, the following: the effectiveness of our strategic business improvement initiatives, including the effectiveness of our affordability, service improvement, technology, and off-site initiatives to drive traffic and sales; the effectiveness of our marketing strategies and promotions to achieve restaurant sales growth; our ability to effectively use and monitor social media; uncertainty regarding general economic conditions; concentration of restaurants in certain markets, and lack of market awareness in new markets; changes in consumer disposable income; consumer spending trends and habits; the effectiveness of our information technology and new technology systems, including cyber security with respect to those systems; regional mall and lifestyle center traffic trends or other trends

affecting traffic at our restaurants; increased competition and discounting in the casual dining restaurant market; costs and availability of food and beverage inventory; changes in commodity prices, particularly ground beef; changes in energy and labor costs, including due to changes in health care, and market wage levels; the success of our refranchising efforts; changes in federal, state, or local laws and regulations affecting the operation of our restaurants, including but not limited to, minimum wages, consumer health and safety, health insurance coverage, nutritional disclosures, and employment eligibility-related documentation requirements; limitations on our ability to execute stock repurchases at all or at the times or in the amounts we currently anticipate due to lack of available share or acceptable stock price levels or other market or Company-specific conditions, or to otherwise achieve anticipated benefits of a share repurchase program; our ability to attract qualified managers and team members; the adequacy of cash flows or available access to capital or debit resources under our credit facility or otherwise to fund operations and growth opportunities; costs and other effects of legal claims by team members, franchisees, customers, vendors, stockholders, and others, including settlement of those claims or negative publicity regarding food safety or cyber security; weather conditions, and related events in regions where our restaurants are operated; and changes in accounting standards policies, and practices or related interpretations by auditors or regulatory entities.

All forward-looking statements speak only as of the date made. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances.

ITEM 1A. Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully read and consider the risks described below before making an investment decision. The occurrence of any of the following risks could materially harm our business, financial condition, results of operations, or cash flows. The trading price or value of our common stock could decline, and you could lose all or part of your investment. When making an investment decision with respect to our common stock, you should also refer to the other information contained or incorporated by reference in this Annual Report on Form 10-K, including our consolidated financial statements and the related notes.

Risks Related to Our Business

Our business strategy may not be successful or achieve the desired results, which may have an adverse impact on our business and financial results.

Our business strategy is designed to allow Red Robin to achieve success in a rapidly evolving marketplace. Our strategy focuses on attracting, retaining, and engaging high performance teams, evolving to better serve middle income families, embracing the "gift of time" as a key differentiator, and improving company and 4-wall economics.

Additional initiatives supporting our strategy include online ordering services, using an offsite call center to receive to-go orders, catering services, and delivery of orders directly or through third parties. These initiatives may not result in sustained higher sales. Catering, online ordering, and other out-of-restaurant sales options also involve additional operating procedures for our restaurants and increase reliance on third parties. We may not successfully execute these procedures and are not in control of the experience provided by third parties, which could adversely impact the guest experience and, as a result, harm guest perception of our brand and sales. Our business depends upon our ability to continue to grow and evolve through various important strategic initiatives. There can be no assurance we will be able to develop or implement these or other important strategic initiatives, or that we have, or will have, sufficient resources to fully and successfully implement, sustain results from, or achieve additional expected benefits from them, which could in turn adversely affect our business.

Our success depends on our ability to effectively compete in the restaurant industry to attract and retain Guests.

Competition in the restaurant industry is intense and barriers to entry are low. Our competitors include a large and diverse group of restaurants in all segments ranging from quick serve and fast casual to polished casual and those verging on fine dining. These competitors range from independent local operators that have opened restaurants in various markets, high growth targeted “better” burger concepts in the quick serve and fast casual space, to the well-capitalized national restaurant companies. Many of these concepts have already captured segments of the market that we are targeting, such as adult-only occasions, and are expanding faster than we are, penetrating both desirable geographic and demographic markets. Many of our competitors are well established in the casual dining market segment and in certain geographic locations and some of our competitors have substantially greater financial, marketing, and other resources than we have available. Accordingly, they may be better equipped than us to increase marketing or to take other measures to maintain their competitive position, including the use of

significant discount offers to attract Guests. We also compete with other restaurants and retail establishments for real estate and attractive locations.

Our marketing and branding strategies to attract, engage, and retain our Guests may not be successful, which could negatively affect our business.

We continue to evolve our marketing and branding strategies in order to appeal to customers and compete effectively to attract, engage, and retain customers. Our unique loyalty program, “Red Robin Royalty™” has experienced some success in driving sales and guest counts by providing loyal Guests with various incentives and rewards. We intend to continue our focus on serving families while targeting adult occasions, and to grow beverage and food sales, including alcoholic beverages, appetizers and desserts, through menu and service enhancements. We do not have any assurance our marketing strategies will be successful. If our advertising, branding, and other marketing programs and methods are not successful, we may not generate the level of restaurant sales or guest traffic we expect and the expense associated with these programs may negatively affect our financial results. Moreover, many of our competitors have larger marketing resources and more extensive national marketing strategies and media usage and we may not be able to successfully compete against those established programs.

Our inability to effectively use and monitor social media could harm our marketing efforts as well as our reputation, which could negatively impact our restaurant sales and financial performance.

As part of our marketing efforts, we rely on search engine marketing and social media platforms such as Facebook® and Twitter® to attract and retain Guests. As a result, we need to continuously innovate and develop our social media strategies in order to maintain broad appeal. Many of our competitors are expanding their use of social media and new social media platforms are rapidly being developed, potentially making more traditional social media platforms obsolete and making it challenging for us to differentiate our social media messaging. As a result, we need to continuously innovate and develop our social media strategies in order to maintain broad appeal.

Social media can be challenging because it provides consumers, employees, and others with the ability to communicate approval or displeasure with a business, in near real time, and provides any individual with the ability to reach a broad audience and with comments that are often not filtered or checked for accuracy. If we are unable to quickly and effectively respond, any negative publicity could "go viral" causing nearly immediate and potentially significant harm to our brand and reputation, whether or not factually accurate. In addition, social media can facilitate the improper disclosure of proprietary information, exposure of personally identifiable information, fraud, or out-of-date information.

As a result, if we do not appropriately manage our social media strategies, our marketing efforts in this area may not be successful and any failure (or perceived failure) to effectively respond to negative or potentially damaging social media chatter, whether accurate or not, could damage our reputation, negatively impacting our restaurant sales and financial performance. The inappropriate use of social media vehicles by our Guests or Team Members could increase our costs, lead to litigation, or result in negative publicity that could damage our reputation.

A privacy or security breach involving our information technology systems or the failure of our data security measures could interrupt our business, damage our reputation, and negatively affect our operations and profits.

The protection of customer, employee and company data is critical to us. We are subject to laws relating to information security, privacy, cashless payments, consumer credit, and fraud. Additionally, an increasing number of government and industry groups have established laws and standards for the protection of personal and health information. The regulatory environment surrounding information security and privacy is increasingly demanding, with the frequent imposition of new and constantly changing requirements. Compliance with these requirements may result in cost increases due to necessary system changes and the development of new administrative processes, and if we fail to comply with the laws and regulations regarding privacy and security, we could be exposed to risks of fines, investigations, litigation and disruption of our operations.

Moreover, we accept electronic payment cards from our Guests for payment in our restaurants. In the ordinary course of our business, we receive and maintain certain personal information from our Guests, Team Members, and vendors, and we process guest payments using payment information. Customers and employees have a high expectation we will adequately protect their personal information. Third parties may have the technology or know-how to breach the security of this customer information, and our security measures and those of our technology vendors may not effectively prohibit others from obtaining improper access to this information. A number of restaurant operators and retailers have experienced security breaches in which credit and debit card information may have been stolen. Although we employ security technologies and practices, and have taken other steps to try to prevent a breach, we may nevertheless not have the resources or technical sophistication to prevent rapidly evolving types of cyber attacks. If we have experienced, or in the future experience, a security breach, we could become subject to claims, lawsuits, or other proceedings for purportedly fraudulent transactions arising out of the theft of credit or debit

card information, compromised security and information systems, failure of our employees to comply with applicable laws, the unauthorized acquisition or use of such information by third parties, or other similar claims. Any such incidents or proceedings could disrupt the operation of our restaurants, adversely affect our reputation, guest confidence, and our results of operations, or result in the imposition of penalties or cause us to incur significant unplanned losses and expenditures, including those necessary to remediate any damage to persons whose personal information may have been compromised. Although we have established a consumer cyber security “bill of rights” for our Guests, which includes a number of procedures designed to increase transparency and address our guests’ concerns regarding data breaches (whether actual or perceived), this policy may not be effective in addressing those concerns, which may in turn adversely affect our reputation and guest confidence. We maintain a separate insurance policy covering cyber security risks and such insurance coverage may, subject to policy terms and conditions, cover certain aspects of cyber risks, but is subject to a retention amount and may not be applicable to a particular incident or otherwise may be insufficient to cover all our losses beyond any retention. Further, in light of recent court rulings and amendments to policy forms, there is uncertainty as to whether traditional commercial general liability policies will be construed to cover the expenses related to a cyber attack and breaches if credit and debit card information is stolen.

Because of the number of credit card transactions we process, we are required to maintain the highest level of PCI Data Security Standard compliance at our corporate offices and Company-owned restaurants. As part of an overall security program and to meet PCI standards, we undergo regular external vulnerability scans and we are reviewed by a third-party assessor. As PCI standards change, we may be required to implement additional security measures. If we do not maintain the required level of PCI compliance, we could be subject to costly fines or additional fees from the card brands that we accept, or lose our ability to accept those payment cards. Our franchisees are separate businesses that have different levels of compliance required depending on the number of credit card transactions processed. If our franchisees fail to maintain the appropriate level of PCI compliance or they experience a security breach, it could negatively impact their business operations, and we could face a loss of or reduction in royalties or other payments they are required to remit to us and it could adversely affect our reputation and guest confidence.

Changes in consumer preferences could negatively affect our results of operations.

The restaurant industry is characterized by the continual introduction of new concepts and is subject to rapidly changing consumer preferences, tastes, and eating and purchasing habits. Our restaurants compete on the basis of a varied menu and feature burgers, salads, soups, appetizers, other entrees, desserts, and our signature alcoholic and non-alcoholic beverages in a family-friendly atmosphere. Our continued success depends, in part, upon the continued popularity of these foods and this style of casual dining. Shifts in consumer preferences away from this cuisine or dining style could have a material adverse effect on our future profitability. In addition, competitors’ use of significant advertising and food discounting could influence our guests’ dining choices. One of our strategies is to provide a balance of both family-friendly and adult-focused guest experiences. There is no assurance this balance will be successful or that it will not negatively affect our family guest experience.

Further, changing health or dietary preferences may cause consumers to avoid our products in favor of alternative foods. The food service industry as a whole rests on consumer preferences and demographic trends at the local, regional, national, and international levels, and the effect on consumer eating habits of new information regarding diet, nutrition, and health. New laws requiring additional nutritional information to be disclosed on our menus, changes in nutritional guidelines issued by the federal government agencies, issuance of similar guidelines or statistical information by other federal, state or local municipalities, or academic studies, among other things, may affect consumer choice and cause consumers to significantly alter their dining choices in ways that adversely affect our sales and profitability.

We are subject to all of the risks associated with leasing space subject to long-term non-cancelable leases, as well as risks related to renewal.

As of December 30, 2018, 447 of our 484 Company-owned restaurants are located on leased premises. Payments under our operating leases account for a significant portion of our operating expenses. Additional sites that we lease are likely to be subject to similar long-term non-cancelable leases. In connection with closing restaurants, we may nonetheless be committed to perform our obligations under the applicable lease including, among other things, paying the base rent for the balance of the lease term.

In addition, as each of our leases expires, there can be no assurance we will be able to renew our expiring leases after the expiration of all remaining renewal options, either on commercially acceptable terms or at all. As a result we may incur additional costs to operate our restaurants, including increased rent and other costs related to the negotiation of terms of occupancy of an existing leased premise. If we are unable to renew a lease or determine not to renew a lease, there may be costs related to the relocation and development of a replacement restaurant or, if we are unable to relocate, reduced revenue.

The global and domestic economic environment may negatively affect frequency of guest visits and average ticket spend at our restaurants, which would negatively affect our revenues and our results of operations.

The global and domestic economic environment affects the restaurant industry, and may negatively affect us directly and indirectly through our customers, distributors, and suppliers. These conditions include unemployment, weakness and lack of consistent improvement in the housing markets, downtrend or delays in residential or commercial real estate development, volatility in the U.S. stock market and in other financial markets, inflationary pressures, wage rates, tariffs and other trade barriers, reduced access to credit or other economic factors that may affect consumer confidence. As a result, our Guests may be apprehensive about the economy and maintain or further reduce their level of discretionary spending. This could affect the frequency with which our Guests choose to dine out or the amount they spend on meals, thereby decreasing our revenues and potentially negatively affecting our operating results. Also, our Guests may choose to purchase food at supermarkets or other food retailers. We believe there is a risk that prolonged negative or uncertain economic conditions might cause consumers to make long-lasting changes to their discretionary spending behavior, including dining out less frequently or at lower priced restaurants on a more permanent basis, which would have a negative effect on our profitability as we spread fixed costs across a lower level of sales.

Changes in consumer buying patterns, particularly due to declines in traffic near our leased locations, and the increase in popularity of e-commerce sites and off premise sales, may affect our revenues, operating results, and liquidity.

The success of our restaurants depends in large part on leased locations. Our restaurants are primarily located near high density retail areas such as regional malls, lifestyle centers, big box shopping centers, and entertainment centers. We depend on a high volume of visitors at these centers to attract Guests to our restaurants. As demographic and economic patterns change, current locations may or may not continue to be attractive or profitable. E-Commerce or online shopping continues to increase and negatively impact consumer traffic at traditional “brick and mortar” retail sites located in regional malls, lifestyle centers, big box shopping centers and entertainment centers. A decline in development or closures of businesses in these settings or a decline in visitors to retail areas near our restaurants could negatively affect our restaurant sales. In addition, desirable locations for the relocation of existing restaurants may not be available at an acceptable cost, due in part to the inability to easily terminate a long-term lease.

In the last several years, off premise sales, specifically delivery, have increased due to consumer demand for convenience. While we plan to continue to invest in the growth of our online, to-go, catering, and delivery services to drive off premise sales, there can be no guarantee we will be able to continue to increase our off premise sales. Off premise sales could also cannibalize dine in sales, or our systems and procedures may not be sufficient to handle off premise sales, which may require additional investments in technology or people. Additionally, a large percentage of delivery from our restaurants is through third party delivery companies. These third party delivery companies require us to pay them a commission, which lowers our profit margin on those sales. Any bad press, whether true or not, regarding third party delivery companies or their business model may negatively impact our sales.

Our operations are susceptible to the changes in cost and availability of commodities which could negatively affect our operating results.

Our profitability depends in part on our ability to anticipate and react to changes in commodity costs. Various factors beyond our control, including adverse weather conditions, governmental regulation and monetary policy, potential imposition of tariffs on imports from other countries, product availability, recalls of food products, and seasonality, as well as the effects of the current macroeconomic environment on our suppliers, may affect our commodity costs or cause a disruption in our supply chain. In an effort to mitigate some of this risk, we enter into fixed price agreements on some of our food and beverage products, including certain proteins, produce and cooking oil. As of the end of 2018, 62.3% of our estimated 2019 annual food and beverage purchases were covered by fixed price contracts, most of which are scheduled to expire at various times during 2019. Changes in the price or availability of commodities for which we do not have fixed price contracts could have a material adverse effect on our profitability. Expiring contracts with our food suppliers could also result in unfavorable renewal terms and therefore increase costs associated with these suppliers or may necessitate negotiations with alternate suppliers. We may be unable to obtain favorable contract terms with suppliers or adjust our purchasing practices and menu prices to respond to changing food costs, and a failure to do so could negatively affect our operating results.

We may experience interruptions in the delivery of food and other products from third parties.

Our restaurants depend on frequent deliveries of fresh produce, food, beverage and other products. This subjects us to the risk of interruptions in food and beverage supplies that may result from a variety of causes including, but not limited to, outbreaks of food-borne illness, disruption of operation of production facilities, the financial difficulties, including bankruptcy of our suppliers or other unforeseen circumstances. Such shortages could adversely affect our revenue and profits. Our

restaurants bear risks associated with the timeliness of deliveries by suppliers and distributors as well as the solvency, reputation, labor relationships, freight rates, and health and safety standards of each supplier and distributor. Other significant risks associated with our suppliers and distributors include improper handling of food and beverage products and/or the adulteration or contamination of such food and beverage products.

Price increases may negatively affect guest visits.

We may make future price increases, primarily to offset increased costs and operating expenses. We cannot provide assurance that any future price increases will not deter Guests from visiting our restaurants, reduce the frequency of their visits, or affect their purchasing decisions.

New or improved technologies or changes in consumer behavior facilitated by these technologies could negatively affect our business.

Advances in technologies or certain changes in consumer behavior driven by such technologies could have a negative effect on our business. Technology and consumer offerings continue to develop, and we expect new or enhanced technologies and consumer offerings will be available in the future. We may pursue certain of those technologies and consumer offerings if we believe they offer a sustainable guest proposition and can be successfully integrated into our business model. However, we cannot predict consumer acceptance of these delivery channels or their impact on our business. In addition, our competitors, some of whom have greater resources than us, may be able to benefit from changes in technologies or consumer acceptance of such changes, which could harm our competitive position. There can be no assurance we will be able to successfully respond to changing consumer preferences, including with respect to new technologies or to effectively adjust our product mix, service offerings, and marketing initiatives for products and services that address, and anticipate advances in, technology, and market trends. If we are not able to successfully respond to these challenges, our business, financial condition, and operating results could be harmed.

If there is a material failure in our information technology systems, our business operations and profits could be negatively affected, and our systems may be inadequate to support our future growth strategies.

We rely heavily on information technology systems in all aspects of our operations including our restaurant point-of sale systems, financial systems, marketing programs, employee engagement, supply chain management, cyber-security, and various other processes and transactions. Our ability to effectively manage and run our business depends on the reliability and capacity of our information technology systems, including technology services and systems for which we contract from third parties. These systems and services may be insufficient to effectively manage and run our business. These systems and our business needs will continue to evolve and require upgrading and maintenance over time, consequently requiring significant future commitments of resources and capital.

Moreover, these technology services and systems, communication systems, and electronic data could be subject or vulnerable to damage or interruption from earthquakes, terrorist attacks, floods, fires, power loss, telecommunications failures, computer viruses, loss of data, data breaches, or other attempts to harm our systems. See “-A privacy or security breach involving our information technology systems or the failure of our data security measures could interrupt our business, damage our reputation, and negatively affect our operations and profits” above. A failure of these systems to operate effectively, problems with transitioning to upgraded or replacement systems, or any other failure to maintain a continuous and secure information technology network for any of the above reasons could result in interruption and delays in guest services, adversely affect our reputation, and negatively impact our results of operations.

Expanding our restaurant base is a component of our long-term growth and our ability to open and profitably operate new restaurants is subject to factors beyond our control.

The expansion of our restaurant base depends in large part on our ability and the ability of our franchisees to timely and efficiently open new restaurants and to operate these restaurants on a profitable basis. Delays or failures in opening new restaurants, or the inability to profitably operate them once opened, could materially and adversely affect our planned growth. The success of our expansion strategy and the success of new restaurants depends upon numerous factors, many of which are beyond our control, including the following:

| |

• | changes to our volatility in the macroeconomic environment nationally and regionally, which could affect restaurant-level performance and influence our decisions on the rate of expansion, timing, and the number of restaurants to be opened; |

| |

• | competition in our markets and general economic conditions that may affect consumer spending or choice; |

| |

• | identification of and ability to secure an adequate supply of available and suitable restaurant sites; |

| |

• | timely adherence to development schedules; |

| |

• | cost and availability of capital to fund restaurant expansion and operation; |

| |

• | negotiation of favorable lease and construction terms; |

| |

• | the availability of construction materials and labor; |

| |

• | our ability to manage construction and development costs of new restaurants; |

| |

• | unforeseen environmental problems with new locations; |

| |

• | securing required governmental approvals and permits, including liquor licenses, in a timely manner or at all; |

| |

• | our ability to locate, hire, train, and retain qualified operating personnel to staff our new restaurants, especially managers; |

| |

• | our ability to attract and retain Guests; |

| |

• | weather, natural disasters, and other calamities; and |

| |

• | our ability to operate at acceptable profit margins. |

We are subject to the risks presented by acquisitions or refranchising.

As part of our expansion efforts, we have acquired some of our franchised restaurants in the past. In the future, we may, from time to time, consider opportunistic acquisitions or dispositions of restaurants. We have also identified certain markets where we are pursuing refranchising with quality operators. Any future acquisitions or dispositions will be accompanied by the risks commonly encountered in acquisitions. These risks include among other things:

| |

• | the difficulty of integrating operations and personnel; |

| |

• | the potential disruption to our ongoing business; |

| |

• | the potential distraction of management; |

| |

• | the effect on selling, general, and administrative expenses and earnings; |

| |

• | the inability to maintain uniform standards, controls, procedures and policies; and |

| |

• | the impairment of relationships with Team Members and Guests as a result of changes in ownership and management. |

New or less mature restaurants, once opened, may vary in profitability and levels of operating revenue for six months or more.

New and less mature restaurants typically experience higher operating costs in both dollars and percentage of revenue initially when compared to restaurants in the comparable restaurant base. There is no assurance new restaurants in the future will continue to experience success. It takes approximately six months or more for new restaurants to reach normalized operating levels due to inefficiencies and other factors typically associated with new restaurants. These factors include operating costs, which are often significantly greater during the first several months of operation, and fluctuating guest counts at new locations, as well as competition from our competitors or our own restaurants, consumer acceptable of our restaurants in new markets and lack of market awareness of our brand in a new market. Further, there is no assurance our less mature restaurants will attain operating results similar to those of our existing restaurants.

The large number of Company-owned restaurants concentrated in the western United States makes us susceptible to changes in economic and other trends in that region.

As of December 30, 2018, a total of 181 or 37.4% of all Company-owned restaurants, representing 45.1% of restaurant revenue, were located in the western United States (i.e., Arizona, California, Colorado, Nevada, Oregon, Idaho, New Mexico, and Washington state). As a result of our geographic concentration, negative publicity regarding any of our restaurants in the western United States, as well as regional differences in the legal, regulatory, and litigation environment, could have a material adverse effect on our business and operations, as could other regional occurrences such as local strikes, energy shortages, or increases in energy prices, droughts, earthquakes, fires, or other natural disasters.

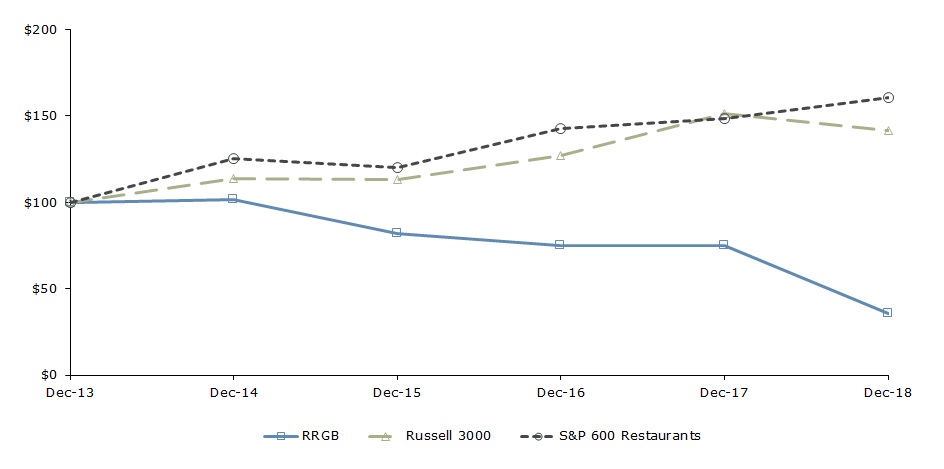

Our revenues and operating results may fluctuate significantly due to various risks and unexpected circumstances, including increases in costs, seasonality, weather, and other factors outside our control.