CLASSIFIED – INTERNAL USE ONLY March 3, 2021 Fourth Quarter 2020 Results

Forward-Looking Statements Forward-looking statements in this press release regarding the Company's future performance, demand and business recovery, growth drivers, long-term value creation, revenue and comparable revenue growth, sales and profitability including sales trajectory, off-premise sales, incrementality, enterprise margin improvement, preliminary results including net comparable restaurant revenue and average weekly net sales per restaurant, NOL cash tax refunds, capital expenditures including restaurant maintenance and infrastructure and rollout of Donatos® to additional locations and timing thereof, digital guest and operational technology solutions, and off-premise execution enhancements, and all other statements that are not historical facts, are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on assumptions believed by the Company to be reasonable and speak only as of the date on which such statements are made. Without limiting the generality of the foregoing, words such as "expect," "believe," "anticipate," "intend," "plan," "project," "could," "should," "will," or "estimate," or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. Except as required by law, the Company undertakes no obligation to update such statements to reflect events or circumstances arising after such date and cautions investors not to place undue reliance on any such forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those described in the statements based on a number of factors, including but not limited to the following: the impact of COVID-19 on our results of operations, supply chain, and liquidity; the effectiveness of the Company's strategic initiatives, including alternative labor models, service, and operational improvement initiatives; our ability to train and retain our workforce for service execution; the effectiveness of the Company's marketing strategies and promotions; menu changes and pricing strategy; the anticipated sales growth, costs, and timing of the Donatos® expansion; the implementation, rollout, and timing of new technology solutions; our ability to achieve revenue and cost savings from off-premise sales and other initiatives; competition in the casual dining market and discounting by competitors; changes in consumer spending trends and habits; changes in the cost and availability of key food products, distribution, labor, and energy; general economic conditions, including changes in consumer disposable income, weather conditions, and related events in regions where our restaurants are operated; the adequacy of cash flows and the cost and availability of capital or credit facility borrowings; the impact of federal, state, and local regulation of the Company's business; changes in federal, state, or local laws and regulations affecting the operation of our restaurants, including minimum wages, consumer health and safety, health insurance coverage, nutritional disclosures, and employment eligibility-related documentation requirements; costs and other effects of legal claims by Team Members, franchisees, customers, vendors, stockholders, and others, including negative publicity regarding food safety or cyber security; and other risk factors described from time to time in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments to those reports) filed with the U.S. Securities and Exchange Commission. This presentation also contains non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of the Company’s financial performance, identifying trends in results, and providing meaningful period-to-period comparisons. For a reconciliation of non-GAAP measures presented in this document, see the Appendix of this presentation or the Schedules to the Q3 press release posted on redrobin.com. PAGE 2

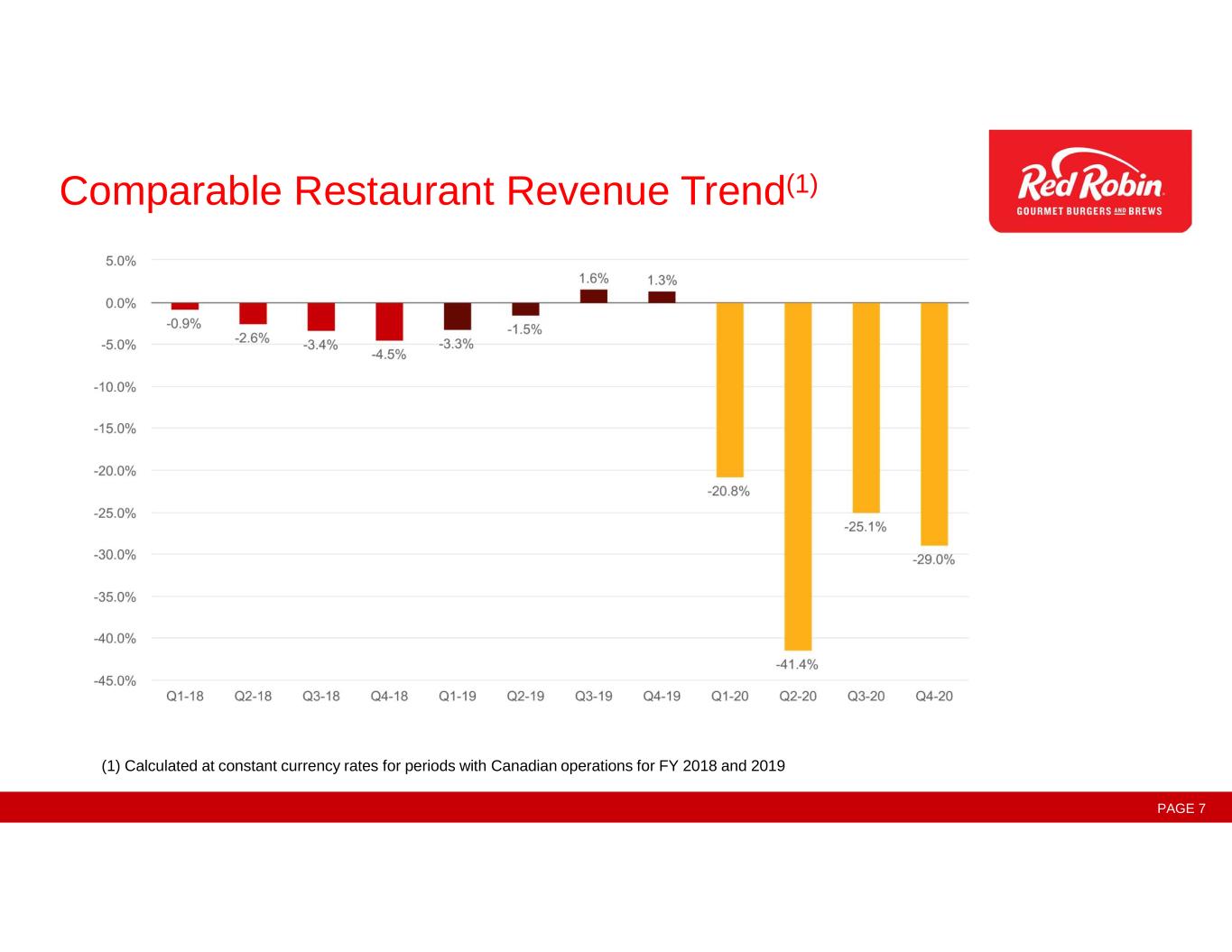

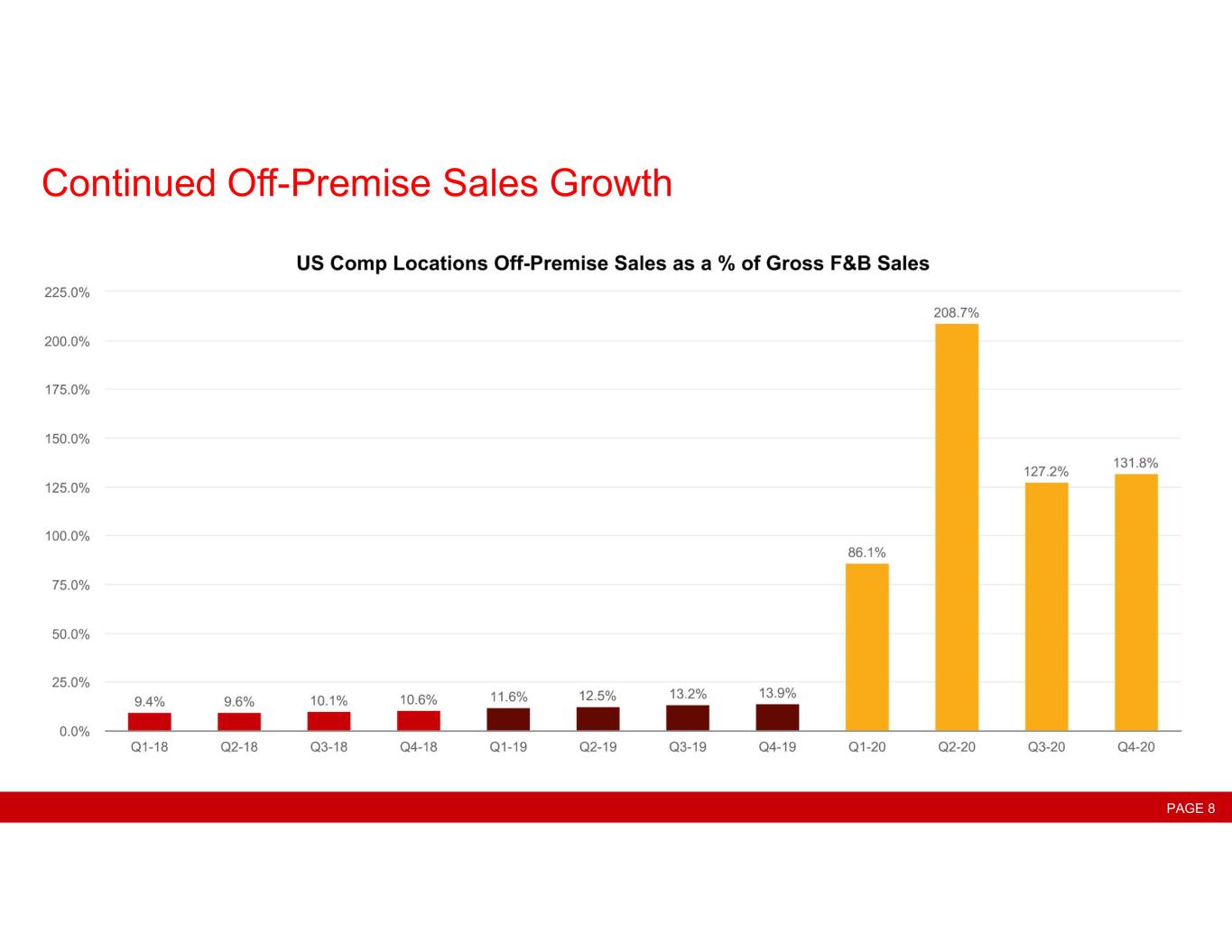

• Red Robin entered fiscal 2020 with strong business momentum and substantially improved guest satisfaction scores ◦ Through the first eight weeks of the year, comparable restaurant revenue grew 3.7%, driven in part by positive Guest counts ◦ In the fourth fiscal quarter, increased jurisdictional indoor dining restrictions in California, Colorado, Oregon, and Washington had a significant, negative impact to our topline momentum • Comparable restaurant revenue decreased 29.0% for Q4 • 372 indoor dining rooms reopened as of February 28, 2021 • Off-premise sales increased 131.8% for Q4 comprising 43.9% of total food and beverage sales, including catering; in Q4 2019, off-premise sales were approximately 14% of total food and beverage sales. • GAAP loss per diluted share was $2.53 compared to a loss of $0.60 in Q4 2019. Adjusted diluted loss per share(1) was $1.79 compared to adjusted loss per diluted share of $0.36 in Q4 2019 • Net loss was $39.3 million compared to net loss of $7.7 million in Q4 2019 • Adjusted EBITDA(1) was a loss of $6.4 million compared to earnings of $26.7 million in Q4 2019 • Restaurant-level operating profit(1) was 6.2% compared to 18.9% in the prior year Red Robin Fourth Quarter Financial and Operating Results 1 See reconciliations of non-GAAP financial measures to the most comparable GAAP financial measures in Appendix. PAGE 3

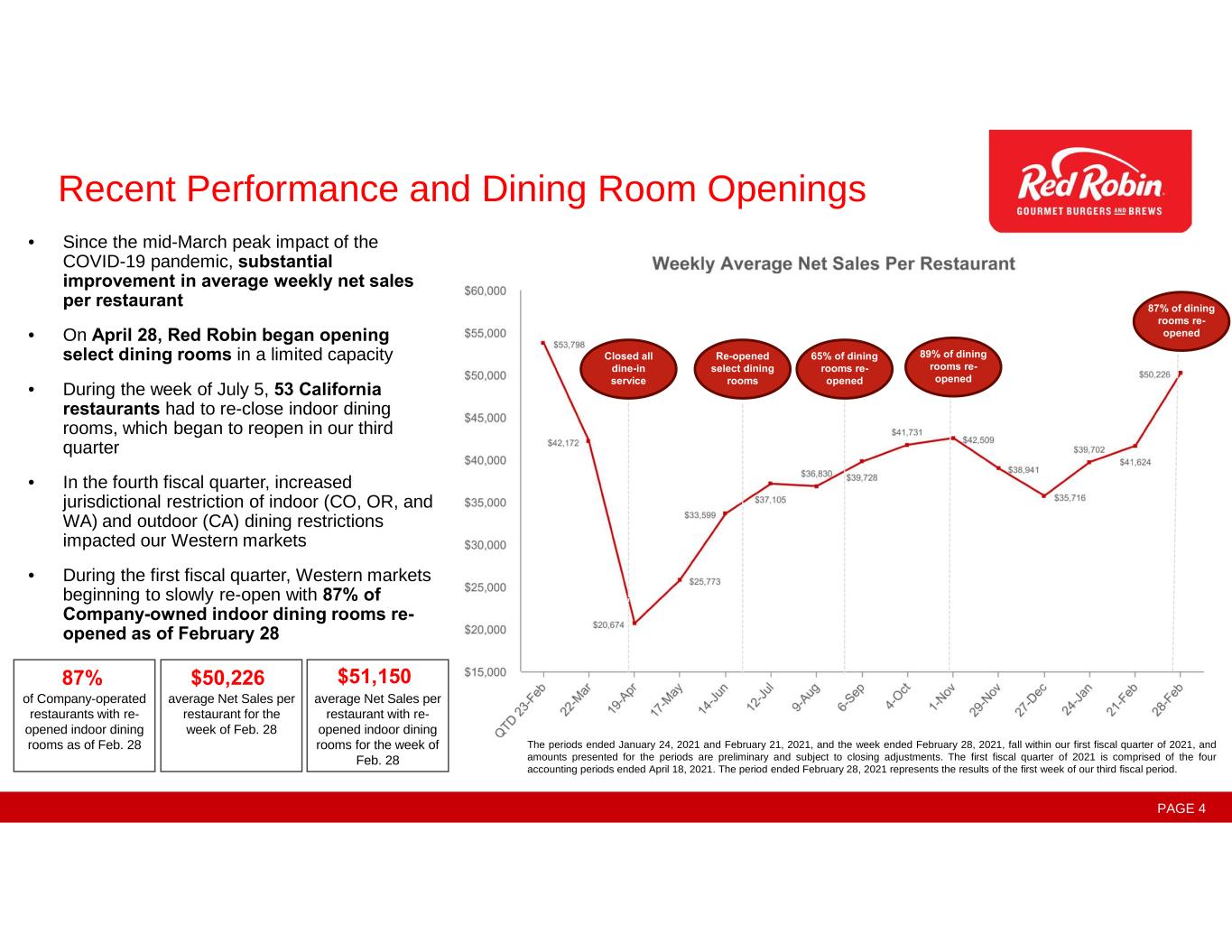

Recent Performance and Dining Room Openings PAGE 4 • Since the mid-March peak impact of the COVID-19 pandemic, substantial improvement in average weekly net sales per restaurant • On April 28, Red Robin began opening select dining rooms in a limited capacity • During the week of July 5, 53 California restaurants had to re-close indoor dining rooms, which began to reopen in our third quarter • In the fourth fiscal quarter, increased jurisdictional restriction of indoor (CO, OR, and WA) and outdoor (CA) dining restrictions impacted our Western markets • During the first fiscal quarter, Western markets beginning to slowly re-open with 87% of Company-owned indoor dining rooms re- opened as of February 28 Re-opened select dining rooms 65% of dining rooms re- opened 89% of dining rooms re- opened Closed all dine-in service 87% of Company-operated restaurants with re- opened indoor dining rooms as of Feb. 28 $50,226 average Net Sales per restaurant for the week of Feb. 28 $51,150 average Net Sales per restaurant with re- opened indoor dining rooms for the week of Feb. 28 The periods ended January 24, 2021 and February 21, 2021, and the week ended February 28, 2021, fall within our first fiscal quarter of 2021, and amounts presented for the periods are preliminary and subject to closing adjustments. The first fiscal quarter of 2021 is comprised of the four accounting periods ended April 18, 2021. The period ended February 28, 2021 represents the results of the first week of our third fiscal period. 87% of dining rooms re- opened

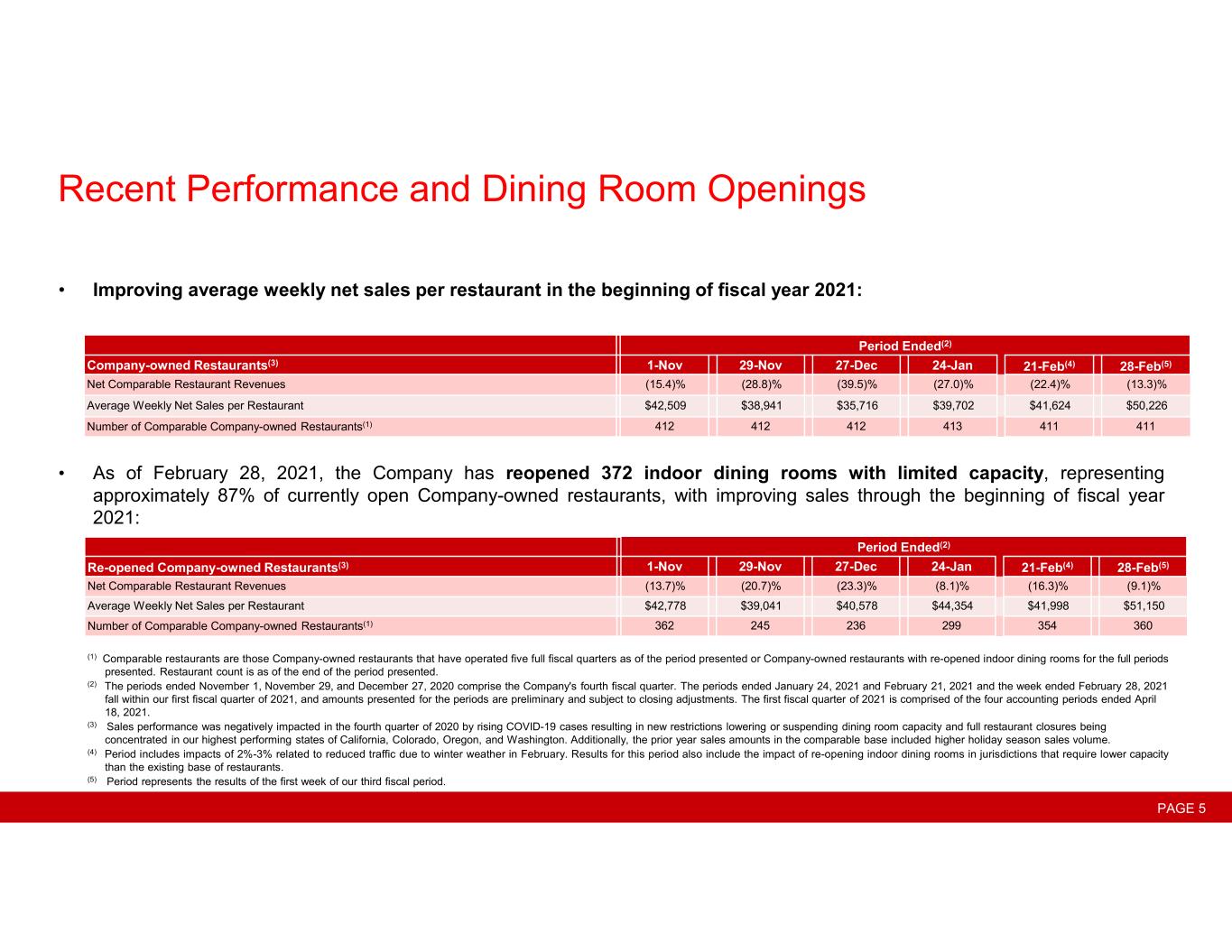

Recent Performance and Dining Room Openings PAGE 5 Period Ended(2) Company-owned Restaurants(3) 1-Nov 29-Nov 27-Dec 24-Jan 21-Feb(4) 28-Feb(5) Net Comparable Restaurant Revenues (15.4)% (28.8)% (39.5)% (27.0)% (22.4)% (13.3)% Average Weekly Net Sales per Restaurant $42,509 $38,941 $35,716 $39,702 $41,624 $50,226 Number of Comparable Company-owned Restaurants(1) 412 412 412 413 411 411 Period Ended(2) Re-opened Company-owned Restaurants(3) 1-Nov 29-Nov 27-Dec 24-Jan 21-Feb(4) 28-Feb(5) Net Comparable Restaurant Revenues (13.7)% (20.7)% (23.3)% (8.1)% (16.3)% (9.1)% Average Weekly Net Sales per Restaurant $42,778 $39,041 $40,578 $44,354 $41,998 $51,150 Number of Comparable Company-owned Restaurants(1) 362 245 236 299 354 360 (1) Comparable restaurants are those Company-owned restaurants that have operated five full fiscal quarters as of the period presented or Company-owned restaurants with re-opened indoor dining rooms for the full periods presented. Restaurant count is as of the end of the period presented. (2) The periods ended November 1, November 29, and December 27, 2020 comprise the Company's fourth fiscal quarter. The periods ended January 24, 2021 and February 21, 2021 and the week ended February 28, 2021 fall within our first fiscal quarter of 2021, and amounts presented for the periods are preliminary and subject to closing adjustments. The first fiscal quarter of 2021 is comprised of the four accounting periods ended April 18, 2021. (3) Sales performance was negatively impacted in the fourth quarter of 2020 by rising COVID-19 cases resulting in new restrictions lowering or suspending dining room capacity and full restaurant closures being concentrated in our highest performing states of California, Colorado, Oregon, and Washington. Additionally, the prior year sales amounts in the comparable base included higher holiday season sales volume. (4) Period includes impacts of 2%-3% related to reduced traffic due to winter weather in February. Results for this period also include the impact of re-opening indoor dining rooms in jurisdictions that require lower capacity than the existing base of restaurants. (5) Period represents the results of the first week of our third fiscal period. • As of February 28, 2021, the Company has reopened 372 indoor dining rooms with limited capacity, representing approximately 87% of currently open Company-owned restaurants, with improving sales through the beginning of fiscal year 2021: • Improving average weekly net sales per restaurant in the beginning of fiscal year 2021:

Red Robin is Well-positioned to Emerge Strong Coming Out of the Crisis PAGE 6

Comparable Restaurant Revenue Trend(1) (1) Calculated at constant currency rates for periods with Canadian operations for FY 2018 and 2019 PAGE 7

Continued Off-Premise Sales Growth PAGE 8

Appendix PAGE 9

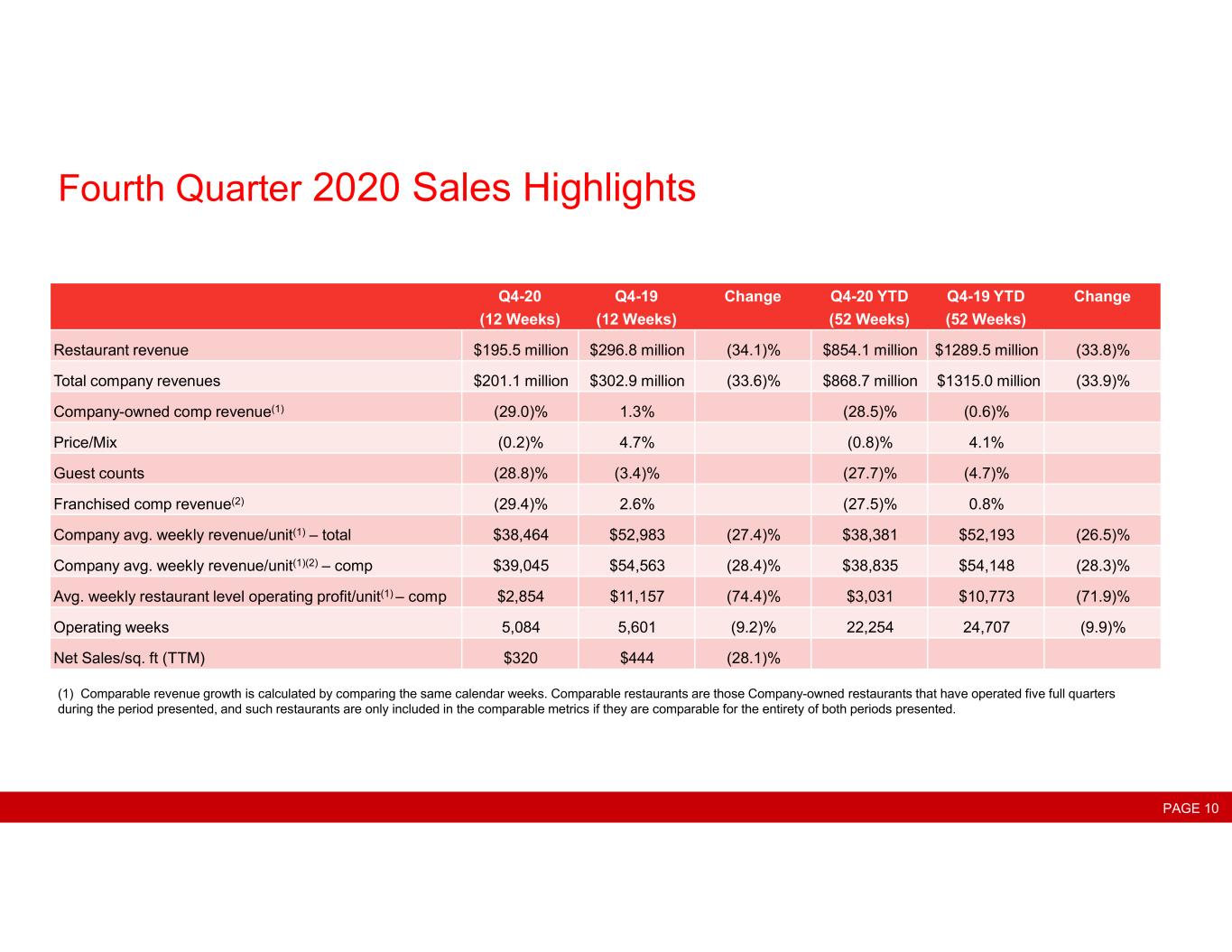

Fourth Quarter 2020 Sales Highlights (1) Comparable revenue growth is calculated by comparing the same calendar weeks. Comparable restaurants are those Company-owned restaurants that have operated five full quarters during the period presented, and such restaurants are only included in the comparable metrics if they are comparable for the entirety of both periods presented. Q4-20 Q4-19 Change Q4-20 YTD Q4-19 YTD Change (12 Weeks) (12 Weeks) (52 Weeks) (52 Weeks) Restaurant revenue $195.5 million $296.8 million (34.1)% $854.1 million $1289.5 million (33.8)% Total company revenues $201.1 million $302.9 million (33.6)% $868.7 million $1315.0 million (33.9)% Company-owned comp revenue(1) (29.0)% 1.3% (28.5)% (0.6)% Price/Mix (0.2)% 4.7% (0.8)% 4.1% Guest counts (28.8)% (3.4)% (27.7)% (4.7)% Franchised comp revenue(2) (29.4)% 2.6% (27.5)% 0.8% Company avg. weekly revenue/unit(1) – total $38,464 $52,983 (27.4)% $38,381 $52,193 (26.5)% Company avg. weekly revenue/unit(1)(2) – comp $39,045 $54,563 (28.4)% $38,835 $54,148 (28.3)% Avg. weekly restaurant level operating profit/unit(1) – comp $2,854 $11,157 (74.4)% $3,031 $10,773 (71.9)% Operating weeks 5,084 5,601 (9.2)% 22,254 24,707 (9.9)% Net Sales/sq. ft (TTM) $320 $444 (28.1)% PAGE 10

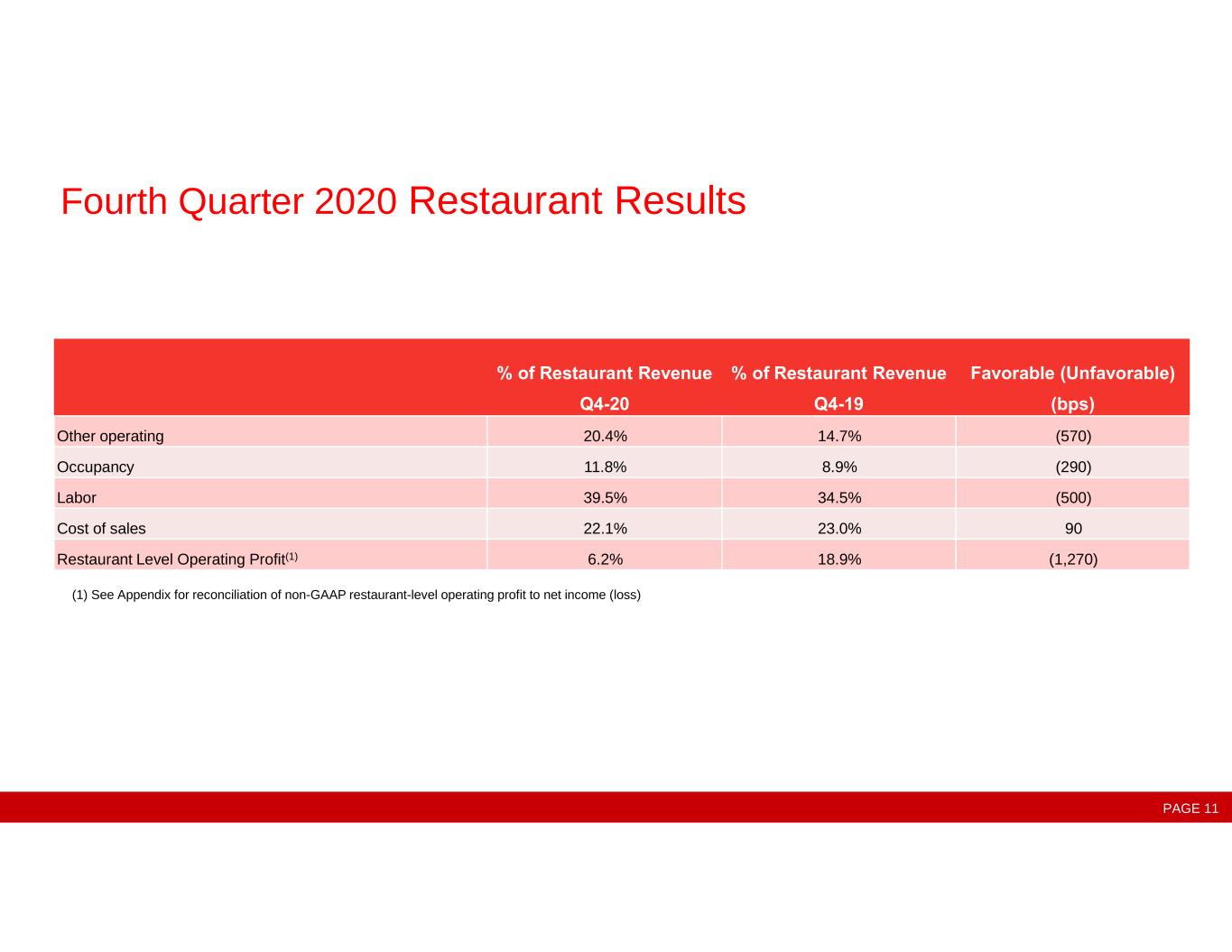

Fourth Quarter 2020 Restaurant Results (1) See Appendix for reconciliation of non-GAAP restaurant-level operating profit to net income (loss) % of Restaurant Revenue % of Restaurant Revenue Favorable (Unfavorable) Q4-20 Q4-19 (bps) Other operating 20.4% 14.7% (570) Occupancy 11.8% 8.9% (290) Labor 39.5% 34.5% (500) Cost of sales 22.1% 23.0% 90 Restaurant Level Operating Profit(1) 6.2% 18.9% (1,270) PAGE 11

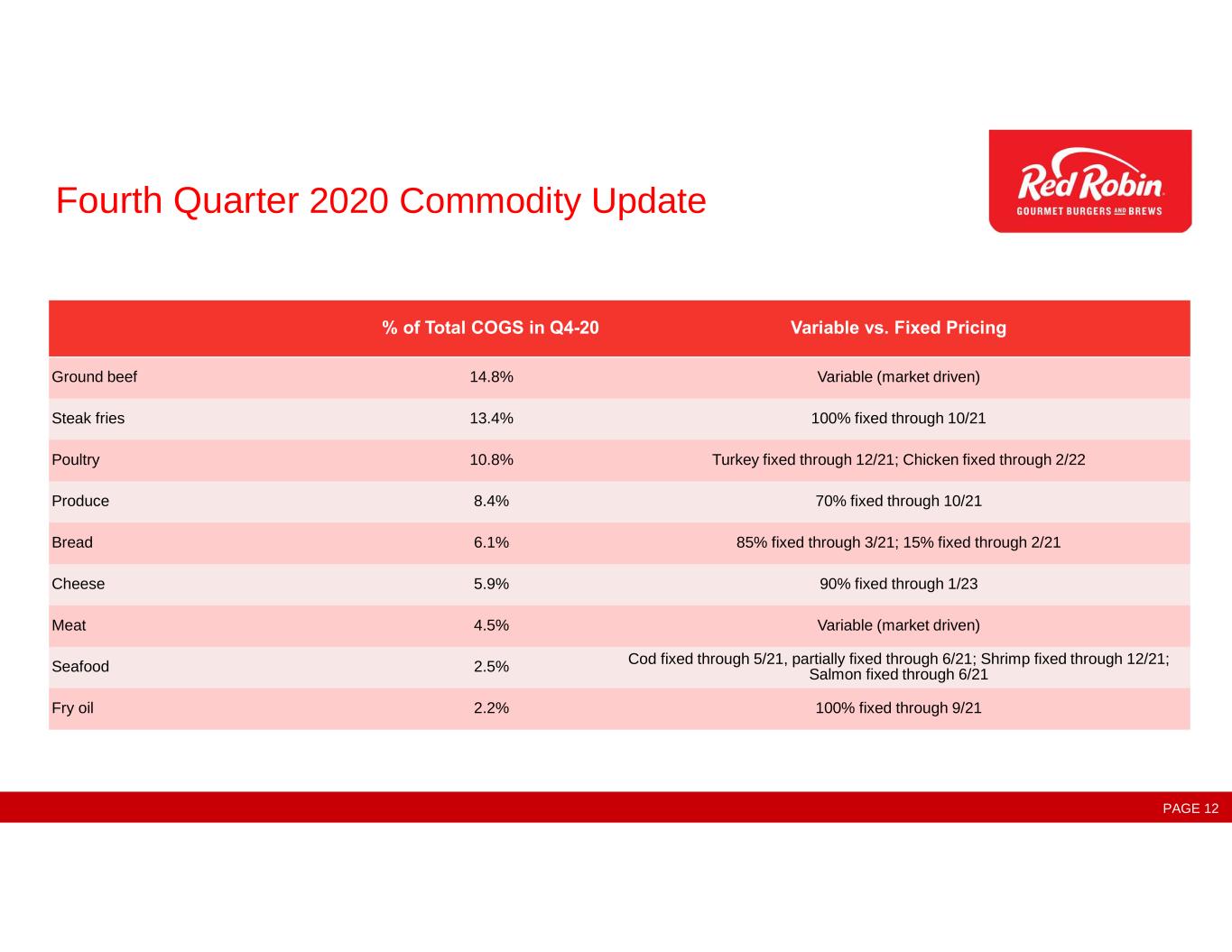

Fourth Quarter 2020 Commodity Update % of Total COGS in Q4-20 Variable vs. Fixed Pricing Ground beef 14.8% Variable (market driven) Steak fries 13.4% 100% fixed through 10/21 Poultry 10.8% Turkey fixed through 12/21; Chicken fixed through 2/22 Produce 8.4% 70% fixed through 10/21 Bread 6.1% 85% fixed through 3/21; 15% fixed through 2/21 Cheese 5.9% 90% fixed through 1/23 Meat 4.5% Variable (market driven) Seafood 2.5% Cod fixed through 5/21, partially fixed through 6/21; Shrimp fixed through 12/21; Salmon fixed through 6/21 Fry oil 2.2% 100% fixed through 9/21 PAGE 12

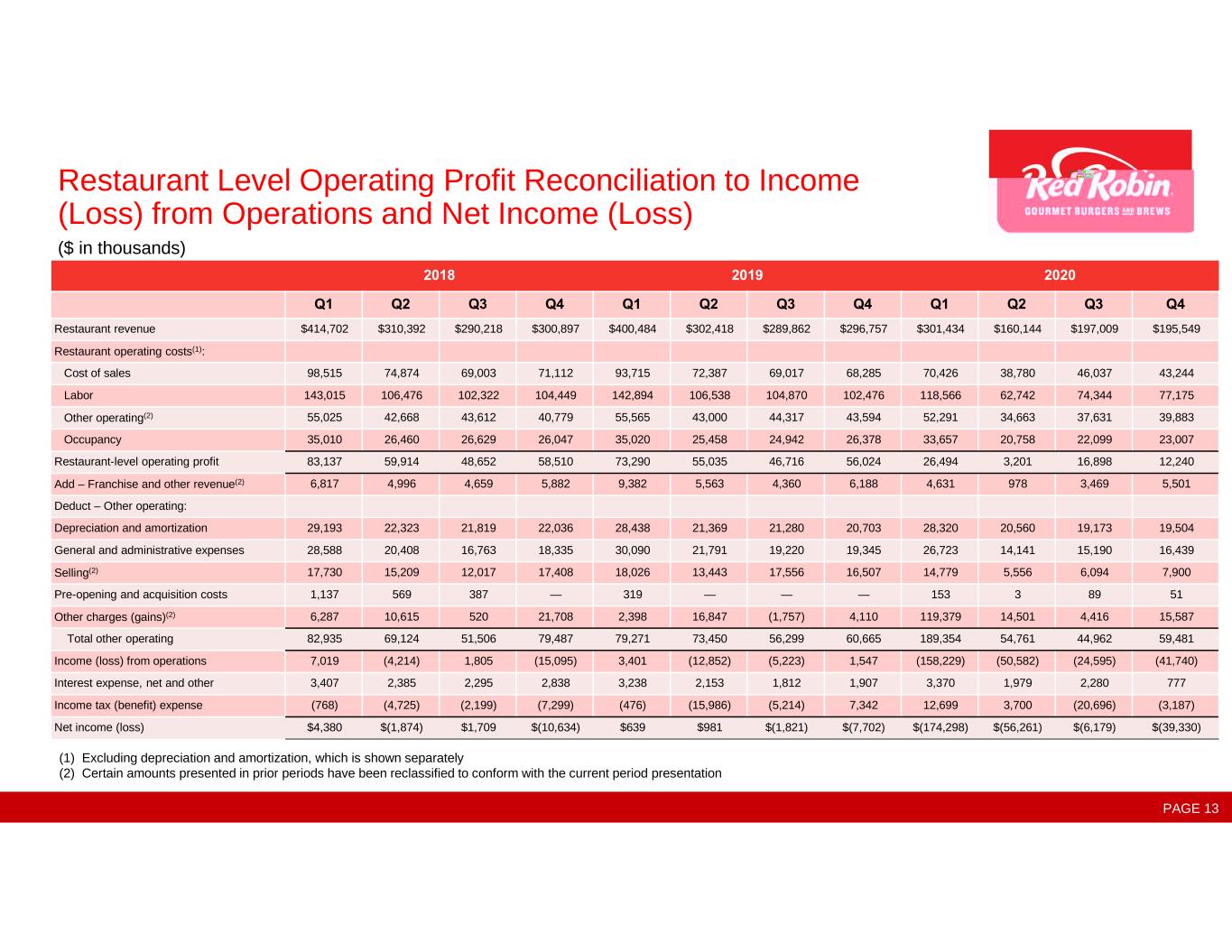

Restaurant Level Operating Profit Reconciliation to Income (Loss) from Operations and Net Income (Loss) ($ in thousands) (1) Excluding depreciation and amortization, which is shown separately (2) Certain amounts presented in prior periods have been reclassified to conform with the current period presentation 2018 2019 2020 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Restaurant revenue $414,702 $310,392 $290,218 $300,897 $400,484 $302,418 $289,862 $296,757 $301,434 $160,144 $197,009 $195,549 Restaurant operating costs(1): Cost of sales 98,515 74,874 69,003 71,112 93,715 72,387 69,017 68,285 70,426 38,780 46,037 43,244 Labor 143,015 106,476 102,322 104,449 142,894 106,538 104,870 102,476 118,566 62,742 74,344 77,175 Other operating(2) 55,025 42,668 43,612 40,779 55,565 43,000 44,317 43,594 52,291 34,663 37,631 39,883 Occupancy 35,010 26,460 26,629 26,047 35,020 25,458 24,942 26,378 33,657 20,758 22,099 23,007 Restaurant-level operating profit 83,137 59,914 48,652 58,510 73,290 55,035 46,716 56,024 26,494 3,201 16,898 12,240 Add – Franchise and other revenue(2) 6,817 4,996 4,659 5,882 9,382 5,563 4,360 6,188 4,631 978 3,469 5,501 Deduct – Other operating: Depreciation and amortization 29,193 22,323 21,819 22,036 28,438 21,369 21,280 20,703 28,320 20,560 19,173 19,504 General and administrative expenses 28,588 20,408 16,763 18,335 30,090 21,791 19,220 19,345 26,723 14,141 15,190 16,439 Selling(2) 17,730 15,209 12,017 17,408 18,026 13,443 17,556 16,507 14,779 5,556 6,094 7,900 Pre-opening and acquisition costs 1,137 569 387 — 319 — — — 153 3 89 51 Other charges (gains)(2) 6,287 10,615 520 21,708 2,398 16,847 (1,757) 4,110 119,379 14,501 4,416 15,587 Total other operating 82,935 69,124 51,506 79,487 79,271 73,450 56,299 60,665 189,354 54,761 44,962 59,481 Income (loss) from operations 7,019 (4,214) 1,805 (15,095) 3,401 (12,852) (5,223) 1,547 (158,229) (50,582) (24,595) (41,740) Interest expense, net and other 3,407 2,385 2,295 2,838 3,238 2,153 1,812 1,907 3,370 1,979 2,280 777 Income tax (benefit) expense (768) (4,725) (2,199) (7,299) (476) (15,986) (5,214) 7,342 12,699 3,700 (20,696) (3,187) Net income (loss) $4,380 $(1,874) $1,709 $(10,634) $639 $981 $(1,821) $(7,702) $(174,298) $(56,261) $(6,179) $(39,330) PAGE 13

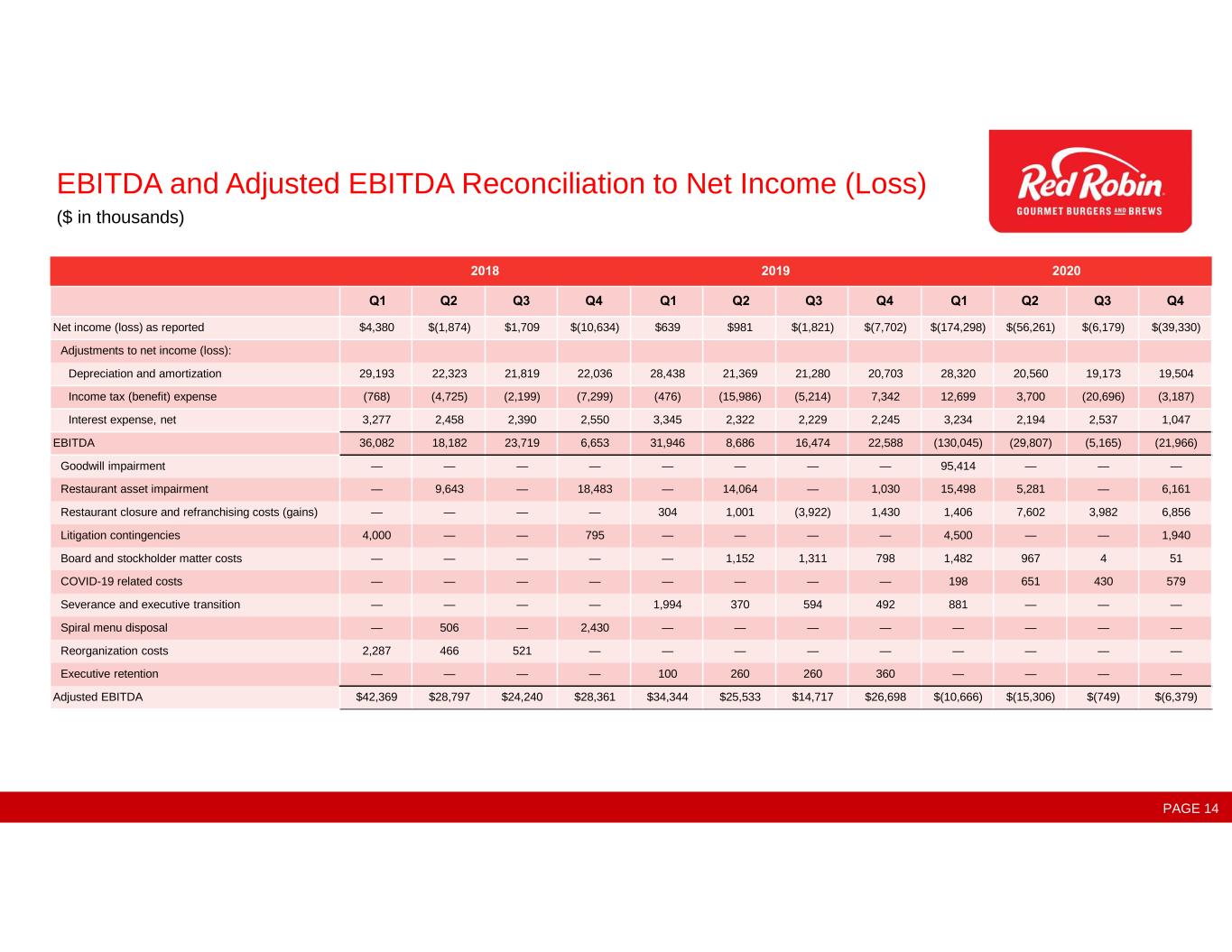

EBITDA and Adjusted EBITDA Reconciliation to Net Income (Loss) ($ in thousands) 2018 2019 2020 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net income (loss) as reported $4,380 $(1,874) $1,709 $(10,634) $639 $981 $(1,821) $(7,702) $(174,298) $(56,261) $(6,179) $(39,330) Adjustments to net income (loss): Depreciation and amortization 29,193 22,323 21,819 22,036 28,438 21,369 21,280 20,703 28,320 20,560 19,173 19,504 Income tax (benefit) expense (768) (4,725) (2,199) (7,299) (476) (15,986) (5,214) 7,342 12,699 3,700 (20,696) (3,187) Interest expense, net 3,277 2,458 2,390 2,550 3,345 2,322 2,229 2,245 3,234 2,194 2,537 1,047 EBITDA 36,082 18,182 23,719 6,653 31,946 8,686 16,474 22,588 (130,045) (29,807) (5,165) (21,966) Goodwill impairment — — — — — — — — 95,414 — — — Restaurant asset impairment — 9,643 — 18,483 — 14,064 — 1,030 15,498 5,281 — 6,161 Restaurant closure and refranchising costs (gains) — — — — 304 1,001 (3,922) 1,430 1,406 7,602 3,982 6,856 Litigation contingencies 4,000 — — 795 — — — — 4,500 — — 1,940 Board and stockholder matter costs — — — — — 1,152 1,311 798 1,482 967 4 51 COVID-19 related costs — — — — — — — — 198 651 430 579 Severance and executive transition — — — — 1,994 370 594 492 881 — — — Spiral menu disposal — 506 — 2,430 — — — — — — — — Reorganization costs 2,287 466 521 — — — — — — — — — Executive retention — — — — 100 260 260 360 — — — — Adjusted EBITDA $42,369 $28,797 $24,240 $28,361 $34,344 $25,533 $14,717 $26,698 $(10,666) $(15,306) $(749) $(6,379) PAGE 14

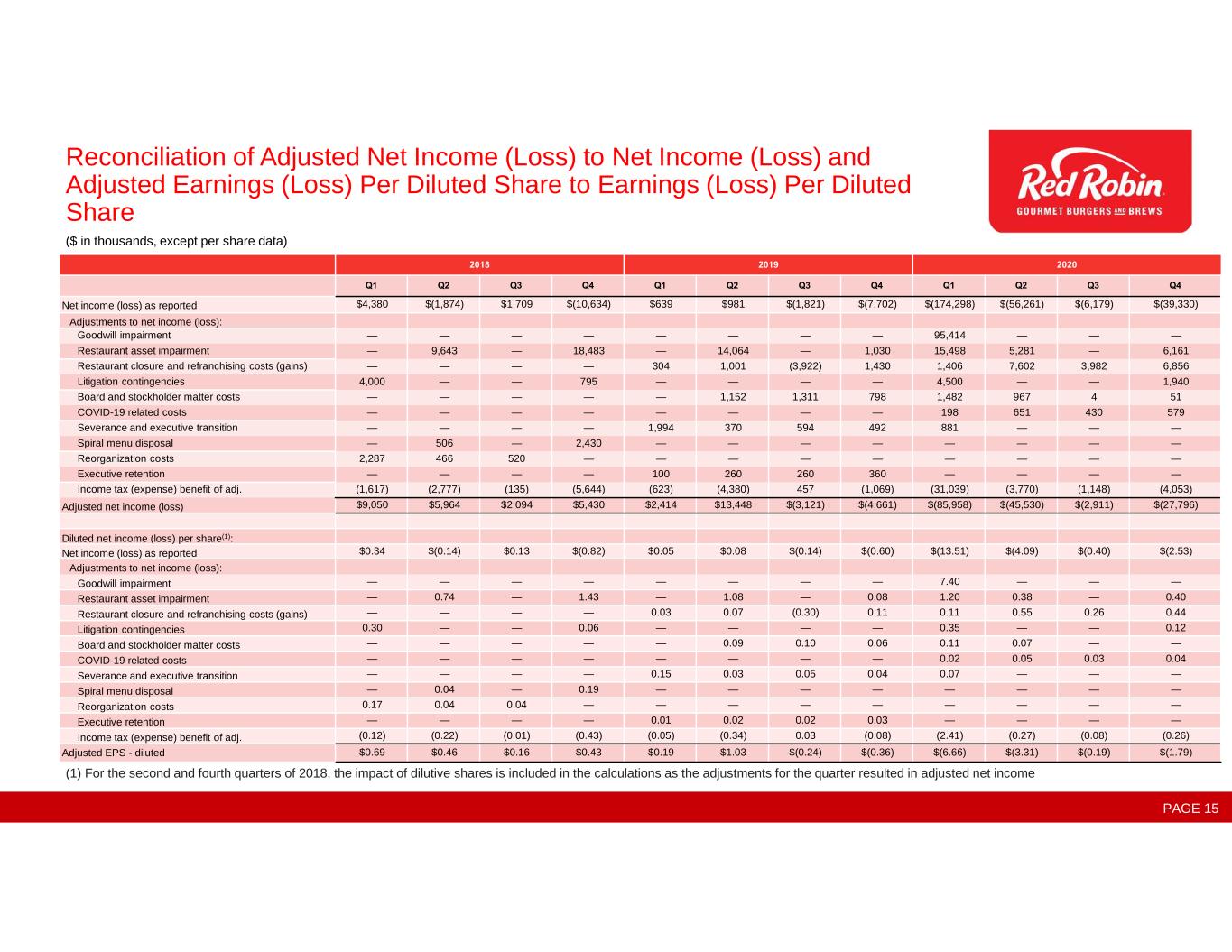

Reconciliation of Adjusted Net Income (Loss) to Net Income (Loss) and Adjusted Earnings (Loss) Per Diluted Share to Earnings (Loss) Per Diluted Share ($ in thousands, except per share data) (1) For the second and fourth quarters of 2018, the impact of dilutive shares is included in the calculations as the adjustments for the quarter resulted in adjusted net income 2018 2019 2020 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net income (loss) as reported $4,380 $(1,874) $1,709 $(10,634) $639 $981 $(1,821) $(7,702) $(174,298) $(56,261) $(6,179) $(39,330) Adjustments to net income (loss): Goodwill impairment — — — — — — — — 95,414 — — — Restaurant asset impairment — 9,643 — 18,483 — 14,064 — 1,030 15,498 5,281 — 6,161 Restaurant closure and refranchising costs (gains) — — — — 304 1,001 (3,922) 1,430 1,406 7,602 3,982 6,856 Litigation contingencies 4,000 — — 795 — — — — 4,500 — — 1,940 Board and stockholder matter costs — — — — — 1,152 1,311 798 1,482 967 4 51 COVID-19 related costs — — — — — — — — 198 651 430 579 Severance and executive transition — — — — 1,994 370 594 492 881 — — — Spiral menu disposal — 506 — 2,430 — — — — — — — — Reorganization costs 2,287 466 520 — — — — — — — — — Executive retention — — — — 100 260 260 360 — — — — Income tax (expense) benefit of adj. (1,617) (2,777) (135) (5,644) (623) (4,380) 457 (1,069) (31,039) (3,770) (1,148) (4,053) Adjusted net income (loss) $9,050 $5,964 $2,094 $5,430 $2,414 $13,448 $(3,121) $(4,661) $(85,958) $(45,530) $(2,911) $(27,796) Diluted net income (loss) per share(1): Net income (loss) as reported $0.34 $(0.14) $0.13 $(0.82) $0.05 $0.08 $(0.14) $(0.60) $(13.51) $(4.09) $(0.40) $(2.53) Adjustments to net income (loss): Goodwill impairment — — — — — — — — 7.40 — — — Restaurant asset impairment — 0.74 — 1.43 — 1.08 — 0.08 1.20 0.38 — 0.40 Restaurant closure and refranchising costs (gains) — — — — 0.03 0.07 (0.30) 0.11 0.11 0.55 0.26 0.44 Litigation contingencies 0.30 — — 0.06 — — — — 0.35 — — 0.12 Board and stockholder matter costs — — — — — 0.09 0.10 0.06 0.11 0.07 — — COVID-19 related costs — — — — — — — — 0.02 0.05 0.03 0.04 Severance and executive transition — — — — 0.15 0.03 0.05 0.04 0.07 — — — Spiral menu disposal — 0.04 — 0.19 — — — — — — — — Reorganization costs 0.17 0.04 0.04 — — — — — — — — — Executive retention — — — — 0.01 0.02 0.02 0.03 — — — — Income tax (expense) benefit of adj. (0.12) (0.22) (0.01) (0.43) (0.05) (0.34) 0.03 (0.08) (2.41) (0.27) (0.08) (0.26) Adjusted EPS - diluted $0.69 $0.46 $0.16 $0.43 $0.19 $1.03 $(0.24) $(0.36) $(6.66) $(3.31) $(0.19) $(1.79) PAGE 15