Fourth Quarter 2019 Results February 25, 2020 CLASSIFIED – INTERNAL USE ONLY

Forward-Looking Statements Forward-looking statements in this presentation regarding the Company’s future performance, including accelerating growth, and all other statements that are not historical facts, are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on assumptions believed by the Company to be reasonable and speak only as of the date on which such statements are made. Without limiting the generality of the foregoing, words such as “expect,” “believe,” “anticipate,” “intend,” “plan,” “project,” “will” or “estimate,” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. Except as required by law, the Company undertakes no obligation to update such statements to reflect events or circumstances arising after such date and cautions investors not to place undue reliance on any such forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those described in the statements based on a number of factors, including but not limited to the following: the effectiveness of the Company’s strategic initiatives, including alternative labor models, service, and operational improvement initiatives; the ability to train and retain the Company’s workforce for service execution, including the complexities related to growth of multiple revenue streams within the restaurants; the effectiveness of the Company’s marketing strategies and promotions; menu changes, including the anticipated sales growth, costs, and timing of the Donatos® expansion; the implementation and rollout of new technology solutions in the restaurants and timing thereof; the ability to increase off-premise sales; the ability to achieve revenue and cost savings from these and other initiatives; the Company’s franchise strategy; competition in the casual dining market and discounting by competitors; the cost and availability of key food products, distribution, labor, and energy; general economic conditions; the cost and availability of capital or credit facility borrowings; the adequacy of cash flows or available debt resources to fund operations and growth opportunities; limitations on our ability to execute stock repurchases at all or at the times or in the amounts we currently anticipate or to achieve anticipated benefits of a share repurchase program; the impact of federal, state, and local regulation of the Company’s business; and other risk factors described from time to time in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments to those reports) filed with the U.S. Securities and Exchange Commission. This presentation also contains non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of the Company’s financial performance, identifying trends in results, and providing meaningful period-to-period comparisons. For a reconciliation of non-GAAP measures presented in this document, see the Appendix of this presentation or the Schedules to the Q4 press release posted on redrobin.com. PAGE 2

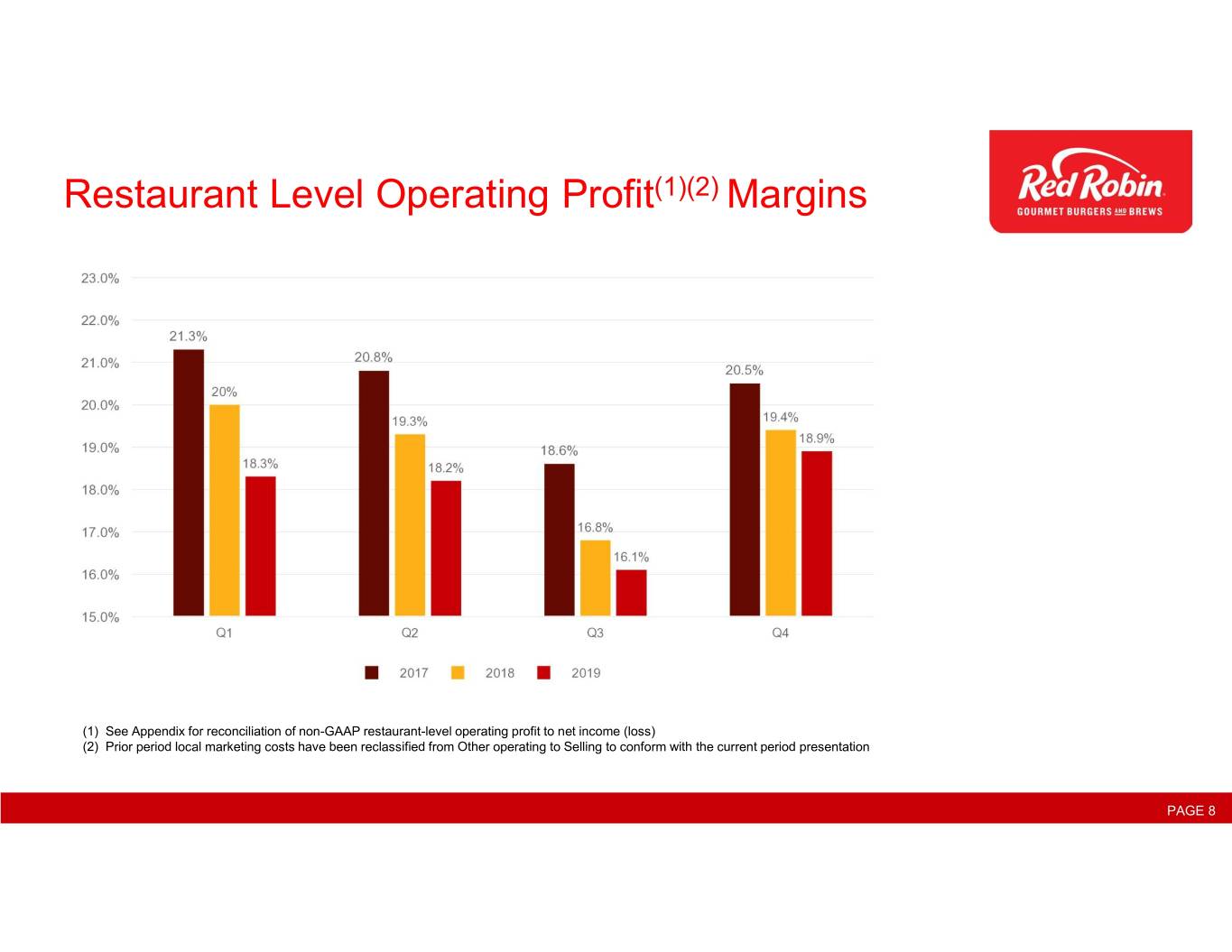

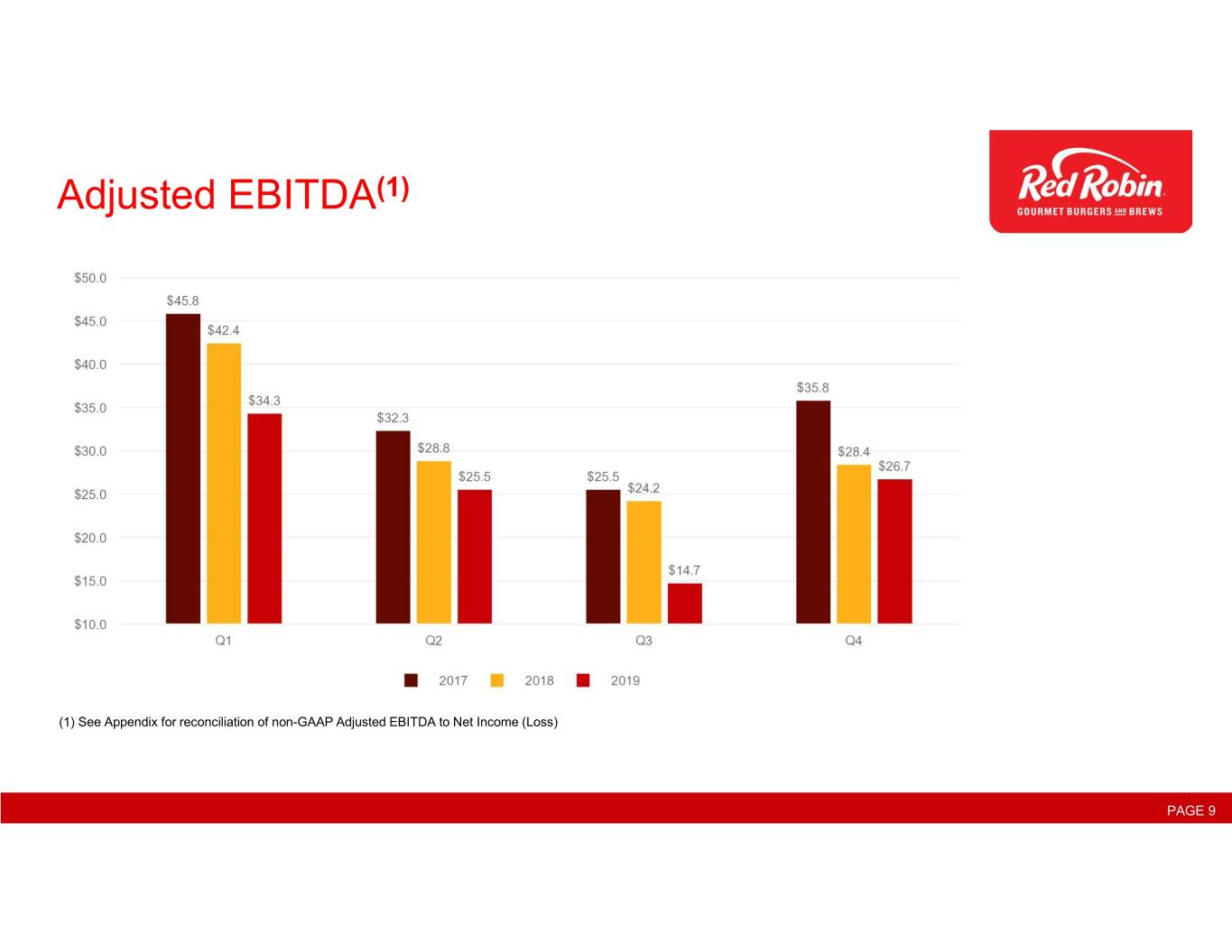

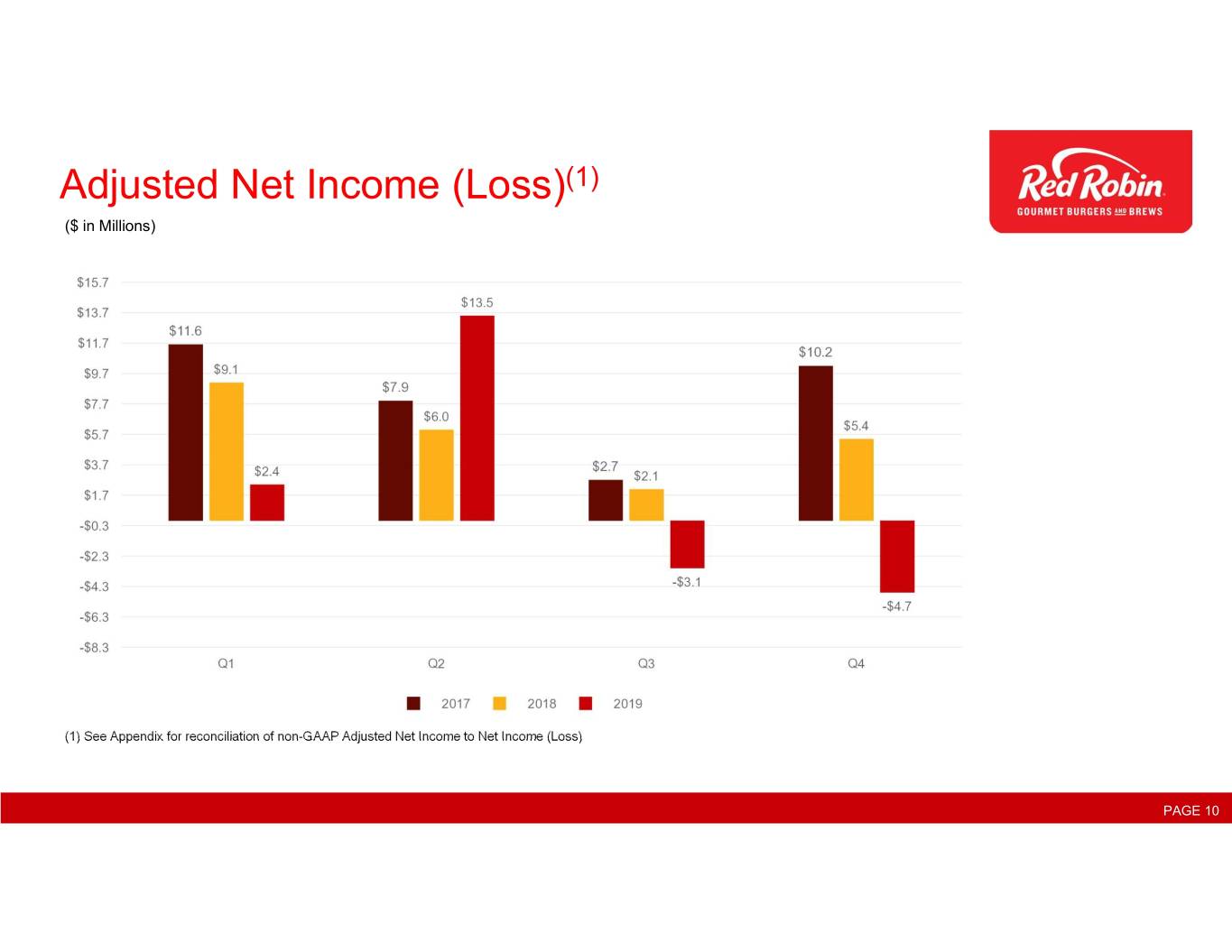

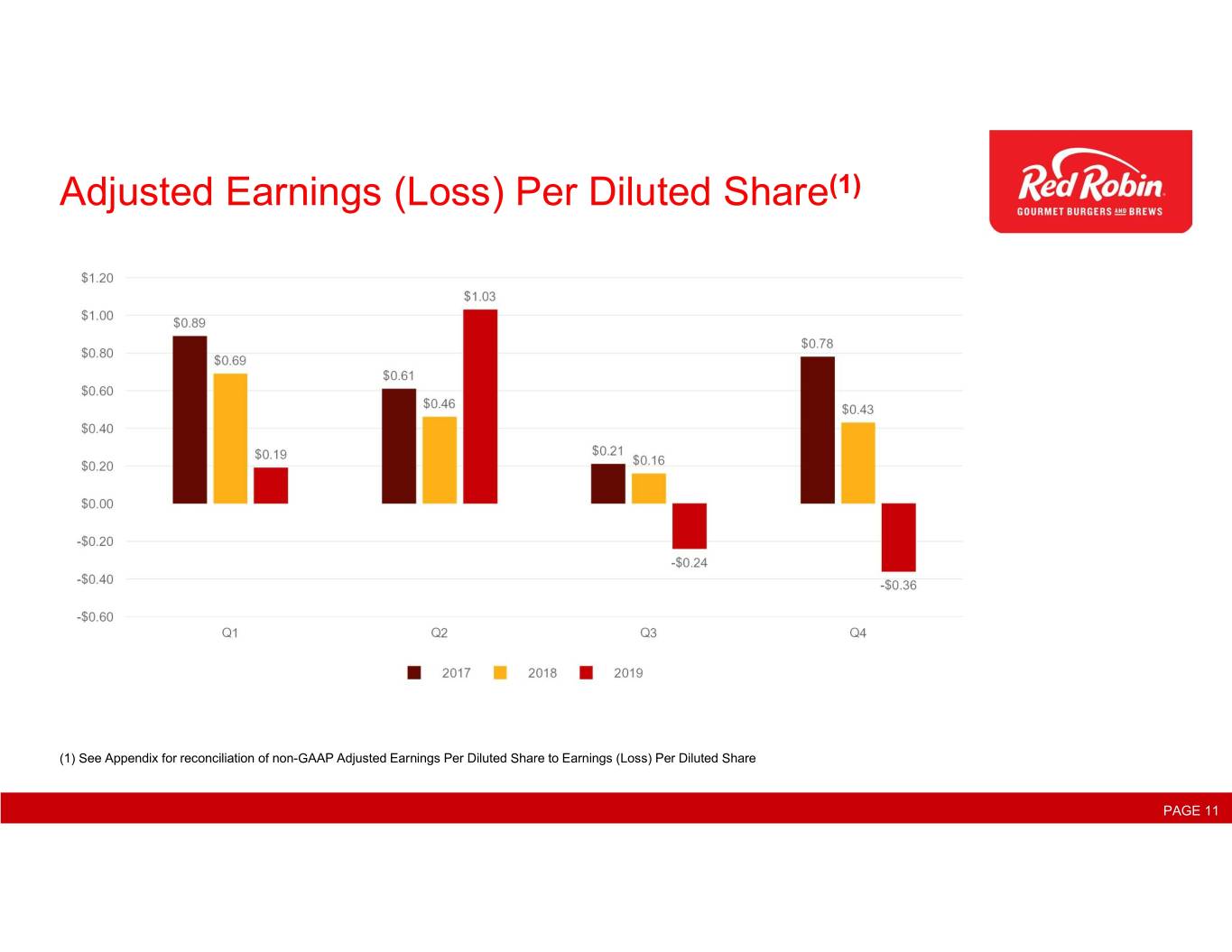

Red Robin Fourth Quarter Financial and Operating Results • Comparable restaurant revenue increased 1.3% (using constant currency rates), the second consecutive quarter of positive growth • Off-premise sales increased 26.9%, now comprising 13.9% of total food and beverage sales, including catering • Comparable restaurant guest counts decreased 3.4% • Total revenues decreased 1.2% • GAAP loss per diluted share was $0.60 compared to $0.82 in Q4 2018. Adjusted diluted loss per share(1) was $0.36 compared to earnings per diluted share of $0.43 in Q4 2018 • Net loss was $7.7 million compared to $10.6 million in Q4 2018 • Adjusted EBITDA(1) was $26.7 million compared to $28.4 million in Q4 2018 • Restaurant-level operating profit(1) was 18.9% compared to 19.4% in the prior year • Record overall guest satisfaction scores and continued lower ticket times • Essentially fully staffed at manager positions and turnover approaching or exceeding best-in-class casual dining benchmarks (1) See reconciliations of non-GAAP financial measures to the most comparable GAAP financial measures in Appendix. PAGE 3

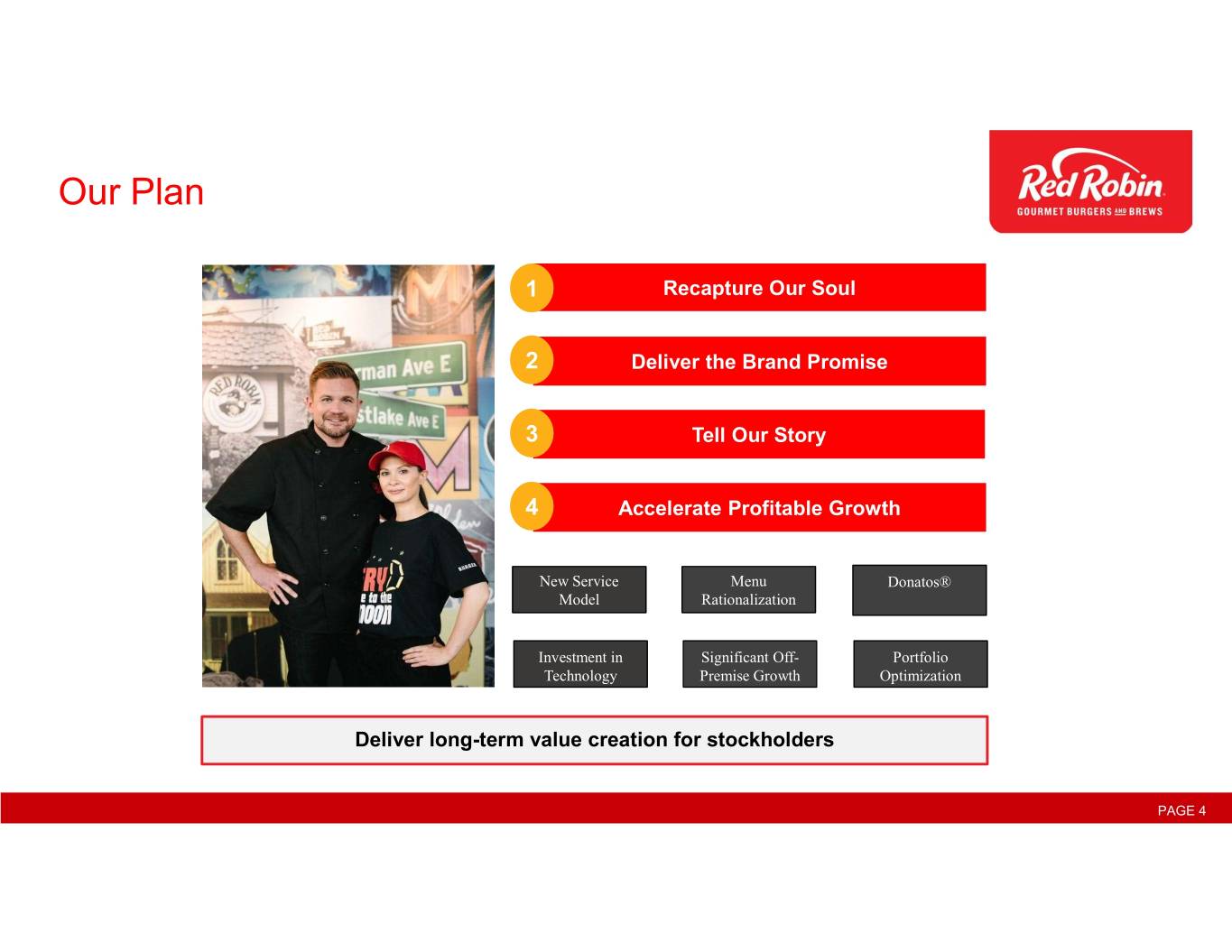

Our Plan 1 Recapture Our Soul 2 Deliver the Brand Promise 3 Tell Our Story 4 Accelerate Profitable Growth New Service Menu Donatos® Model Rationalization Investment in Significant Off- Portfolio Technology Premise Growth Optimization Deliver long-term value creation for stockholders PAGE 4

Accelerating Our Business Turnaround PAGE 5

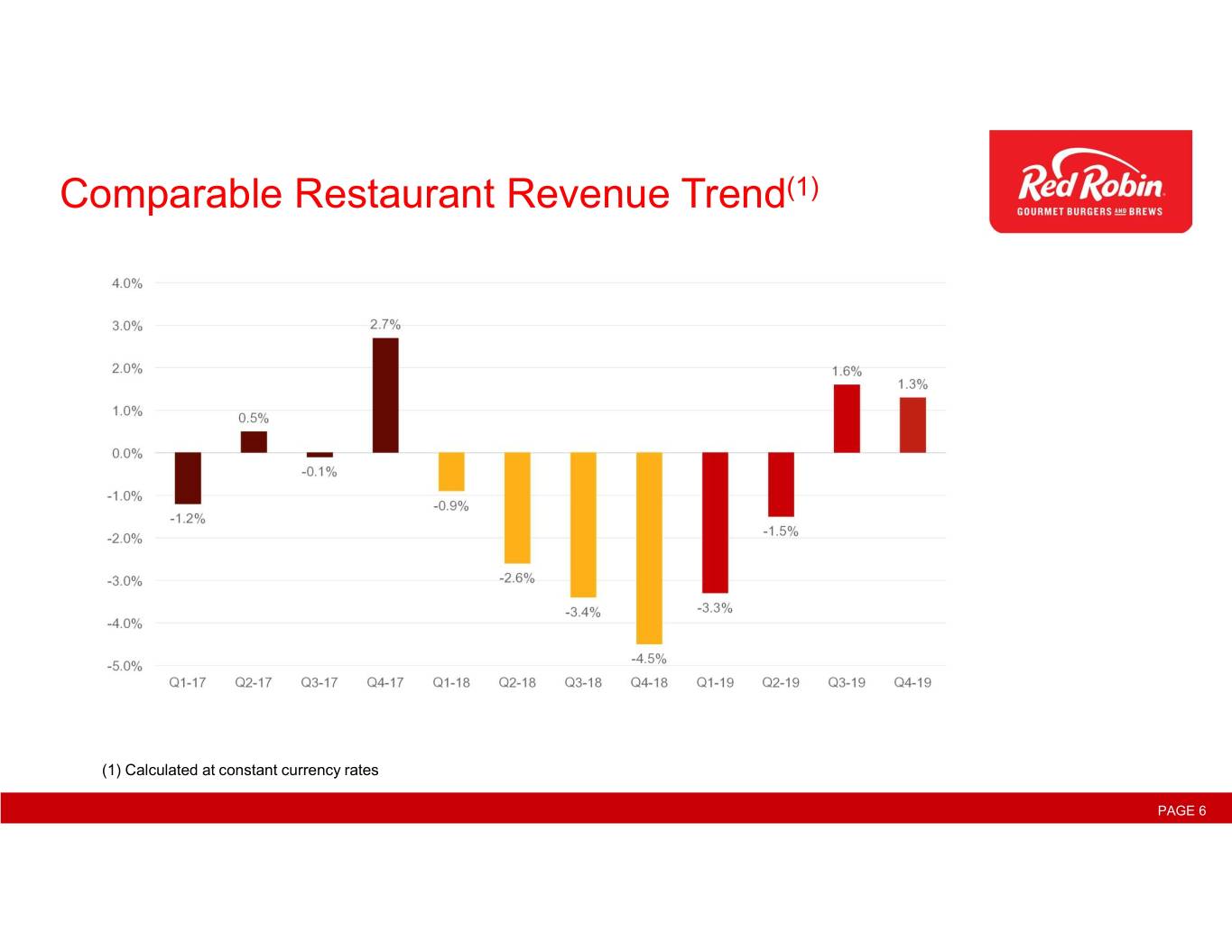

Comparable Restaurant Revenue Trend(1) (1) Calculated at constant currency rates PAGE 6

Continued Off-Premise Sales Growth +330 bps Y-O-Y in Q4 2019 PAGE 7

Restaurant Level Operating Profit(1)(2) Margins (1) See Appendix for reconciliation of non-GAAP restaurant-level operating profit to net income (loss) (2) Prior period local marketing costs have been reclassified from Other operating to Selling to conform with the current period presentation PAGE 8

Adjusted EBITDA(1) (1) See Appendix for reconciliation of non-GAAP Adjusted EBITDA to Net Income (Loss) PAGE 9

Adjusted Net Income (Loss)(1) ($ in Millions) (1) See Appendix for reconciliation of non-GAAP Adjusted Net Income to Net Income (Loss) PAGE 10

Adjusted Earnings (Loss) Per Diluted Share(1) (1) See Appendix for reconciliation of non-GAAP Adjusted Earnings Per Diluted Share to Earnings (Loss) Per Diluted Share PAGE 11

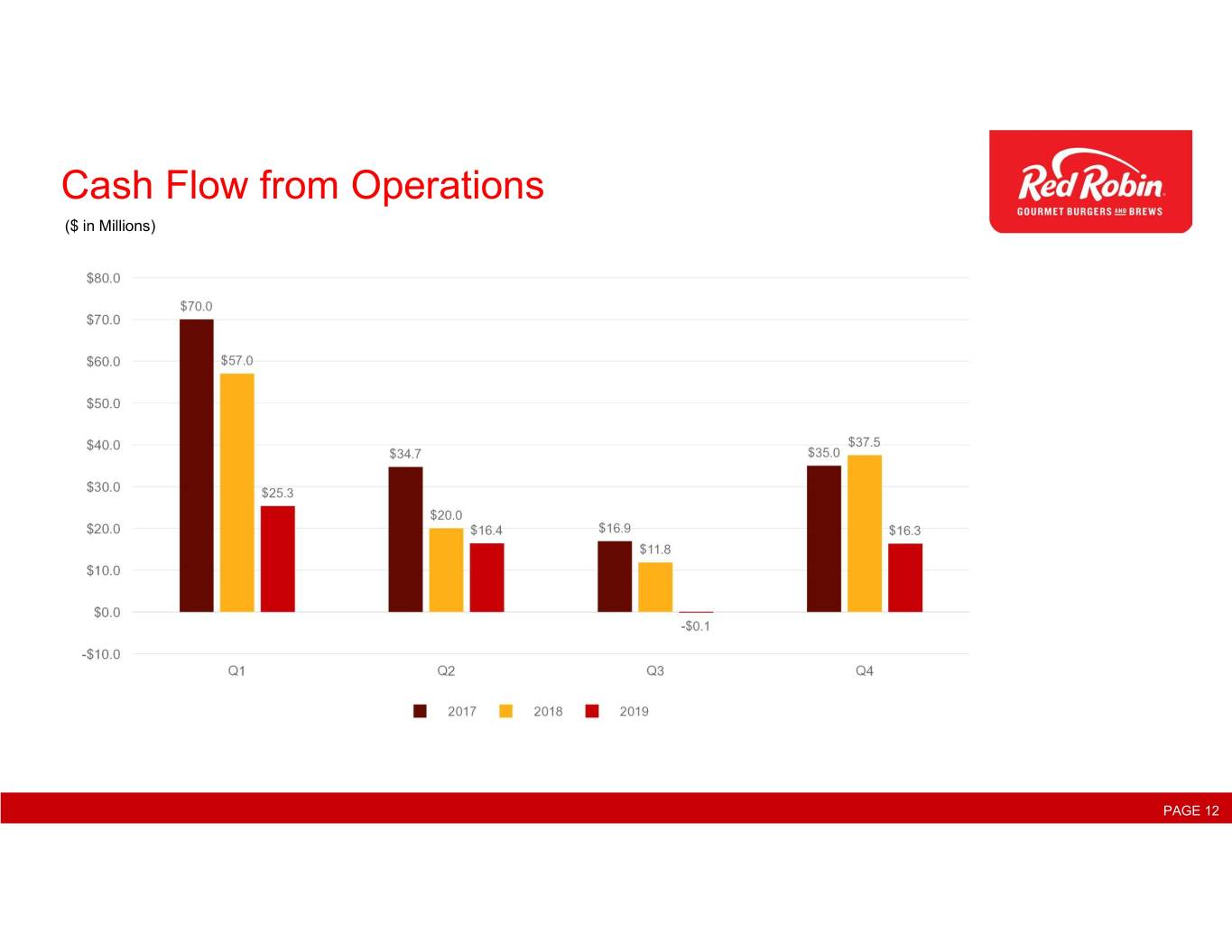

Cash Flow from Operations ($ in Millions) PAGE 12

Appendix PAGE 13

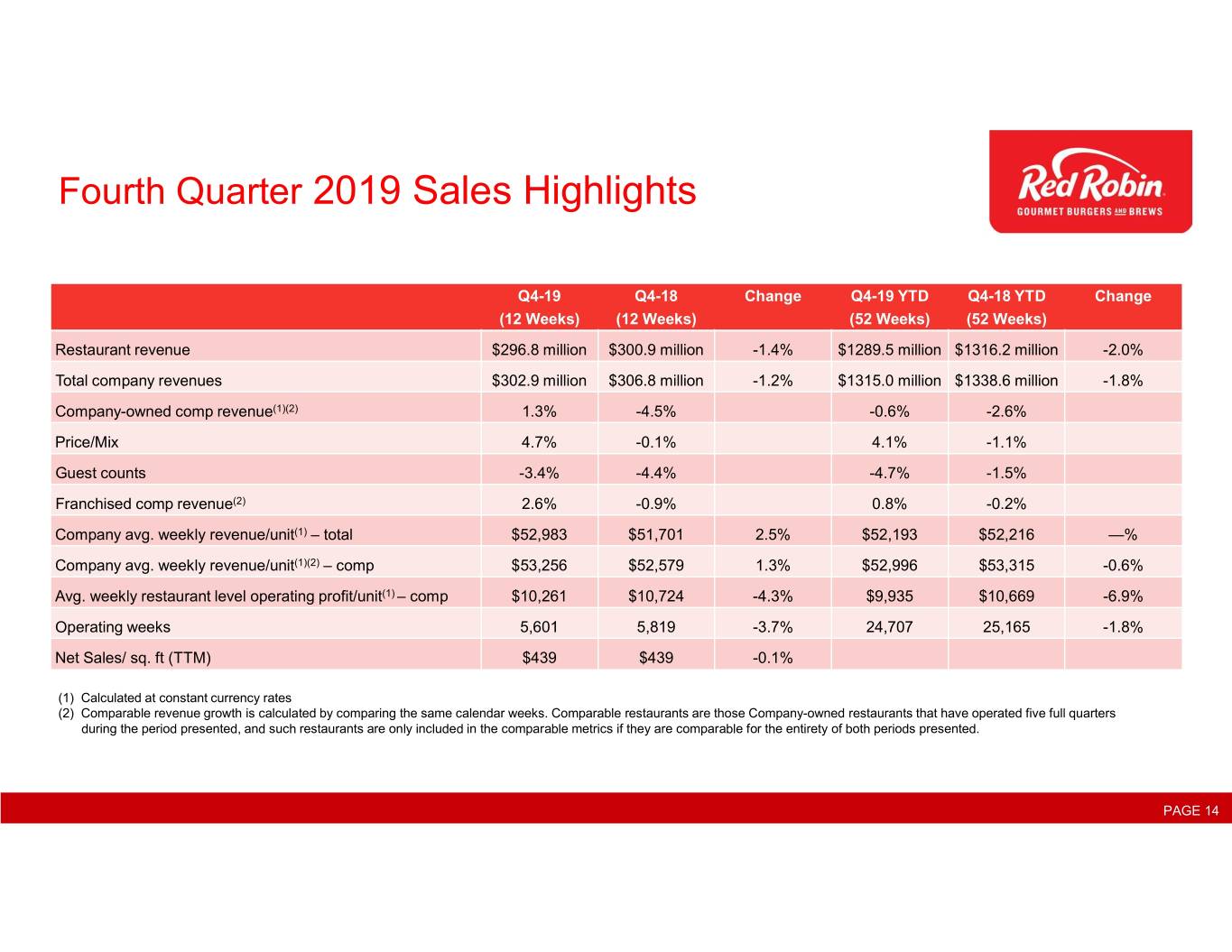

Fourth Quarter 2019 Sales Highlights Q4-19 Q4-18 Change Q4-19 YTD Q4-18 YTD Change (12 Weeks) (12 Weeks) (52 Weeks) (52 Weeks) Restaurant revenue $296.8 million $300.9 million -1.4% $1289.5 million $1316.2 million -2.0% Total company revenues $302.9 million $306.8 million -1.2% $1315.0 million $1338.6 million -1.8% Company-owned comp revenue(1)(2) 1.3% -4.5% -0.6% -2.6% Price/Mix 4.7% -0.1% 4.1% -1.1% Guest counts -3.4% -4.4% -4.7% -1.5% Franchised comp revenue(2) 2.6% -0.9% 0.8% -0.2% Company avg. weekly revenue/unit(1) – total $52,983 $51,701 2.5% $52,193 $52,216 —% Company avg. weekly revenue/unit(1)(2) – comp $53,256 $52,579 1.3% $52,996 $53,315 -0.6% Avg. weekly restaurant level operating profit/unit(1) – comp $10,261 $10,724 -4.3% $9,935 $10,669 -6.9% Operating weeks 5,601 5,819 -3.7% 24,707 25,165 -1.8% Net Sales/ sq. ft (TTM) $439 $439 -0.1% (1) Calculated at constant currency rates (2) Comparable revenue growth is calculated by comparing the same calendar weeks. Comparable restaurants are those Company-owned restaurants that have operated five full quarters during the period presented, and such restaurants are only included in the comparable metrics if they are comparable for the entirety of both periods presented. PAGE 14

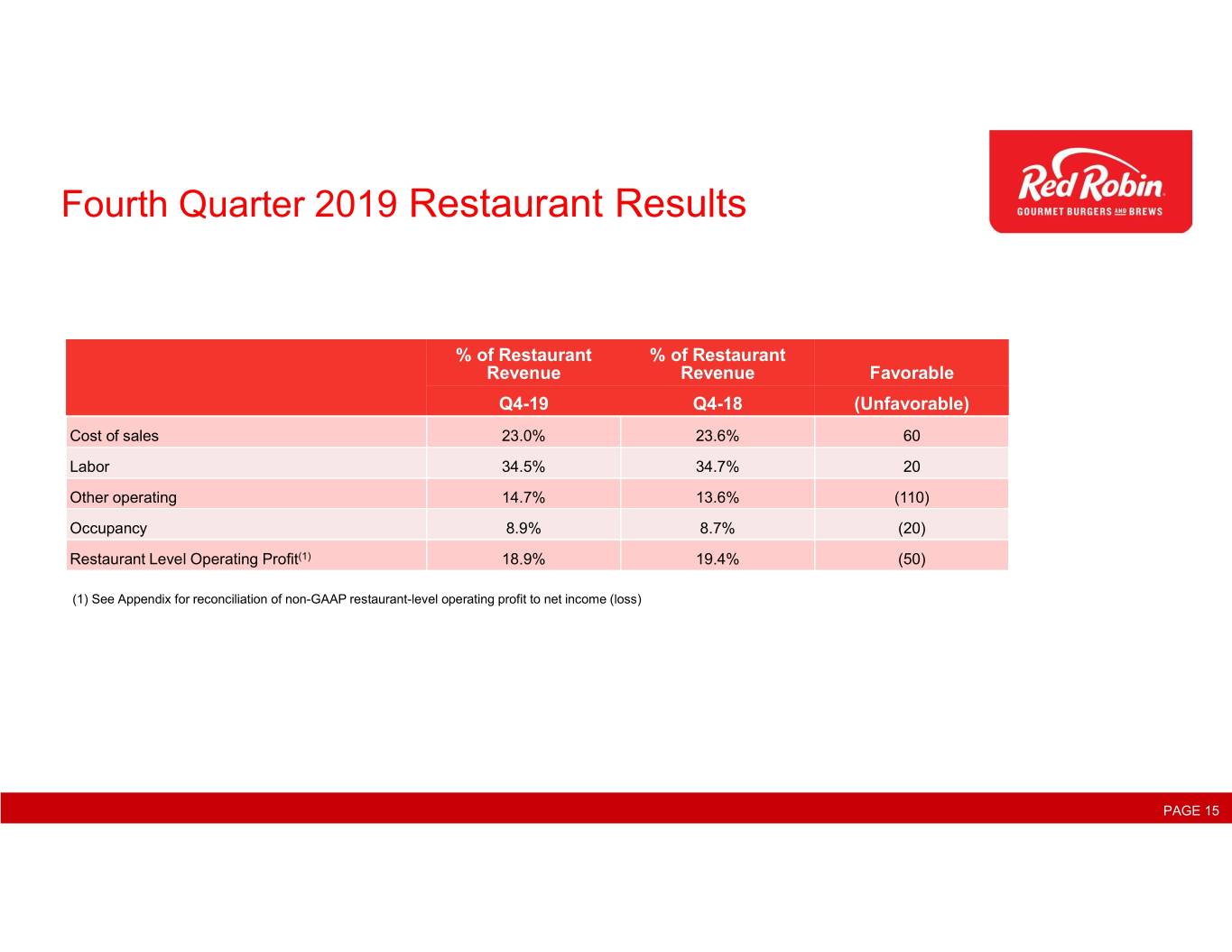

Fourth Quarter 2019 Restaurant Results % of Restaurant % of Restaurant Revenue Revenue Favorable Q4-19 Q4-18 (Unfavorable) Cost of sales 23.0% 23.6% 60 Labor 34.5% 34.7% 20 Other operating 14.7% 13.6% (110) Occupancy 8.9% 8.7% (20) Restaurant Level Operating Profit(1) 18.9% 19.4% (50) (1) See Appendix for reconciliation of non-GAAP restaurant-level operating profit to net income (loss) PAGE 15

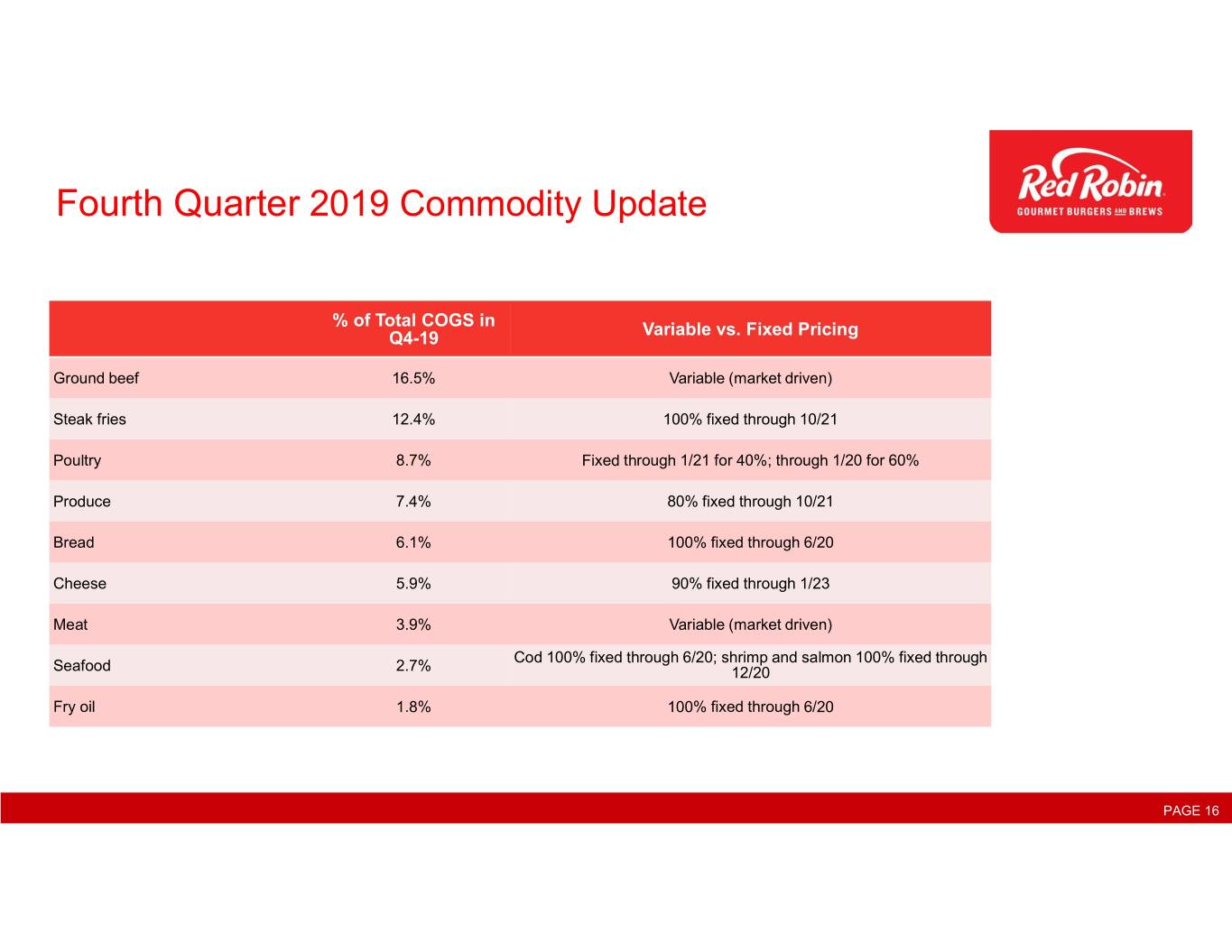

Fourth Quarter 2019 Commodity Update % of Total COGS in Q4-19 Variable vs. Fixed Pricing Ground beef 16.5% Variable (market driven) Steak fries 12.4% 100% fixed through 10/21 Poultry 8.7% Fixed through 1/21 for 40%; through 1/20 for 60% Produce 7.4% 80% fixed through 10/21 Bread 6.1% 100% fixed through 6/20 Cheese 5.9% 90% fixed through 1/23 Meat 3.9% Variable (market driven) Cod 100% fixed through 6/20; shrimp and salmon 100% fixed through Seafood 2.7% 12/20 Fry oil 1.8% 100% fixed through 6/20 PAGE 16

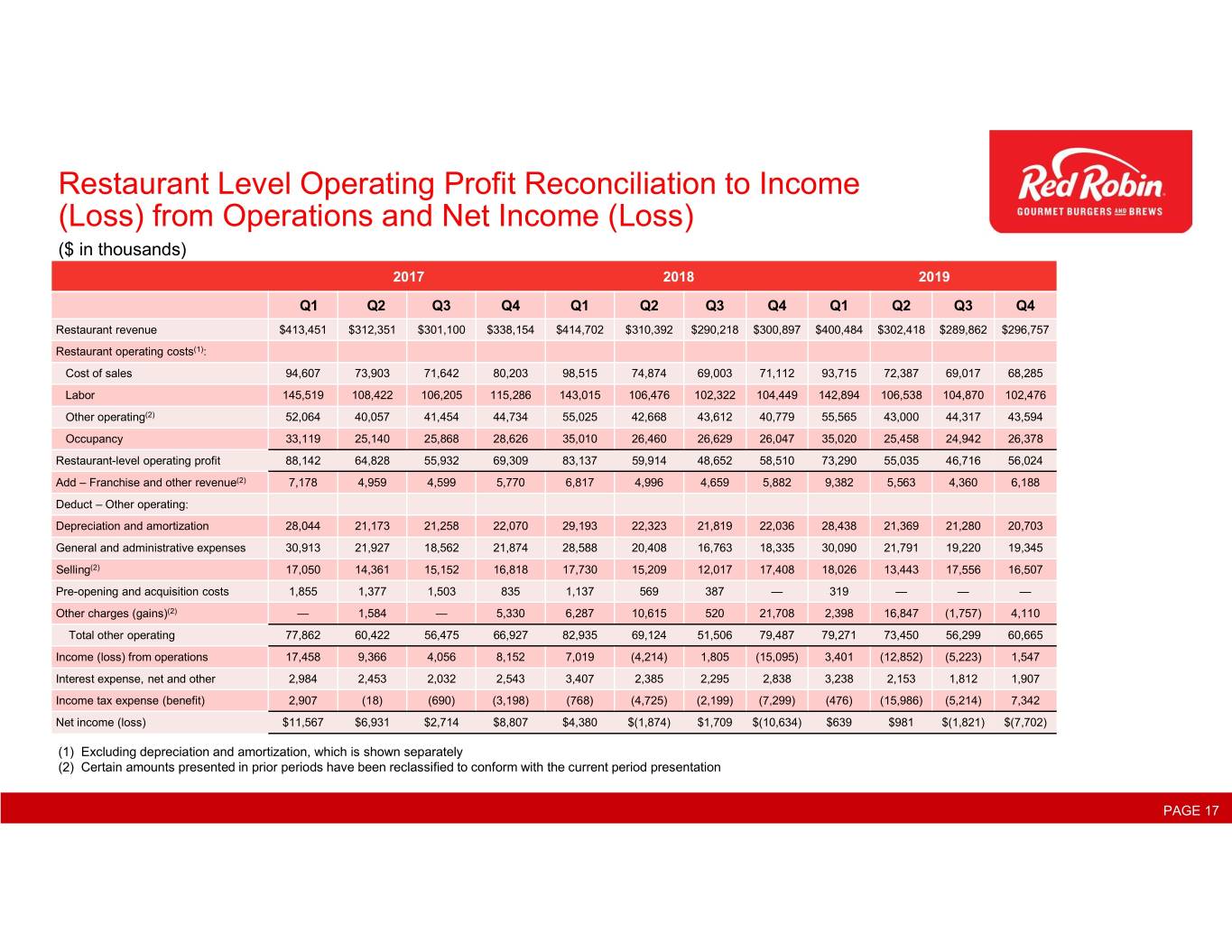

Restaurant Level Operating Profit Reconciliation to Income (Loss) from Operations and Net Income (Loss) ($ in thousands) 2017 2018 2019 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Restaurant revenue $413,451 $312,351 $301,100 $338,154 $414,702 $310,392 $290,218 $300,897 $400,484 $302,418 $289,862 $296,757 Restaurant operating costs(1): Cost of sales 94,607 73,903 71,642 80,203 98,515 74,874 69,003 71,112 93,715 72,387 69,017 68,285 Labor 145,519 108,422 106,205 115,286 143,015 106,476 102,322 104,449 142,894 106,538 104,870 102,476 Other operating(2) 52,064 40,057 41,454 44,734 55,025 42,668 43,612 40,779 55,565 43,000 44,317 43,594 Occupancy 33,119 25,140 25,868 28,626 35,010 26,460 26,629 26,047 35,020 25,458 24,942 26,378 Restaurant-level operating profit 88,142 64,828 55,932 69,309 83,137 59,914 48,652 58,510 73,290 55,035 46,716 56,024 Add – Franchise and other revenue(2) 7,178 4,959 4,599 5,770 6,817 4,996 4,659 5,882 9,382 5,563 4,360 6,188 Deduct – Other operating: Depreciation and amortization 28,044 21,173 21,258 22,070 29,193 22,323 21,819 22,036 28,438 21,369 21,280 20,703 General and administrative expenses 30,913 21,927 18,562 21,874 28,588 20,408 16,763 18,335 30,090 21,791 19,220 19,345 Selling(2) 17,050 14,361 15,152 16,818 17,730 15,209 12,017 17,408 18,026 13,443 17,556 16,507 Pre-opening and acquisition costs 1,855 1,377 1,503 835 1,137 569 387 — 319 — — — Other charges (gains)(2) — 1,584 — 5,330 6,287 10,615 520 21,708 2,398 16,847 (1,757) 4,110 Total other operating 77,862 60,422 56,475 66,927 82,935 69,124 51,506 79,487 79,271 73,450 56,299 60,665 Income (loss) from operations 17,458 9,366 4,056 8,152 7,019 (4,214) 1,805 (15,095) 3,401 (12,852) (5,223) 1,547 Interest expense, net and other 2,984 2,453 2,032 2,543 3,407 2,385 2,295 2,838 3,238 2,153 1,812 1,907 Income tax expense (benefit) 2,907 (18) (690) (3,198) (768) (4,725) (2,199) (7,299) (476) (15,986) (5,214) 7,342 Net income (loss) $11,567 $6,931 $2,714 $8,807 $4,380 $(1,874) $1,709 $(10,634) $639 $981 $(1,821) $(7,702) (1) Excluding depreciation and amortization, which is shown separately (2) Certain amounts presented in prior periods have been reclassified to conform with the current period presentation PAGE 17

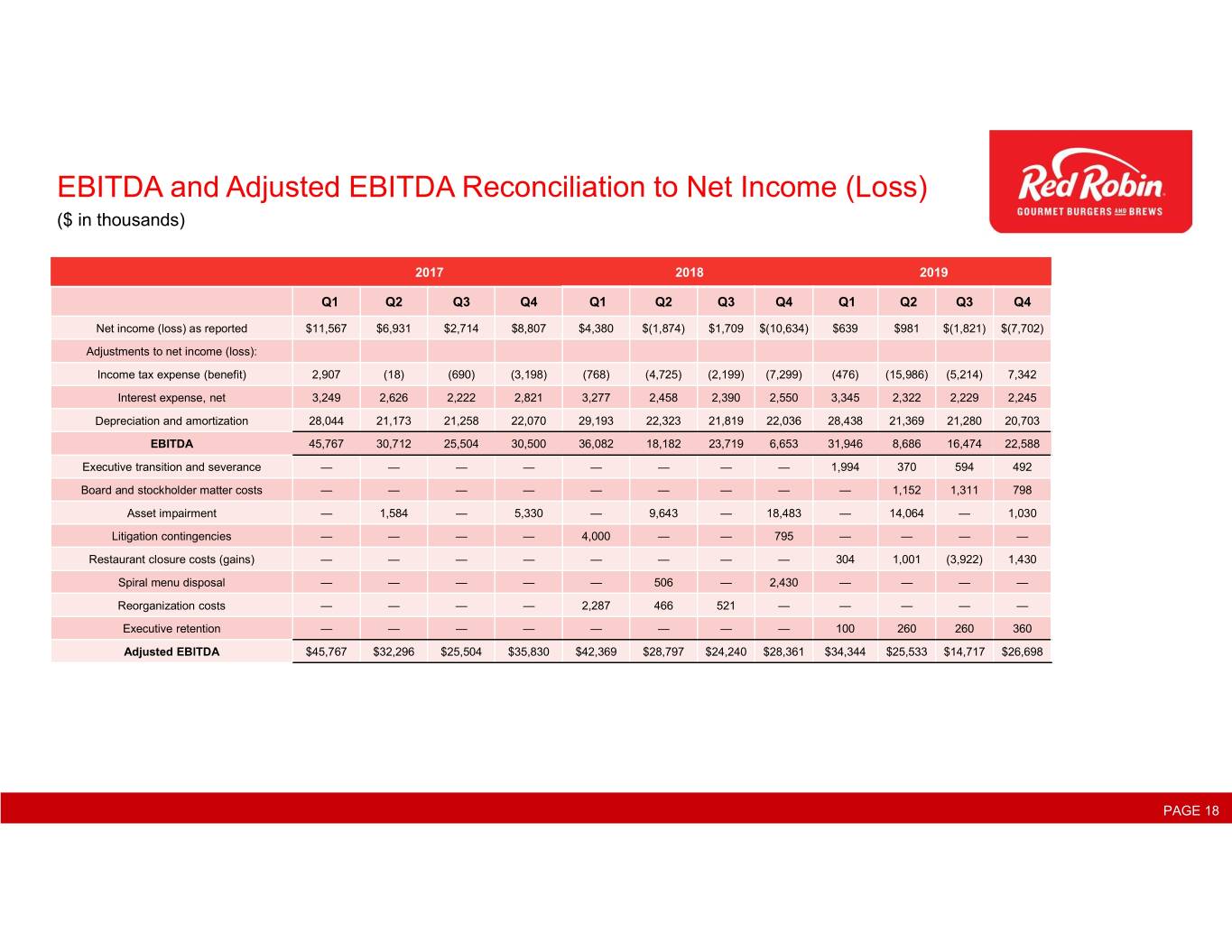

EBITDA and Adjusted EBITDA Reconciliation to Net Income (Loss) ($ in thousands) 2017 2018 2019 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net income (loss) as reported $11,567 $6,931 $2,714 $8,807 $4,380 $(1,874) $1,709 $(10,634) $639 $981 $(1,821) $(7,702) Adjustments to net income (loss): Income tax expense (benefit) 2,907 (18) (690) (3,198) (768) (4,725) (2,199) (7,299) (476) (15,986) (5,214) 7,342 Interest expense, net 3,249 2,626 2,222 2,821 3,277 2,458 2,390 2,550 3,345 2,322 2,229 2,245 Depreciation and amortization 28,044 21,173 21,258 22,070 29,193 22,323 21,819 22,036 28,438 21,369 21,280 20,703 EBITDA 45,767 30,712 25,504 30,500 36,082 18,182 23,719 6,653 31,946 8,686 16,474 22,588 Executive transition and severance — — — — — — — — 1,994 370 594 492 Board and stockholder matter costs — — — — — — — — — 1,152 1,311 798 Asset impairment — 1,584 — 5,330 — 9,643 — 18,483 — 14,064 — 1,030 Litigation contingencies — — — — 4,000 — — 795 — — — — Restaurant closure costs (gains) — — — — — — — — 304 1,001 (3,922) 1,430 Spiral menu disposal — — — — — 506 — 2,430 — — — — Reorganization costs — — — — 2,287 466 521 — — — — — Executive retention — — — — — — — — 100 260 260 360 Adjusted EBITDA $45,767 $32,296 $25,504 $35,830 $42,369 $28,797 $24,240 $28,361 $34,344 $25,533 $14,717 $26,698 PAGE 18

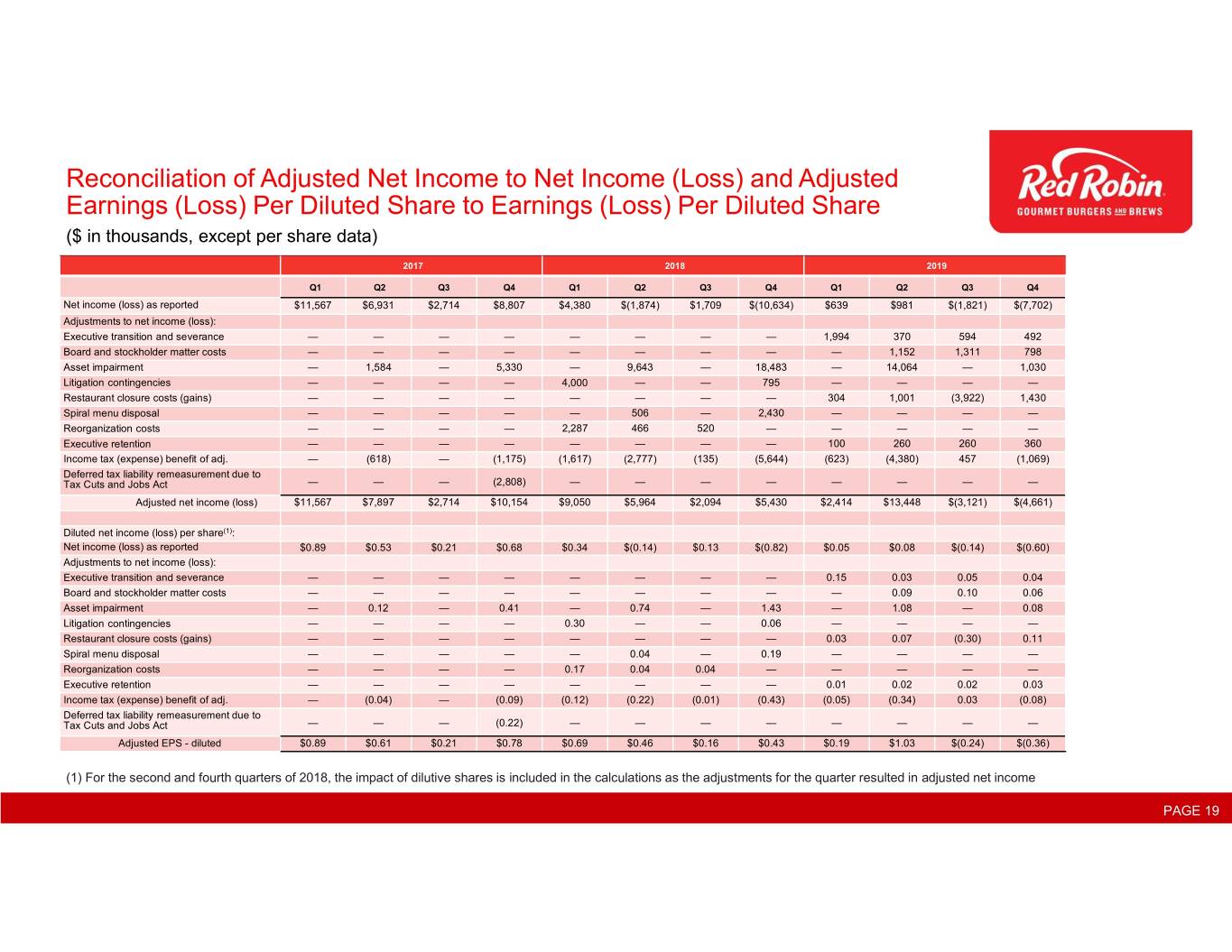

Reconciliation of Adjusted Net Income to Net Income (Loss) and Adjusted Earnings (Loss) Per Diluted Share to Earnings (Loss) Per Diluted Share ($ in thousands, except per share data) 2017 2018 2019 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net income (loss) as reported $11,567 $6,931 $2,714 $8,807 $4,380 $(1,874) $1,709 $(10,634) $639 $981 $(1,821) $(7,702) Adjustments to net income (loss): Executive transition and severance — — — — — — — — 1,994 370 594 492 Board and stockholder matter costs — — — — — — — — — 1,152 1,311 798 Asset impairment — 1,584 — 5,330 — 9,643 — 18,483 — 14,064 — 1,030 Litigation contingencies — — — — 4,000 — — 795 — — — — Restaurant closure costs (gains) — — — — — — — — 304 1,001 (3,922) 1,430 Spiral menu disposal — — — — — 506 — 2,430 — — — — Reorganization costs — — — — 2,287 466 520 — — — — — Executive retention — — — — — — — — 100 260 260 360 Income tax (expense) benefit of adj. — (618) — (1,175) (1,617) (2,777) (135) (5,644) (623) (4,380) 457 (1,069) Deferred tax liability remeasurement due to Tax Cuts and Jobs Act — — — (2,808) — — — — — — — — Adjusted net income (loss) $11,567 $7,897 $2,714 $10,154 $9,050 $5,964 $2,094 $5,430 $2,414 $13,448 $(3,121) $(4,661) Diluted net income (loss) per share(1): Net income (loss) as reported $0.89 $0.53 $0.21 $0.68 $0.34 $(0.14) $0.13 $(0.82) $0.05 $0.08 $(0.14) $(0.60) Adjustments to net income (loss): Executive transition and severance — — — — — — — — 0.15 0.03 0.05 0.04 Board and stockholder matter costs — — — — — — — — — 0.09 0.10 0.06 Asset impairment — 0.12 — 0.41 — 0.74 — 1.43 — 1.08 — 0.08 Litigation contingencies — — — — 0.30 — — 0.06 — — — — Restaurant closure costs (gains) — — — — — — — — 0.03 0.07 (0.30) 0.11 Spiral menu disposal — — — — — 0.04 — 0.19 — — — — Reorganization costs — — — — 0.17 0.04 0.04 — — — — — Executive retention — — — — — — — — 0.01 0.02 0.02 0.03 Income tax (expense) benefit of adj. — (0.04) — (0.09) (0.12) (0.22) (0.01) (0.43) (0.05) (0.34) 0.03 (0.08) Deferred tax liability remeasurement due to Tax Cuts and Jobs Act — — — (0.22) — — — — — — — — Adjusted EPS -diluted $0.89 $0.61 $0.21 $0.78 $0.69 $0.46 $0.16 $0.43 $0.19 $1.03 $(0.24) $(0.36) (1) For the second and fourth quarters of 2018, the impact of dilutive shares is included in the calculations as the adjustments for the quarter resulted in adjusted net income PAGE 19